- Uniswap pioneered decentralized buying and selling with AMMs, processing $3T+ in quantity since 2018.

- Upgrades like Uniswap v4 and Unichain purpose to chop prices, increase velocity, and broaden adoption.

- UNI might see a robust comeback if protocol charges go stay and institutional adoption grows.

Uniswap, the protocol that turned crypto buying and selling on its head, has develop into the beating coronary heart of decentralized finance. It has dismantled the partitions of centralized gatekeeping, processed trillions in quantity, lots of of tens of millions of trades, and redefined how liquidity flows on-chain.

With a core dedication to non-custodial, permissionless entry and steady iteration by sensible contract innovation, Uniswap isn’t just a protocol—it’s an infrastructure layer that has impressed a whole DeFi technology. So, allow us to take a more in-depth have a look at what makes Uniswap one of the essential tasks in crypto.

What Is Uniswap?

Launched in 2018 by Hayden Adams, Uniswap is an Ethereum-based decentralized alternate (DEX) protocol that permits customers to swap tokens immediately from their wallets. Constructed on the foundational ideas proposed by Ethereum co-founder Vitalik Buterin, it launched the Automated Market Maker (AMM) mannequin, eradicating the necessity for centralized intermediaries and conventional order books.

The protocol operates by sensible contracts that autonomously execute trades, handle liquidity swimming pools, and guarantee pricing effectivity. With no KYC, no accounts, and no middlemen, Uniswap permits anybody with an Ethereum pockets to work together immediately with monetary markets. From a easy ETH-token pair in its first iteration to right this moment’s multichain deployment and concentrated liquidity mechanics, Uniswap’s trajectory has been marked by aggressive innovation and unparalleled adoption.

What Issues Does It Clear up?

Uniswap eliminates a number of ache factors that plague conventional finance and centralized exchanges. First, it eradicated custodial danger. Customers don’t deposit funds into Uniswap; they commerce immediately from their wallets. This removes the specter of hacks, freezes, and mismanagement that plague centralized exchanges.

Second, it shattered entry limitations. No accounts, no KYC, no geographic restrictions. Anybody with a pockets and web connection can commerce, present liquidity, or launch a token. This democratized entry to monetary markets and gave rise to a brand new wave of grassroots crypto tasks.

Third, it solved the liquidity drawback in decentralized buying and selling. Conventional DEXs struggled to match patrons and sellers effectively. Uniswap’s AMM mannequin created steady liquidity by permitting customers to pool property and earn charges. This innovation turned each person into a possible market maker.

Lastly, it tackled transparency and composability. Each transaction, pool, and price is seen on-chain. Different DeFi protocols can plug into Uniswap’s liquidity and buying and selling features, making a modular ecosystem of monetary instruments.

How Does It Work?

Uniswap operates on an Automated Market Maker (AMM) mannequin. It doesn’t match patrons and sellers. As a substitute, trades are routed by token pairs in liquidity swimming pools ruled by sensible contracts.

Each pool is shaped by liquidity suppliers (LPs) who deposit equal values of two tokens—say ETH and USDC. In alternate, LPs obtain LP tokens, representing their share of the pool and any charges accrued. The pricing mechanism follows a continuing product method:

x * y = okay,

the place x and y are token reserves, and okay is a set fixed.

As customers swap tokens, the ratio between x and y modifications, and the value strikes accordingly. This ensures steady, automated pricing and buying and selling. There is no such thing as a order ebook, no matching engine, no want to attend for counterparty affirmation. Each swap is executed immediately by the protocol.

Uniswap v3 additional optimized this mannequin by concentrated liquidity, permitting LPs to specify the precise worth vary inside which they wish to present liquidity. This unlocked dramatically increased capital effectivity whereas giving LPs management over price publicity and danger. A number of price tiers have been launched—0.05%, 0.3%, and 1.0%—permitting markets to tailor themselves primarily based on volatility and buying and selling habits.

