- Over $1.6 billion in stablecoins flowed into ETH in 24 hours, displaying huge shopping for energy ready.

- Binance knowledge exhibits bearish positioning, however that would set off a quick squeeze if consumers step in.

- Analysts counsel ETH might dip to $3,700–$3,800 earlier than rallying towards $10,000 by 2026.

The market’s bought eyes on Ethereum proper now. Regardless of hitting close to document highs, the temper on Binance appears to be like surprisingly bearish. Purchase exercise is unusually low, and quick positions are stacking up, leaving merchants questioning if ETH is about to tank… or explode. On the identical time although, greater than $1.6 billion in stablecoins poured into Ethereum in simply someday, hinting that massive shopping for energy is ready within the shadows.

Ethereum Value Evaluation: Breakout or Correction Forward?

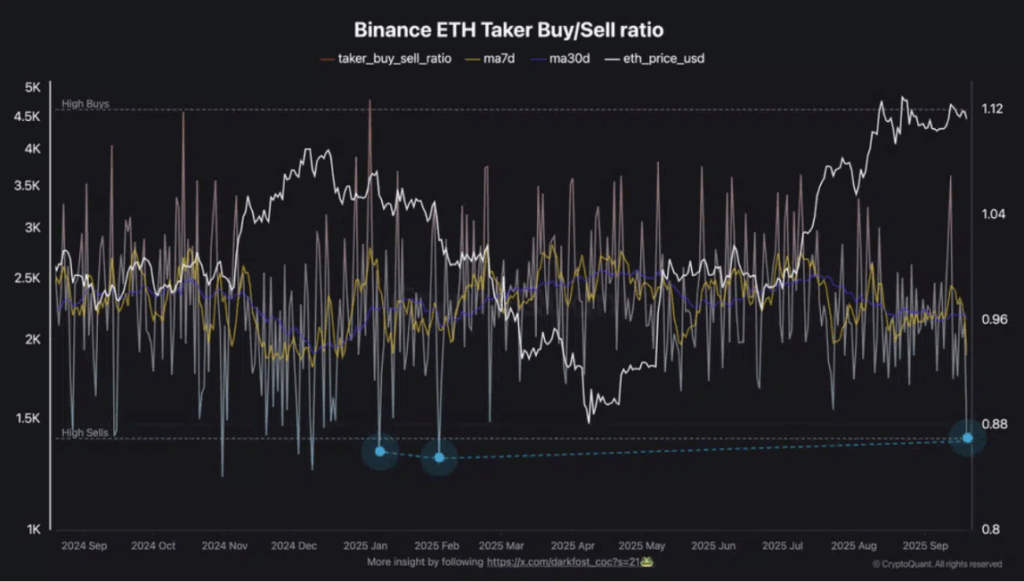

On September nineteenth, knowledge confirmed the taker purchase/promote ratio on Binance dipped beneath 0.87. That’s solely occurred twice earlier this yr—and each instances ETH fell exhausting. Again then, the drops pushed costs beneath $1,500, so naturally, nerves are excessive. The 7-day common can be sitting on the lowest level of 2025 to this point, displaying promote stress is dominating. Nonetheless, when issues get this lopsided, quick squeezes typically comply with. If consumers step in, it might catch bears fully off guard.

Ethereum Prediction: Will ETH Pull Again Earlier than the Subsequent Huge Rally?

Analyst TedPillows identified that ETH is consolidating just under its previous 2021 ATH. His charts counsel a well-known sample: after tagging highs, Ethereum normally pulls again 25% or extra earlier than persevering with greater. That sort of correction now would drag ETH to the $3,700–$3,800 zone. However right here’s the flip aspect—stablecoin reserves on Ethereum have blasted to a document $173 billion, up $50B since January. That’s a conflict chest of liquidity sitting on the sidelines, prepared to fireside up the following rally. If historical past rhymes, ETH might very effectively make its manner towards $10,000 by early 2026.

Key Ethereum Ranges to Watch: Assist and Resistance for Merchants

For the short-term, ETH is hovering round $4,470–$4,500. The chart exhibits assist holding at $4,460, whereas quick resistance sits tight at $4,495. RSI appears to be like impartial, MACD barely bearish—however no robust pattern simply but. Break $4,495 cleanly, and bulls might push towards $4,550. Lose $4,460, and the door opens to $4,400. In different phrases, Ethereum’s at a crossroads: both a pointy dip or the start of a a lot greater breakout.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.