Be a part of Our Telegram channel to remain updated on breaking information protection

Crypto markets had been rocked by $1.7 billion in liquidations over the previous 24 hours as Bitcoin, XRP, and Dogecoin all slumped.

Knowledge from CoinGlass confirmed that greater than 401,000 merchants had been liquidated, with 95% coming from lengthy positions.

That is the most important liquidation since March, with over 95% coming from lengthy positions

Why is an occasion like this vital?

-The market is overheating

– Over-leveraged Longs have to get flushed to reset the market.

Now, the market is setting the stage for the subsequent main transfer… pic.twitter.com/7naCc4bSLj

— Ash Crypto (@Ashcryptoreal) September 22, 2025

The one largest wipeout was a $12.74 million BTC lengthy on OKX, underscoring how shortly bullish bets unraveled as costs turned decrease.

Bitcoin slid 2.5% to $112,754 as of 4:47 a.m. EST, whereas XRP and Dogecoin posted steeper losses of 5.9% and 10%, respectively, in accordance to Coingecko.

The broader crypto market shed greater than 3% over the previous day, pulling complete market capitalization all the way down to $3.99 trillion.

A handful of tokens managed to buck the pattern, with Story (IP) up 10.5%, MemeCore (M) rising 5.1%, and Pax Gold (PAXG) edging 1.1% increased.

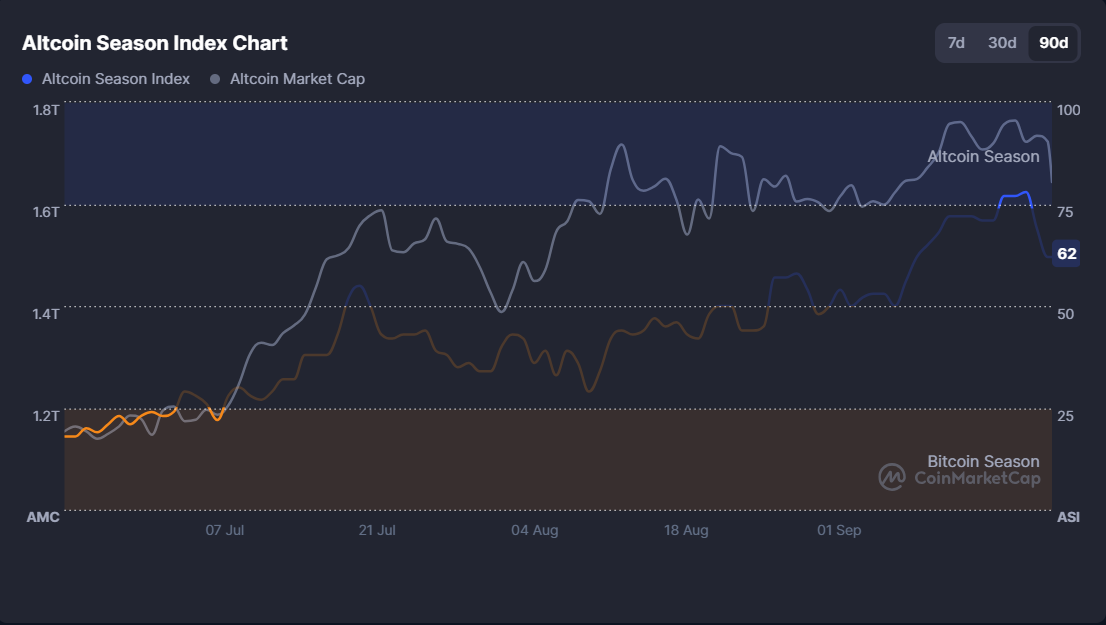

In the meantime, the CMC Altcoin Season Index exhibits that the altcoin season could also be in jeopardy because it dropped from 78 to 62/100.

Bitcoin Value On The Edge: Holding The Channel Or Breaking Down?

