Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth fell 1% within the final 24 hours to commerce at $114,437.94 on a 33% enhance in every day buying and selling quantity to $30.96 billion.

This drop within the BTC worth comes regardless of Japan-based Metaplanet buying an extra 5,419 Bitcoin price $632 million.

The purchase pushed its whole holdings to over 25,500 BTC price about $2.71 billion, taking it previous Bullish because the fifth-largest company holder of the crypto.

Regardless of the latest market dip, Metaplanet says it stays assured in Bitcoin’s long-term potential.

Metaplanet has acquired 5419 BTC for ~$632.53 million at ~$116,724 per bitcoin and has achieved BTC Yield of 395.1% YTD 2025. As of 9/22/2025, we maintain 25,555 $BTC acquired for ~$2.71 billion at ~$106,065 per bitcoin. $MTPLF pic.twitter.com/CBhZi2X9lE

— Simon Gerovich (@gerovich) September 22, 2025

In the meantime, Technique government chairman Michael Saylor hinted that the corporate plans to purchase extra Bitcoin.

Regardless of going through challenges within the inventory market, Saylor stated shopping for dips in Bitcoin stays MicroStrategy’s foremost technique.

JUST IN: Michael Saylor posts the Saylor Bitcoin tracker, hinting at shopping for extra BTC

“The Orange Dots go up and to the fitting.” pic.twitter.com/GGZlKWGbH3

— Bitcoin Journal (@BitcoinMagazine) September 21, 2025

Bitcoin Worth: On-Chain Knowledge Exhibits Power Regardless of Dip

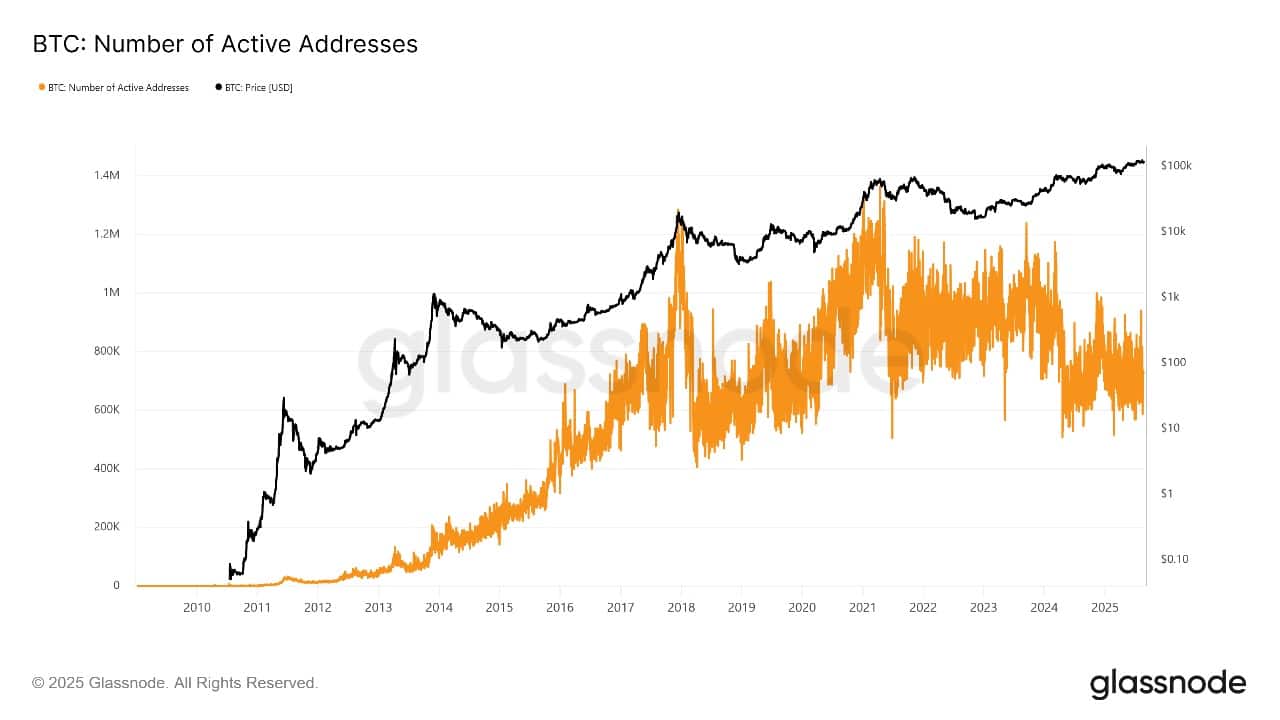

Bitcoin’s worth drop led to extra exercise on the blockchain. Transaction volumes elevated as traders moved cash, with some shopping for the dip whereas others offered to cut back danger after worth beneficial properties. Extra Bitcoin left exchanges, which frequently alerts confidence amongst large holders that costs will get better.

Lively pockets numbers and community exercise remained regular regardless of worth swings. Institutional wallets didn’t scale back holdings a lot, suggesting the drop could possibly be restricted if firms like Metaplanet and Technique proceed accumulating.

Bitcoin Lively Addresses Supply: Glassnode

Consultants say the quantity of Bitcoin saved off exchanges is close to cycle highs. This reduces promoting strain and will put together the marketplace for a rally when circumstances enhance. Sentiment information reveals cautious optimism, a typical sample throughout worth pullbacks.

Bitcoin Worth Technical Evaluation Exhibits Assist and Restoration

On September 22, 2025, Bitcoin traded close to $114,546, down about 0.67% over the previous day. It stayed above the essential 50-day shifting common (SMA) at $110,408, which acts as help. The 200-day SMA close to $83,398 is the following main help degree for long-term patrons.

BTCUSD Evaluation Supply: Tradingview

The Bitcoin worth stays inside a rising channel. Resistance is seen close to $123,731, a key goal if the bulls regain energy. The Relative Power Index (RSI) hovers round 52.3, indicating impartial momentum, neither overbought nor oversold.

The MACD indicator reveals the MACD line under the sign line with unfavorable histogram bars. This implies short-term bearish momentum might proceed except shopping for strain shifts.

If Bitcoin holds above the 50-day SMA, hopes for restoration stay. Nonetheless, falling under this might result in a retest of decrease help close to $100,000. Merchants search for indicators of reversal, such because the MACD crossing constructive or the RSI rising.

In abstract, Bitcoin’s drop under $114,000 comes amid main institutional shopping for from Metaplanet and hints from Michael Saylor about extra purchases. On-chain information reveals holders largely regular, whereas technical indicators counsel the market seeks a backside earlier than a potential rally.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection