Bitcoin miners make a useful contribution to the safety of the toughest cash identified to man, however it’s a dangerous and difficult strategy to make a buck.

Between 5,000 and 10,000 Bitcoin miners function internationally, starting from solo miners to huge companies. It takes a mean of 12 years for a solo miner to discover a block — which means they do it for love and the lottery-like probability of putting large.

Some organizations function a whole lot of 1000’s of Antminers.

To earn a residing wage from Bitcoin mining, you’ll must function “between 200 and 1,000 machines relying in your electrical energy prices,” based on analyst Basic Kenobi from Demand Pool. The world’s largest miner, Marathon Digital, operates 385,000 machines and has a hashrate of 57 exahash per second.

Bit Digital was a smaller operation, operating a fleet of miners that peaked at 2.43 EH/s in September final yr. However in June, the corporate determined to close down mining operations fully. Now, it’s the fourth-largest company holder of Ethereum.

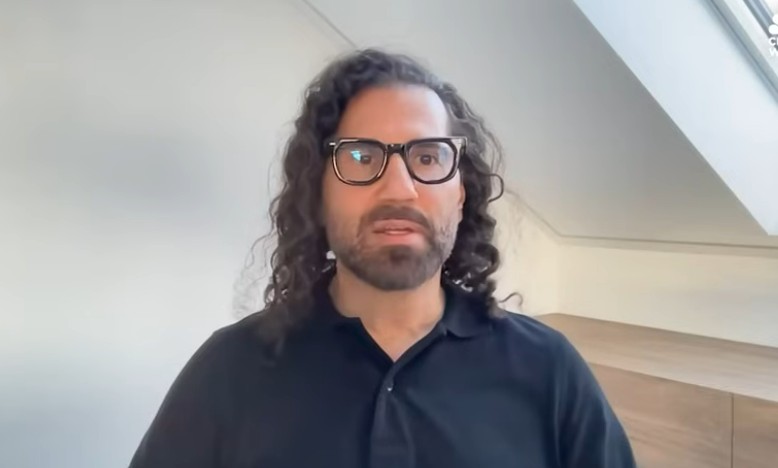

CEO Sam Tabar tells Journal there have been many causes it determined to maneuver on from Bitcoin mining:

“It is a enterprise the place your earnings are assured to be minimize in half each 4 years, the hashrate issue will proceed to go up as an increasing number of individuals are mining, and you can’t predict the place the Bitcoin mining [return] goes to be, so you may’t take debt responsibly, and you need to obliterate all of your fairness shareholders simply to boost capital to purchase the newest technology of machines,” he says.

“That may be a remarkably shitty enterprise.”

Bitcoiners could be tempted to put in writing Tabar’s feedback off because the salty tears of an unsuccessful miner. However Bit Digital has had loads of success. The agency began up an AI infrastructure enterprise known as WhiteFiber in 2023, shortly after the launch of ChatGPT. It now has $100 million in annual income; it raised $183.3 million when it was spun out of Bit Digital to checklist on the Nasdaq in August.

Additionally learn: Bitcoin mining trade ‘going to be useless in 2 years’ — Bit Digital CEO

Bitcoin mining drawback No. 1: Jurisdiction

The seek for low-cost energy led Bit Digital to ascertain its whole fleet within the Chinese language province of Sichuan. With 1,400 rivers, the area has an abundance of hydroelectric energy. Prices fall to only a cent per kWh throughout the wetter months.

However Tabar believed {that a} ban on Bitcoin mining in China was a looming “existential risk,” and so he undertook the “logistical nightmare” of shifting tens of 1000’s of machines to North America throughout the COVID-19 pandemic.

“Everyone thought we had been loopy, and we had been very unpopular doing that, and (that) it was actually silly. Everyone mentioned, ‘Oh, you’re going to lose a lot cash getting these machines offline and migrating into North America and paying increased electrical energy.’”

Six months later, China banned Bitcoin mining fully. Tabar rushed the remaining one-third of the machines to the closest port and obtained them in a foreign country, too.

“All our mates who had their machines in China had been fucked,” Tabar notes.

The EU thought of (however voted towards) banning Bitcoin mining in 2022. In June this yr, the federal government of Norway introduced it could briefly ban proof-of-work mining from Autumn onward. The nation accounts for 1.6% of the worldwide hashrate, making it the biggest mining hub in Europe.

Bitcoin mining drawback No.2: Fixed, costly upgrades

To maintain up with the ever-increasing hashrate and mining issue (which not too long ago hit an all-time excessive of 134.7 trillion), miners should always improve to extra environment friendly machines.

“The machines must be up to date each few months as a result of every technology of machine is extra environment friendly and since the hashrate continues to go up should you don’t have that effectivity, you may’t mine Bitcoin profitably,” he says.

That is terribly costly. It prices “a number of hundreds of thousands and hundreds of thousands of {dollars},” Tabar says. However failing to take action shouldn’t be an possibility; older tools rapidly turns into “very costly paperweights.”

Bitcoin mining drawback No. 3: Debt kills miners

Usually, a enterprise would borrow for big capital expenditure comparable to the acquisition of latest mining tools, after which pay it again over time from the anticipated earnings. However as a consequence of Bitcoin’s value volatility, Tabar says it’s not possible to work out learn how to service the debt responsibly.

“You can’t predict your future money flows in Bitcoin mining since you don’t know the place Bitcoin goes to be,” he says.

“So lots of people who borrowed […] that led to tears. They went poof, a variety of them.”

Learn additionally

Options

Satoshi Nakamoto saves the world in an NFT-enabled comedian e book sequence

Options

How do you DAO? Can DAOs scale and different burning questions

Bitcoin mining drawback No. 4: The halving halves earnings

In idea, miners seeing their earnings halve each 4 years shouldn’t be an issue so long as the Bitcoin value doubles, proper?

That doesn’t take note of surviving the lag earlier than that occurs — or the danger that it gained’t double this time round.

Kenobi explains that every halving occasion sees the exit of much less worthwhile miners, whereas those that keep it up are sometimes pushed by “spiritual religion that Bitcoin will present.”

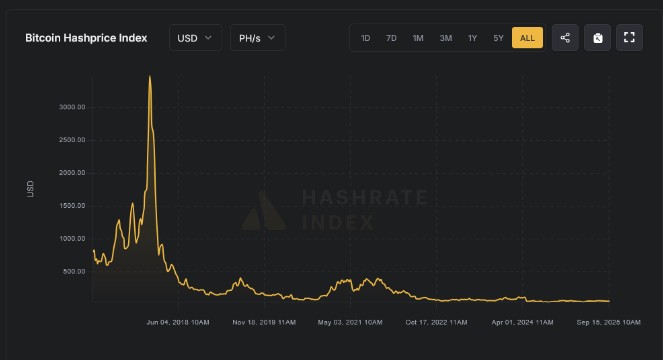

However he additionally factors out that “{dollars} per day per terahash” is trending down over time as a consequence of rising hashrate and mining effectivity. Meaning smaller miners are being pressured out, resulting in rising centralization amongst large gamers.

Tabar says the economics now not stack up.

“Okay, positive, the Bitcoin mining value goes up. However what lots of people didn’t perceive was that… the problem to mine Bitcoin was tougher and tougher. And the value didn’t compensate for the hashrate issue.”

Bitcoin mining drawback No. 5: Diluting shareholders

Bit Digital’s coverage was to keep away from borrowing cash. As a publicly listed miner, the one different path to finance the acquisition of latest tools was to boost capital by issuing extra shares.

“We’ve to mainly dilute our current shareholders….and purchase new machines. And you need to do that always,” he says. “Mainly, obliterating all of the shareholders since you’re simply diluting them to oblivion.”

Bitcoin mining drawback No. 6: No one can get an edge

Tabar argues there’s no means for Bitcoin miners to actually differentiate themselves and achieve an edge over different miners. Meaning there’s no strategy to mine smarter or extra effectively exterior of shopping for higher tools, and there’s no barrier to entry for newcomers.

“Anyone in a single day can construct a Bitcoin mining firm. It simply requires capital. That’s not a enterprise you actually differentiate your self in.”

Learn additionally

Options

Thriller of Polygon’s lacking MATIC: Everybody’s doing it, says ChainArgos

Options

Bitcoin 2022 — Will the actual maximalists please arise?

Bitcoin mining drawback No. 7: Swimming pools take as much as 10% of the earnings

Bitcoin mining swimming pools started to emerge in late 2010. The system steadily developed into FPPS (Full Pay Per Share), the most typical strategy to run a pool at present.

Beneath FPPS, the swimming pools pay miners for the quantity of hashpower they contribute, no matter what number of blocks the pool finds. Whereas this delivers Bitcoin miners constant and reliable money circulation, it requires swimming pools to entrance miners the cash, which means they should both maintain giant reserves or borrow cash to pay miners in periods when the pool finds fewer blocks than regular.

Kenobi says that swimming pools declare to have low charges of 0.5 to 2% however hidden charges and dangerous trade charges push the speed nearer to 10%.

Kenobi is the pinnacle of enterprise improvement for Demand Pool, which goals to be the “first Stratum v2 solely Bitcoin mining pool.” Created by Alejandro De La Torre, who additionally based BTC.com and Poolin, it merely pays miners a share of the particular earnings, which cuts down on prices.

Kenobi argues that the pool’s effectivity good points and decrease charges allow miners to make as much as “15% extra” earnings than with an enormous centralized pool.

The way forward for Bitcoin mining

Partially one in all this sequence, Tabar argued that the business mining trade wouldn’t be capable to survivethe combination of the subsequent halving and nation-states shifting in to mine Bitcoin with free energy.

Kenobi, in the meantime, believes that business mining firms face an enormous risk from electrical energy firms mining Bitcoin with surplus energy, and to assist them stabilise the grid.

Neither prediction is assured, however with revenue margins rising tighter, even Bitcoin’s most ardent supporters can see elevated dangers of mining centralization.

The continued well being and decentralization of the Bitcoin community are extraordinarily essential as a result of, as Kenobi factors out, Bitcoiners try to create a brand new financial system for the subsequent century.

“Miners are being paid to take part in a revolution, you understand, in a peaceable revolution,” he says.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with greater than 25 years expertise, who has been overlaying cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as Deputy Editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched on, printed within the Herald-Solar, Day by day Telegraph and Courier Mail.

His work noticed him cowl the Oscars and Golden Globes and interview a few of the world’s greatest stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Previous to that he labored as a journalist with Melbourne Weekly Journal and The Melbourne Instances the place he gained FCN Finest Function Story twice. His freelance work has been printed by CNN Worldwide, Impartial Reserve, Escape and Journey.com.

He holds a level in Journalism from RMIT and a Bachelor of Letters from the College of Melbourne. His portfolio consists of ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.