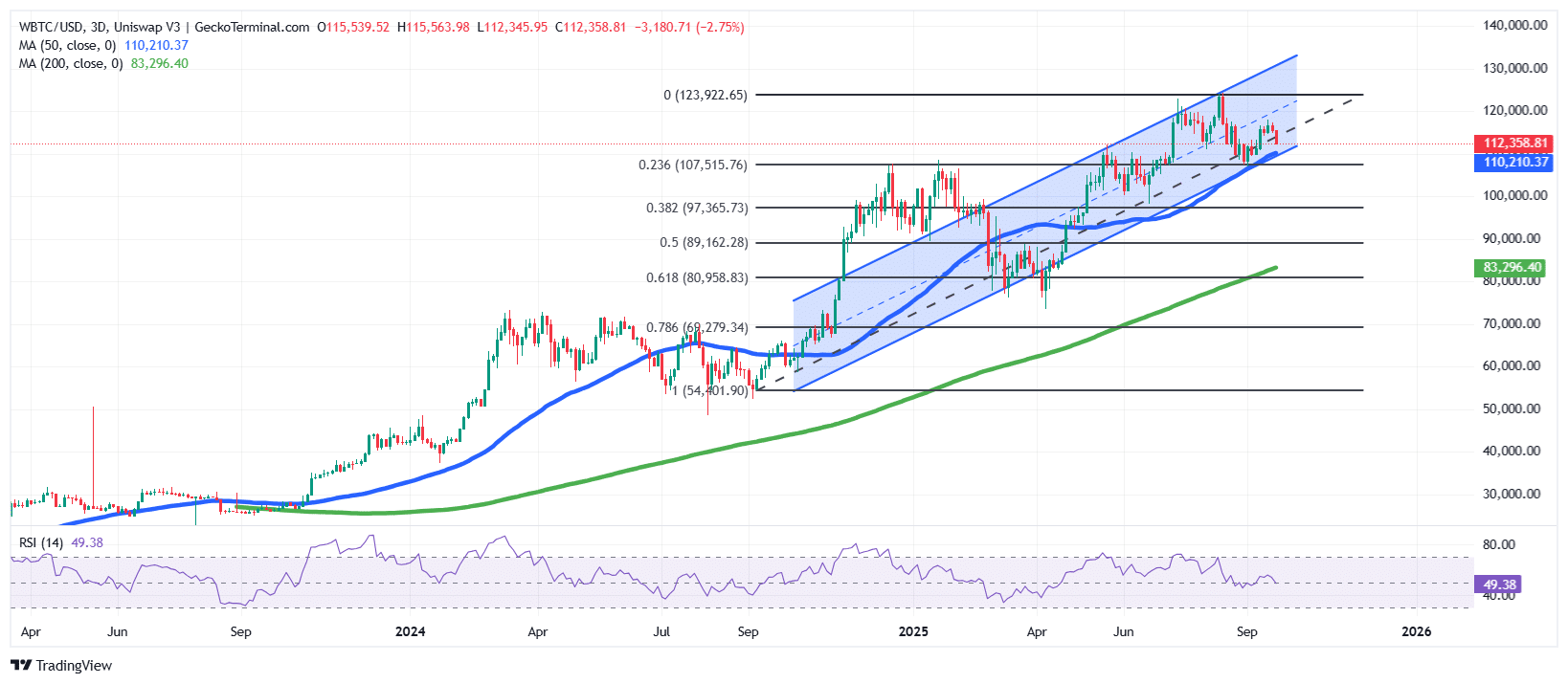

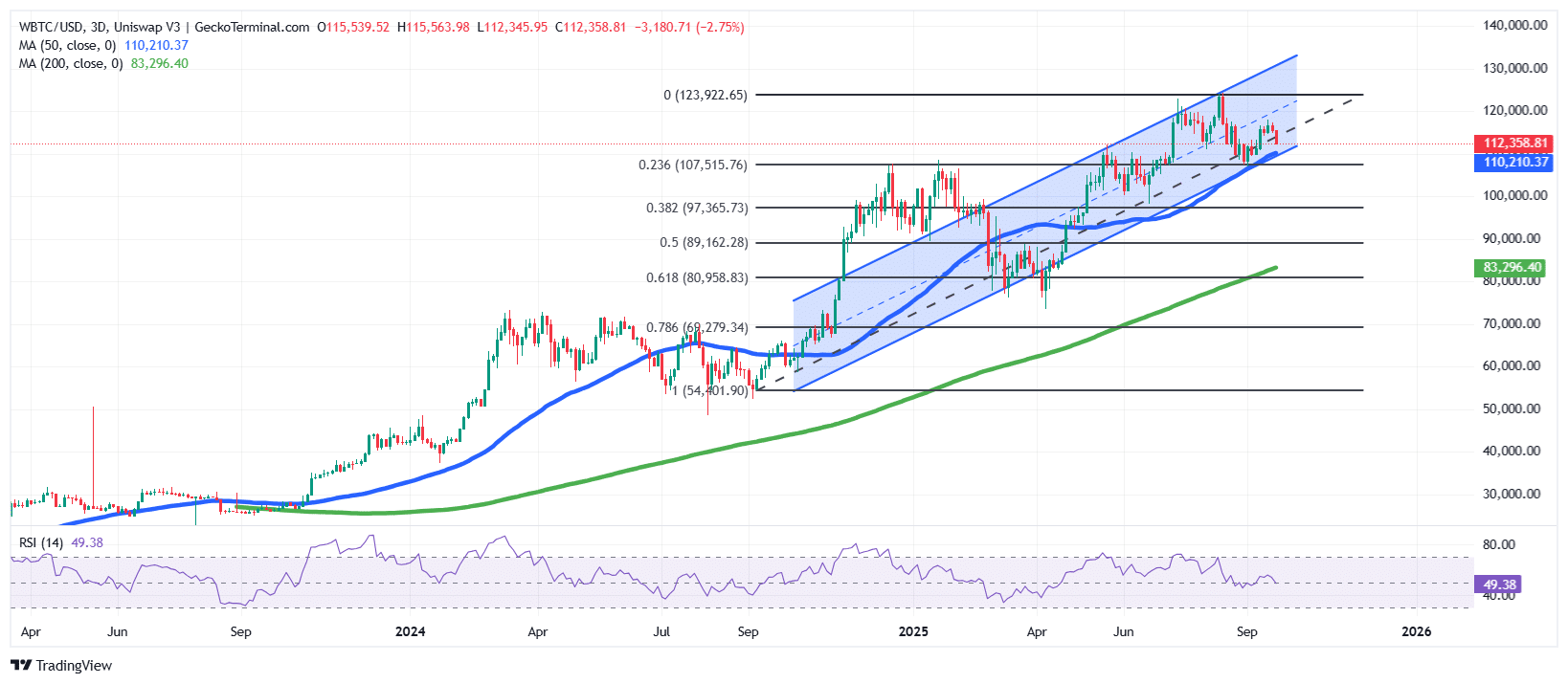

The BTC value is presently buying and selling at $112,358, displaying a decline of practically 3% within the newest candle.

Bitcoin value motion has been shifting inside a well-defined rising channel sample since late 2023, signaling a broader bullish construction. Nonetheless, latest candles recommend weakening momentum because the market checks the decrease boundary of this channel.

The Fibonacci retracement ranges spotlight rapid assist close to $107,515 (0.236 degree) and stronger assist at $97,365 (0.382 degree), whereas resistance stays on the latest excessive of $123,922.

Wanting on the indicators, the 50-day Easy Transferring Common (SMA) at $110,210 is appearing as a near-term assist. A sustained shut beneath this degree may set off additional draw back towards the 200-day SMA at $83,296, which stays a key long-term assist zone.

In the meantime, the Relative Energy Index (RSI) sits at 49.38, hovering across the midpoint, suggesting a impartial market with no clear overbought or oversold situations.