Utility and Choices

Uniswap provides a set of instruments and alternatives that empower customers, builders, and establishments. This contains:

Token Swapping

Uniswap’s core operate is frictionless token swapping. Customers join their wallets and immediately commerce 1000’s of ERC-20 tokens, all with out giving up custody. No registration, no lock-ups, and no centralized approval. This trustless simplicity is a game-changer in markets usually dominated by closed ecosystems.

Liquidity Provision and Yield Era

Anybody can develop into a liquidity supplier by depositing token pairs right into a pool. In return, they earn a share of the charges generated by trades. For steady pairs, this will present a gradual supply of yield; for unstable property, it turns into a high-risk, high-reward play. With v3, liquidity provisioning grew to become a professional-grade toolset. LPs can fine-tune their capital deployment throughout worth ranges and price tiers, giving them extra management over returns and impermanent loss.

Governance through UNI Token

Uniswap’s governance is ruled by the UNI token, which was airdropped to early customers in 2020. Holders of UNI can vote on proposals that have an effect on the protocol—upgrades, treasury spending, cross-chain deployments, and governance framework updates. The governance course of has been central to strategic selections, together with the protocol’s enlargement to different chains and the institution of the Uniswap Basis.

Developer Integration and Composability

Uniswap’s contracts are absolutely open-source and extensively composable. Builders can combine liquidity swimming pools into DeFi apps, wallets, and aggregators. Whether or not powering lending protocols or DEX aggregators, Uniswap’s contracts operate as public infrastructure out there to any Ethereum-compatible software.

Multichain Availability

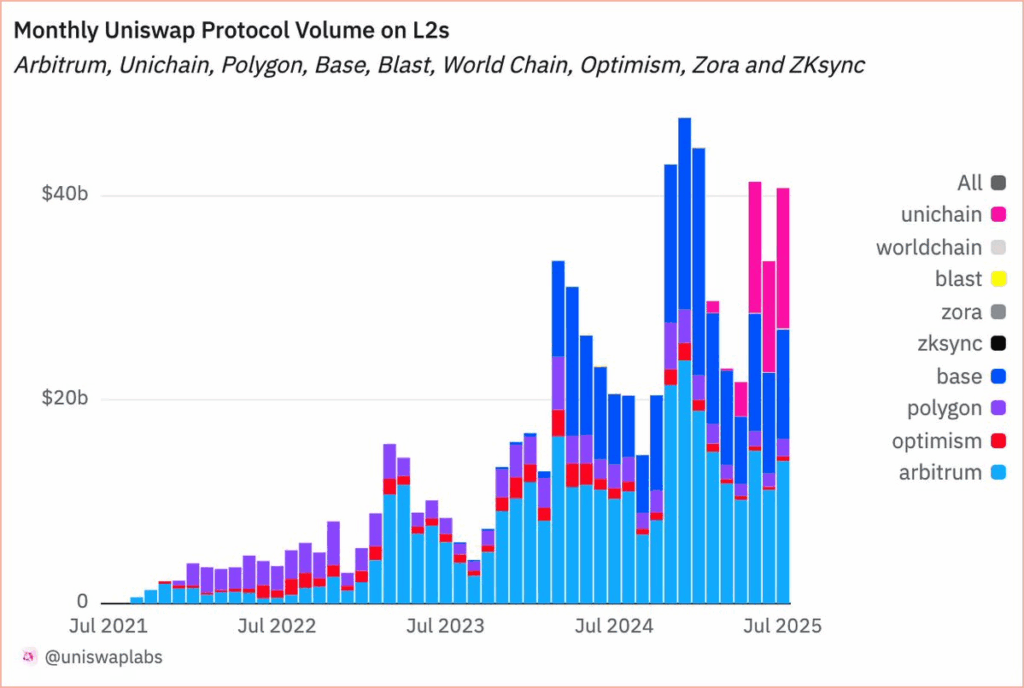

Recognizing Ethereum’s scaling limitations, Uniswap has expanded to a number of Layer 2 and different blockchains, together with Arbitrum, Optimism, Polygon, Base, and BNB Chain. This dramatically reduces gasoline prices and will increase accessibility for smaller merchants and high-frequency customers.

Unichain

Unichain formally launched in early 2025 as a Stage 1 Optimistic rollup constructed on the OP Stack. It provides one second block occasions and gasoline prices as much as 95% decrease than Ethereum mainnet.

Ecosystem Highlights

Uniswap’s development has been explosive, and its affect is unmatched. Some key milestones that spotlight its development embrace:

- Quantity and Adoption – Uniswap has processed near $3 trillion in cumulative quantity and greater than 450 million trades. It persistently ranks among the many prime DEXs by quantity and liquidity.

- Multichain Growth – To scale back gasoline prices and enhance entry, Uniswap has deployed on Arbitrum, Optimism, Polygon, Base, BNB Chain, Avalanche, and extra. These expansions have been authorised by UNI governance and have broadened Uniswap’s attain throughout the crypto panorama.

- Institutional Curiosity – Uniswap has attracted consideration from institutional gamers. The protocol’s transparency, liquidity depth, and non-custodial design make it interesting to funds, merchants, and infrastructure suppliers.

- Efficiency Highlights – In 2024, Uniswap averaged a 0.046% worth enchancment over main aggregators. Its deep liquidity and environment friendly pricing have made it aggressive with centralized exchanges, even for giant trades.

- Safety Observe Report – Regardless of phishing assaults and exploits in associated protocols, Uniswap’s core sensible contracts have by no means suffered a significant exploit. Its code is battle-tested, audited, and trusted throughout the trade.

Roadmap and Plans Forward

Uniswap is making ready for certainly one of its most bold evolutions but with its upcoming suite of protocol upgrades, ecosystem expansions, and governance-led methods. This contains core technical improvements, new infrastructure layers, and long-term positioning throughout the shifting regulatory and market panorama. isn’t standing nonetheless. Its roadmap is bold, and its imaginative and prescient is expansive.

Uniswap v4

Slated to launch after Ethereum’s Cancun-Deneb improve, Uniswap v4 will unlock modular liquidity by “hooks,” letting builders create dynamic price fashions, on-chain restrict orders, and automatic rebalancing. It additionally introduces a singleton structure and flash accounting, drastically decreasing gasoline utilization. v4 is ready to reshape DeFi composability and make liquidity provisioning much more customizable.

Unichain Growth

With the mainnet launched, the subsequent part for Unichain contains increasing its validator set, introducing sub-second “flash blocks,” and evolving towards a permissionless rollup infrastructure. This would cut back latency, improve throughput, and produce Uniswap nearer to its objective of constructing the quickest, most capital-efficient DEX surroundings natively optimized for its personal ecosystem.

Strategic Phases

Wanting forward, Uniswap plans to go deeper into pockets improvement, price economics, and ecosystem coordination. The Uniswap Pockets will acquire superior routing, multichain bridging, and staking integration. Governance might quickly vote on activating the long-discussed protocol price change, probably reworking UNI right into a yield-bearing asset and growing treasury sustainability for ecosystem grants.

Regulatory Navigation

Going through a tightening regulatory local weather, Uniswap is investing in proactive authorized analysis and lobbying through the Uniswap Basis. Future plans contain constructing versatile frontend architectures that assist compliance whereas retaining the underlying protocol decentralized and permissionless.

Remaining Ideas

In conclusion, Uniswap continues to show why it stays on the heart of decentralized finance. With a deal with innovation, scalability, and permissionless entry, it’s constructing not simply instruments—however infrastructure that powers the broader DeFi financial system. And with Uniswap v4, Unichain enlargement, and protocol-level governance evolving, the undertaking is well-positioned to outline the subsequent part of crypto buying and selling.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.