The crypto market’s poor weekend efficiency has snowballed right into a disastrous Monday opening.

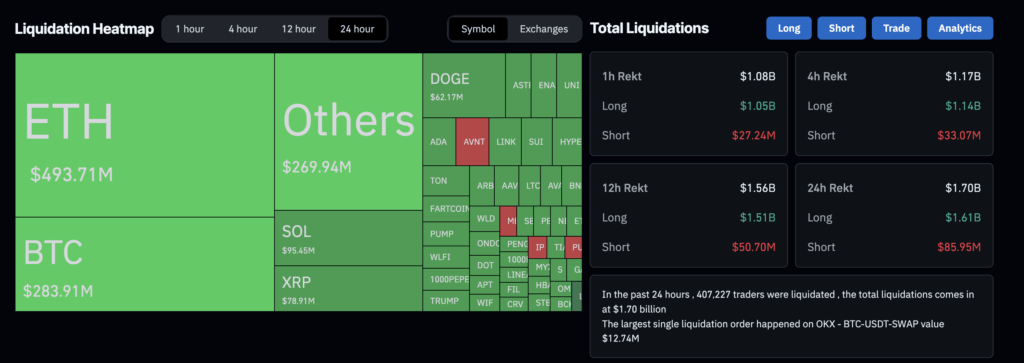

In only one hour, between 2 a.m. and three a.m. ET Monday, greater than $1 billion in leveraged lengthy positions had been liquidated. Knowledge from CoinGlass exhibits the cascade pushed whole liquidations over the previous 24 hours to $1.7 billion.

Ethereum is main the wipeout as its value momentarily dipped to $4,050, down practically 15% from its September excessive. Bitcoin fell beneath $112,000, now down 5% from the month’s excessive.

Altcoins are dealing with the brunt of the market crash, with Aster, Pump.enjoyable and Pi among the many worst performers. Solana meme cash and Ethereum ecosystem cash are posting steep losses as nicely, with Fartcoin falling out of the highest 100 largest crypto listing on CoinMarketCap.

Regardless of the crypto market crash, specialists are assured that the bull market isn’t over.

Why Is Crypto Crashing At this time?

At this time’s crypto market crash isn’t tied to any single bearish growth. As a substitute, a mixture of components has fueled the sell-off.

Notably, the pullback is being pushed by aggressive promoting within the derivatives market, with Bitcoin’s spot Cumulative Quantity Delta proving negligible in comparison with the futures CVD.

Structurally, BTC failed to interrupt above the $118,000 resistance and as a substitute confirmed a bearish head-and-shoulders sample, which performed out in at present’s decline.

Analysts have additionally highlighted that final week’s FOMC was a sell-the-news occasion, and Friday’s Triple Witching has additionally contributed to at present’s bearishness.

Some specialists have additionally taken photographs at exchanges and market makers. Distinguished crypto analyst Marty has alleged market manipulation by Binance and Wintermute as the important thing cause behind the market crash.

The truth is, Marty is asking at present’s pullback the Binance Royal Flush. He’s now seeking to open leveraged lengthy positions, claiming that the bull market isn’t over.

Is The Bull Market Over?

Regardless of at present’s crypto market crash, specialists are assured that the bull market isn’t over.

World Macro Index’s Head of Macro Analysis, Julian Bittel, claims that Bitcoin isn’t even near its cycle high. His institutional-grade software, GMI’s Bitcoin Cycle High Finder, is considerably beneath the degrees which have sometimes indicated the top of a bull market.

Bittel argues that Bitcoin’s typical four-year cycle could run longer this time, because it more and more trades like a macro asset tied to the broader enterprise cycle.

With rates of interest held at elevated ranges for an prolonged interval, the subsequent enterprise cycle enlargement has but to correctly start. Now that the Fed has began chopping charges, he anticipates each the enterprise cycle and Bitcoin’s rally to realize momentum in tandem.

This doesn’t imply that crypto costs wouldn’t see extra draw back volatility heading into the month’s finish. Andrew’s Pitchfork exhibits that BTC may hit $110,000 within the quick time period, whereas the MVRV pricing bands reveal that $93,000 may come into play if the $115,000 assist isn’t reclaimed.

Nonetheless, these would solely be wonderful purchase the dip alternatives.

Finest Cryptos To Purchase Now

Buyers are higher off avoiding makes an attempt to catch the falling knife amid the prevailing bearish sentiment. As a substitute, they need to await a profitable retest of key assist ranges earlier than shopping for.

Quite the opposite, consumers ought to maintain a watch out for a possible bullish reversal in Aster (ASTER). This new DEX coin surprised buyers with a 1900% rally in simply 5 days, surpassing the $3 billion market cap.

Whereas it has pulled again since, there isn’t any cause why ASTER ought to present a powerful correlation with Bitcoin, making it a superb hedge.

Presale cryptos are additionally enticing investments throughout market uncertainty. It’s not with out cause that whales are pouring six-figure investments into Bitcoin Hyper (HYPER), a brand new BTC layer-2 coin that has raised practically $18 million in brief order.

One whale bought over $150k value of HYPER in a single transaction, information from Etherscan reveals.

Layer-2 cash present a powerful correlation with their respective layer-1s. With BTC anticipated to hit $150,000 this bull cycle, HYPER could possibly be a viable funding for outsized returns. As such, the highest L2 tasks like Arbitrum, Optimism and Stacks have a tendency to succeed in multibillion-dollar valuations.

Unsurprisingly, many are calling Bitcoin Hyper one of many subsequent 100x cryptos.

Go to Bitcoin Hyper Presale

This text has been supplied by one among our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember that our business companions could use affiliate packages to generate income via the hyperlinks in this text.