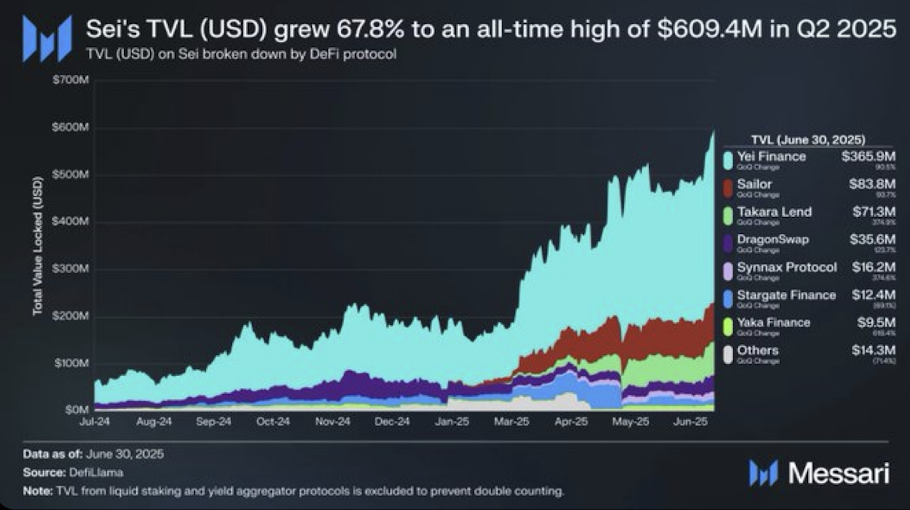

- Sei’s TVL surged 67.8% in Q2 2025, hitting an all-time excessive of $609.4M.

- Protocols like Yei Finance, Sailor, and Takara Lend dominate liquidity inflows, whereas smaller apps add wholesome distribution.

- Technical analysts eye a triangle breakout, with upside projections focusing on the $1.10 vary if momentum holds.

Sei has quietly been carving out its place in DeFi, and now the numbers are beginning to communicate for themselves. In Q2 2025, the chain’s complete worth locked (TVL) jumped almost 68%, hitting a contemporary all-time excessive of $609.4 million. For a community nonetheless thought of younger in comparison with Ethereum or Solana, that’s no small feat.

A giant a part of this surge got here from protocols like Yei Finance, Sailor, and Takara Lend. Collectively, they pulled within the bulk of the liquidity speeding into the chain. One analyst even remarked on X that Sei is lastly exhibiting what “actual traction” in DeFi seems like — and it’s exhausting to argue with that evaluation.

Capital Flows Present Wholesome Distribution

Messari knowledge reveals Yei Finance main the pack with a large $365.9 million in TVL — greater than half the community’s locked worth. Sailor is available in at $83.8M, whereas Takara Lend holds $71.3M. Smaller gamers like DragonSwap ($35.6M) and Synnax Protocol ($16.2M) are additionally contributing, rounding out a extra various image of Sei’s DeFi progress.

This unfold of liquidity throughout a number of protocols is an encouraging signal. As a substitute of 1 challenge dominating the chain, adoption seems extra balanced. That form of diversification often factors to stronger, extra sustainable progress relatively than a hype-driven pump that fizzles out rapidly.

Market Knowledge Backs the Enlargement

Zooming out, Sei’s broader market stats inform an identical story. At round $0.32 per token, Sei at the moment sits at a $1.94 billion market cap, ranked 82nd amongst crypto belongings. Every day buying and selling quantity stays wholesome at $104 million, regardless that the token slipped about 1.4% over the previous day.

With 6.12 billion tokens circulating, Sei has a large distribution that helps accessibility, whereas liquidity is deep sufficient to deal with new inflows. Mix that with the $609M TVL milestone, and it seems like adoption is steadily turning into on-chain exercise and locked capital.

Technicals Trace at a Breakout

From a buying and selling perspective, Sei has been consolidating round $0.32, with analysts recognizing a descending triangle sample that usually units up for a breakout. Mister Crypto, a well-liked dealer on X, shouted in all caps: “$SEI BREAKOUT INCOMING!” — which, love him or not, reveals how intently this coin is being watched.

If Sei manages to crack via its higher resistance, the chart suggests a potential run towards $1.10. That’s a daring name, however not not possible given how briskly momentum can flip in DeFi tokens. After all, volatility continues to be excessive and transferring averages have been combined, so merchants are ready for actual affirmation earlier than piling in.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.