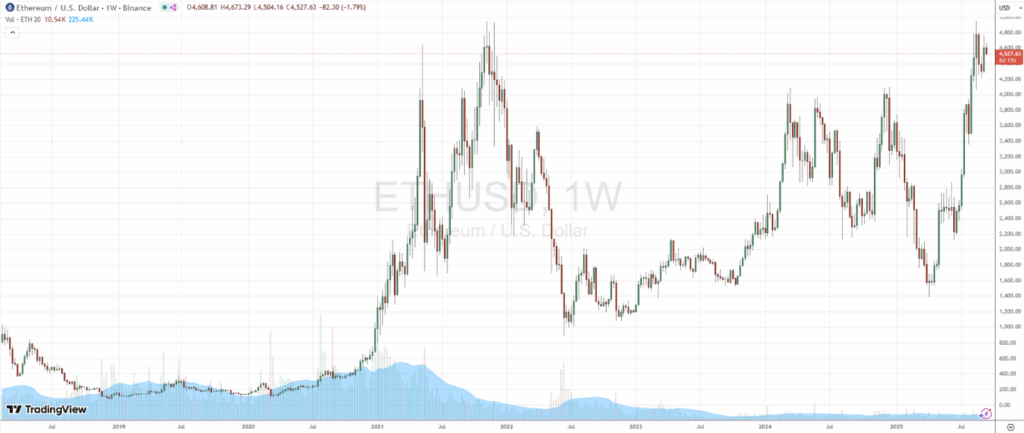

Ethereum units the tempo once more. After weeks of consolidation, ETH has made a decisive rise, returning to the touch the psychological threshold of $4900. Merchants’ consideration is now centered on Bitcoin dominance, which has fallen under 58%, a degree that might pave the way in which for a doable rally for altcoins. The query is inevitable: are we on the verge of a brand new altcoin season or is it only a momentary rebound?

Ethereum leads the market: has the altcoin rally begun?

The restoration of Ethereum is just not a matter of likelihood. In current weeks, the value has damaged upward via a resistance that had blocked each try and restart for months. This breakout has generated a major improve in volumes, a sign that the market was ready for the proper second to re-enter. The technical motion has been accompanied by strong elementary elements: the provide of ETH continues to lower because of staking, which holds an more and more increased share of tokens out of the market, and community upgrades which can be making the ecosystem extra scalable and cost-effective for customers.

The sentiment of institutional buyers has additionally contributed to the rally. Rumors in regards to the doable approval of recent spot ETFs on some altcoins, along with these on ETH, have fueled optimism, whereas on-chain knowledge highlights accumulations by whale wallets, a sign that normally precedes additional upward actions. All these parts have introduced Ethereum again into the highlight, giving momentum to the altcoin sector.

Bitcoin dominance is at a crossroads

Parallel to the ETH rally, the dominance of Bitcoin recorded a decline, falling under 58% for the primary time after months of stability. This indicator, which measures the share of BTC capitalization relative to the whole crypto market, is among the most watched thermometers by analysts as a result of it supplies a right away overview of the place capital is heading.

Traditionally, when Bitcoin dominance decreases, altcoins start to outperform. This occurs as a result of buyers, after consolidating positions on BTC, begin searching for increased returns in cryptocurrencies with larger volatility, giving rise to real altcoin seasons.

One other important sign comes from the ETH/BTC pair, which measures the relative energy of Ethereum in comparison with Bitcoin. In current days, the ratio has recorded a breakout from an extended consolidation channel, suggesting that ETH is just not solely rising in {dollars} however can also be gaining floor in opposition to BTC. This sort of motion is especially related: when ETH/BTC rises, it signifies that capital is shifting in direction of the Ethereum ecosystem, a sign that always precedes a broader rotation in direction of altcoins.

The present state of affairs is subsequently one in every of unstable equilibrium: the mix of declining dominance and rising ETH/BTC strengthens the narrative of a doable altcoin season, however a possible rebound of BTC may rapidly overturn the situation. The approaching weeks will thus be essential to know which of the 2 eventualities will prevail.

Macroeconomics and Liquidity: Favorable Winds for Altcoins?

The present motion matches right into a macroeconomic context that’s changing into extra favorable. Expectations of a loosening of financial insurance policies, with doable charge cuts by central banks, are bringing buyers again to riskier belongings, together with cryptocurrencies. On the regulatory entrance, there are additionally indicators of larger readability, with extra open discussions on spot ETFs and pointers for exchanges, elements that enhance market confidence.

Knowledge on inflows into index funds signifies a renewed curiosity not solely in Bitcoin but additionally in Ethereum and layer 2 options, suggesting that the brand new incoming liquidity is just not restricted to BTC however is being distributed throughout the whole ecosystem. For DeFi, this will translate into a rise in Whole Worth Locked (TVL) and an growth in using stablecoins and lending protocols, in addition to larger experimentation and new progress alternatives for rising initiatives.

However the macroeconomic image alone doesn’t absolutely clarify Ethereum’s current momentum: there’s a issue gaining significance that might turn into a decisive accelerator. It’s the tokenization of actual world belongings (RWA), which means real-world belongings represented on the blockchain within the type of tokens. On this situation, ETH emerges as a number one platform, because of its widespread use in DeFi functions and the sturdy ecosystem that provides infrastructure, safety, and liquidity, however Solana, BNB chain, and Tron are additionally making important strides within the sector.

A current instance is XStocks, the tokenized shares product by Backed Finance, which has formally launched over 60 inventory titles on the Ethereum community, together with names comparable to Nvidia, Amazon, Tesla, Meta, and Walmart. The choice to maneuver to Ethereum (a community that already holds a really important TVL) is just not coincidental: it gives entry to a large base of DeFi customers and leverages the mature sensible contract infrastructure.

This development confirms that buyers and initiatives are not wanting solely on the speculative return of crypto belongings, but additionally at the potential for creating new markets for tokenized actual belongings, with decrease entry obstacles, larger transparency, and interoperability. Ethereum, being already well-established, is in a first-rate place to profit from this growth.

From the attitude of the connection between ETH and BTC, tokenization represents a further energy issue for Ethereum. The fixed improve in volumes and curiosity in direction of actual tokenized belongings on its community helps to consolidate ETH not solely as a speculative instrument however as an infrastructural platform with concrete use worth. On this perspective, each new tokenization initiative strengthens the narrative of Ethereum as a structural different to Bitcoin and as a pillar of the on-chain financial system, making it much less depending on short-term speculative dynamics alone.

Nonetheless, dangers should not missing: the regulatory framework stays unsure; points associated to the authorized rights of tokenized shareholders, comparable to voting rights or possession, should not all the time clear; the safety of sensible contracts and the transparency of the tokenization course of are parts that may make a distinction, and any damaging episode may undermine market confidence.

Conclusion: altcoin season or simply fleeting enthusiasm?

Ethereum is displaying technical and narrative energy, and the declining Bitcoin dominance leaves room for the concept that a brand new altcoin season is perhaps on the horizon, but it surely shouldn’t be forgotten that the market stays extraordinarily unstable and delicate to macroeconomic occasions.

For these working within the sector, the second is attention-grabbing however requires self-discipline. The very best strategy is perhaps to observe affirmation alerts earlier than rising publicity to altcoins and keep a balanced portfolio, able to adapt to sudden adjustments. The approaching weeks will probably be decisive in understanding whether or not it’s a new bull cycle or only a rebound earlier than an extra consolidation part.

See you subsequent time and glad buying and selling!

Andrea Unger