If patrons defend the 50-day SMA, the worth of Bitcoin may retest the channel prime close to $123,000. Conversely, a breakdown might drag the market towards $97,000 within the weeks forward.

XRP And DOGE Costs Below Stress: Can Bulls Defend Key Helps?

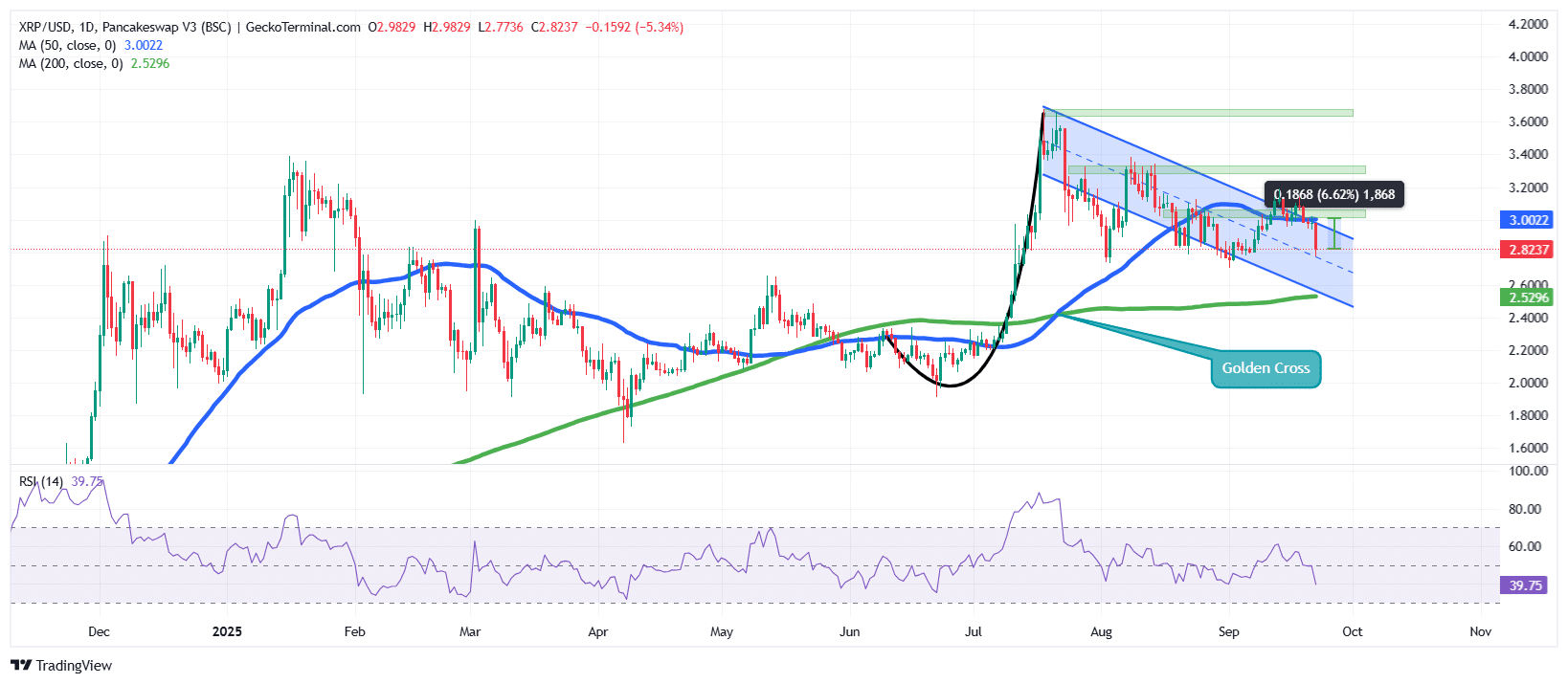

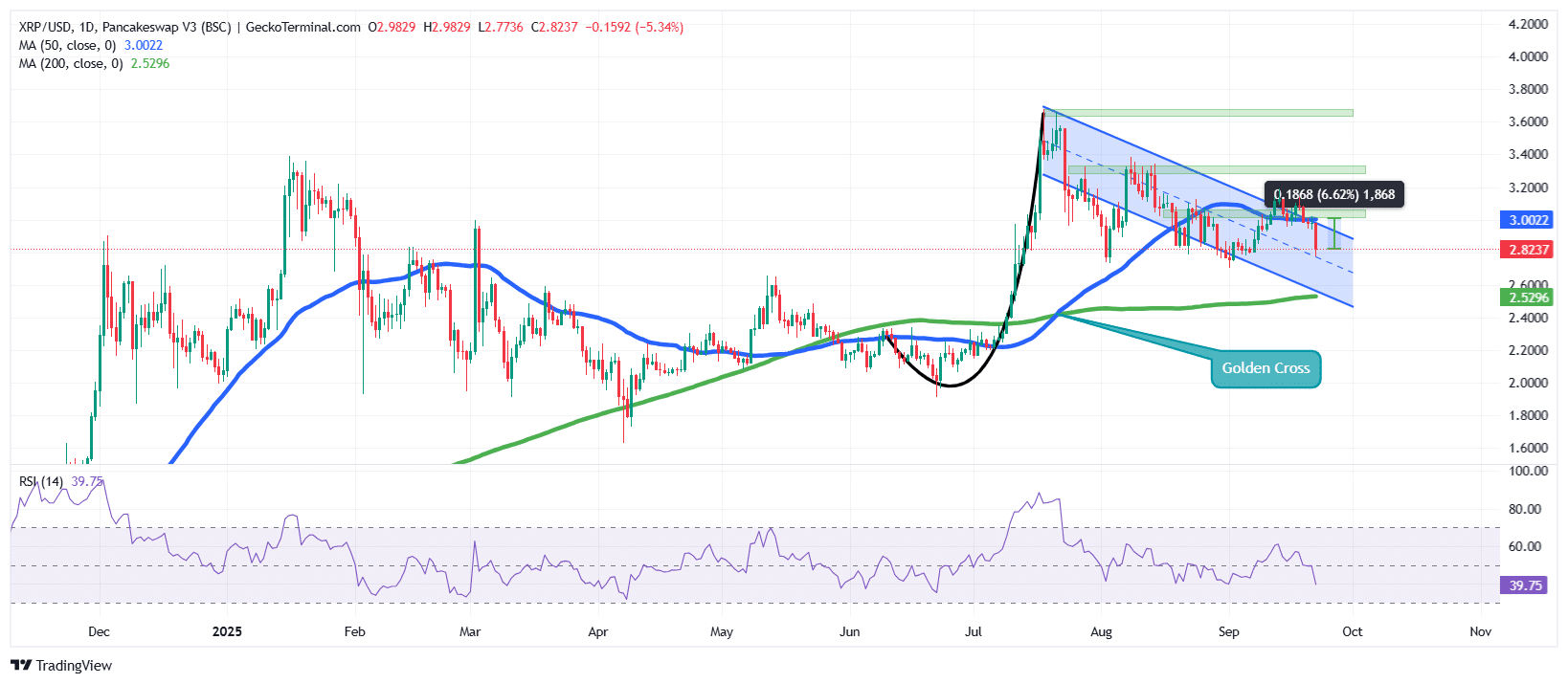

XRP is presently buying and selling at $2.82, down greater than 5% on the day. After a robust parabolic curve earlier this yr, the worth has since been consolidating in a downward channel.

The chart exhibits a Golden Cross, with the 50-day shifting common ($3.00) rising above the 200-day shifting common ($2.52), typically seen as a bullish long-term sign. Nonetheless, short-term momentum stays weak.

The RSI at 39.75 signifies bearish strain, leaning towards the oversold zone.

If the Ripple token value holds above the 200-day SMA, it may stage a rebound towards the $3.20–$3.40 vary. Failure to take action might open the door to deeper retracements close to $2.50.

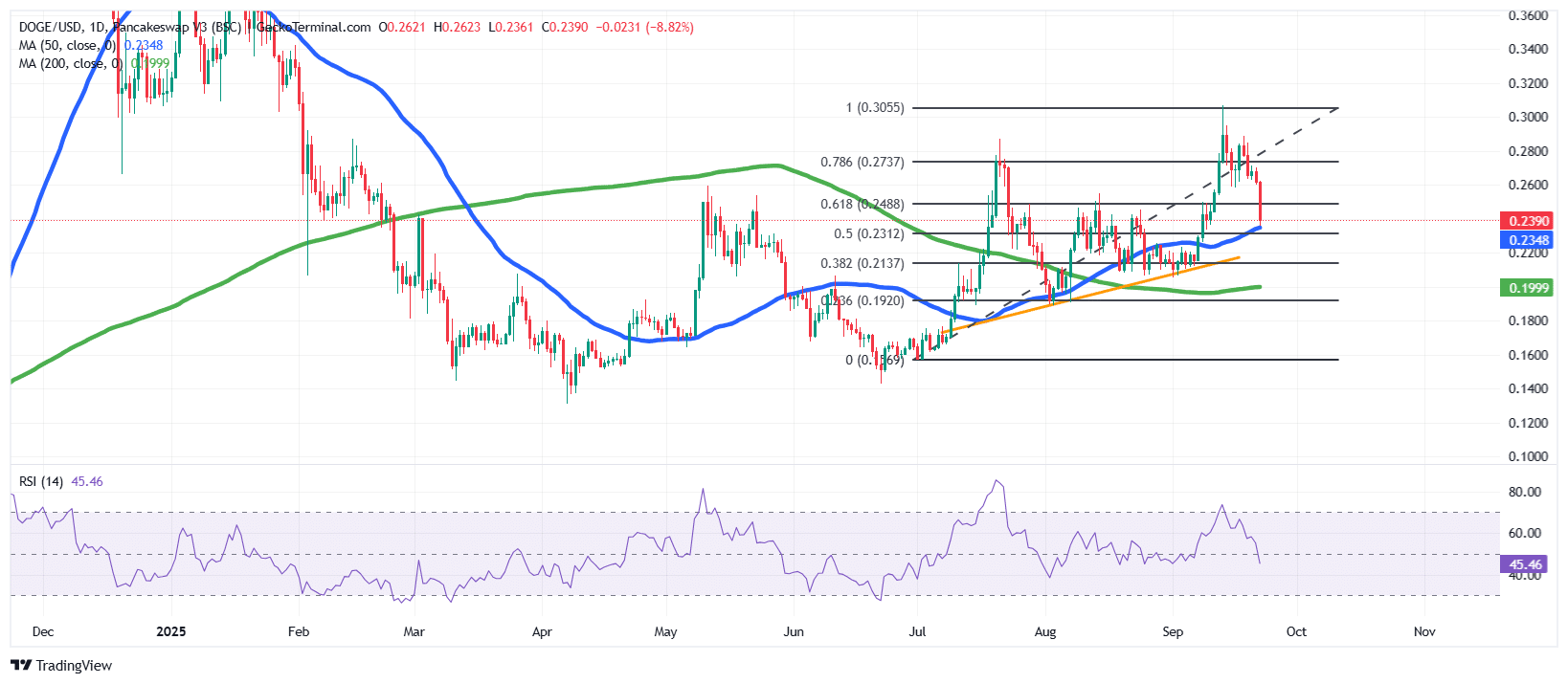

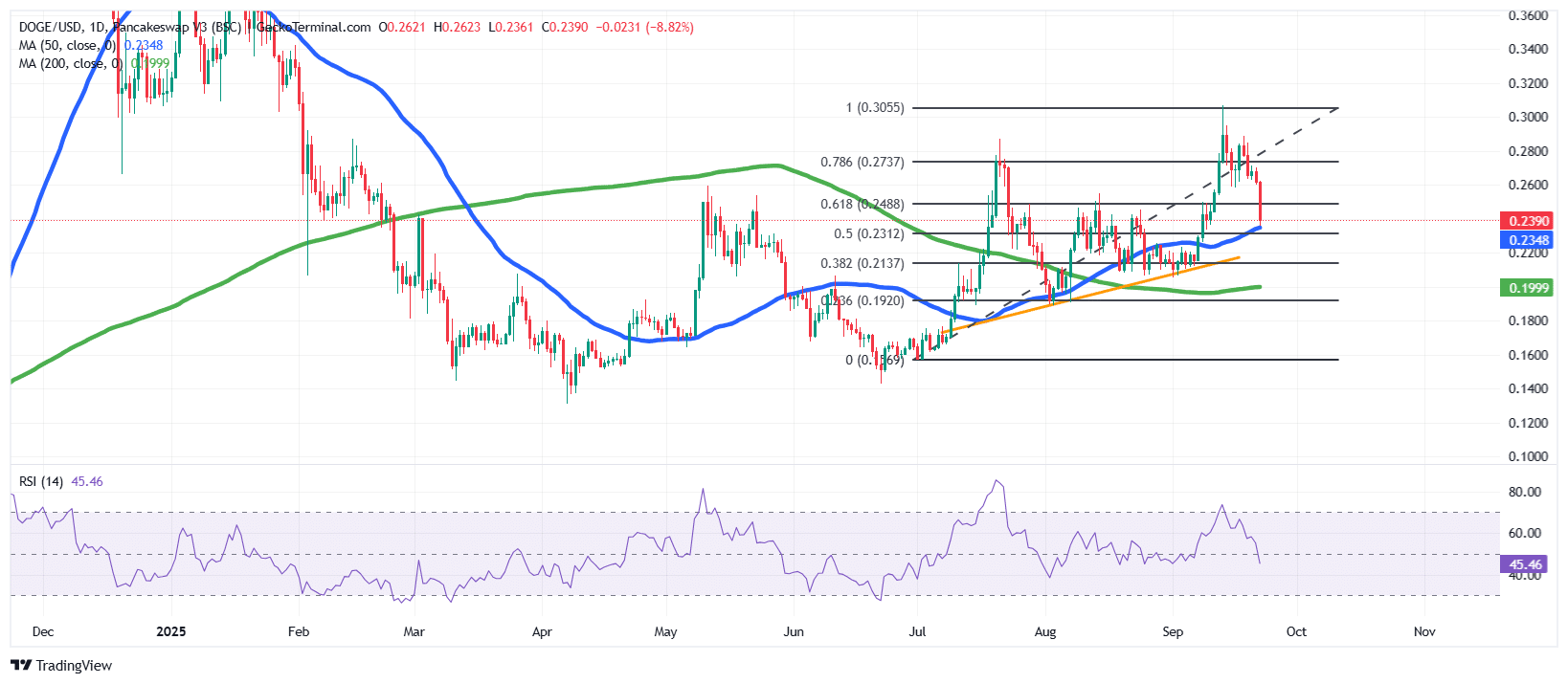

In the meantime, Dogecoin is buying and selling at $0.2390, sliding practically 10% within the newest session after lately testing resistance close to $0.3055.

The DOGE value is retracing from its highs, with the asset now hovering simply above the 50-day Easy Transferring Common (SMA) ($0.2348). This space aligns intently with the 0.5 Fibonacci retracement degree ($0.2312), making it a essential assist zone.

The 200-day SMA ($0.1999) continues to pattern upward, confirming a longer-term bullish basis. Nonetheless, the RSI at 45.46 suggests weakening momentum, leaving DOGE in impartial territory however leaning towards bearish strain.

If the 50-day SMA holds, DOGE may try one other transfer increased towards $0.2737 and doubtlessly retest the $0.30 zone.

However, a decisive breakdown beneath $0.2312 may drag the worth again towards $0.21–$0.20, testing the energy of long-term patrons.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection