Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has climbed 1% within the final 24 hours to commerce at $113,437.94 as of 1 a.m. EST on a forty five% enhance in day by day buying and selling quantity to nearly $59 billion.

This leap within the BTC value comes after Bitcoin mining agency CleanSpark secured $100 million in financing with Coinbase Prime, utilizing a part of its 13,000 BTC holdings as collateral. The corporate plans to make use of the funds to increase Bitcoin mining, HPC, and power operations.

With $300M in BTC-backed financing thus far, CleanSpark not too long ago posted report Q3 income of $198.6M and mined 657 BTC in August, a 37.5% enhance from final 12 months. The agency says versatility throughout mining and computing will drive future development.

CleanSpark $CLSK and $COIN signal $100 million deal. 👀 pic.twitter.com/HNXgx4WWhz

— Cole Grinde (@GrindeOptions) September 22, 2025

In the meantime, BitMEX co-founder Arthur Hayes reaffirmed his $250,000 Bitcoin value goal, arguing that institutional adoption, ETF momentum, and central financial institution insurance policies will gasoline BTC’s subsequent main rally.

With Bitcoin buying and selling above $113k, Hayes believes the market stays on monitor for his formidable forecast.

Bitcoin Futures Open Curiosity Hits File Excessive

Bitcoin futures open curiosity has reached new highs, exhibiting robust development in market exercise. Knowledge from Coinglass reveals that open curiosity has climbed above $100 billion as Bitcoin’s value trades above $120,000. Each have been rising steadily since late Q3, signaling rising confidence amongst merchants.

This surge in open curiosity means extra merchants are coming into the futures market, betting on Bitcoin’s value strikes. It additionally displays deeper liquidity and higher participation from each retail and institutional traders.

When open curiosity rises alongside value, it typically factors to stronger momentum, however it might additionally result in larger volatility if sudden corrections occur.

Trade BTC Futures Open Curiosity: CoinGlass

The pattern highlights how vital futures buying and selling has turn out to be in shaping Bitcoin’s value. With more cash flowing into derivatives, the futures market is enjoying a much bigger function than ever in driving general sentiment.

If this upward pattern continues, Bitcoin might keep its robust momentum. Nevertheless, merchants ought to be cautious of potential dangers, particularly giant liquidations throughout sharp pullbacks.

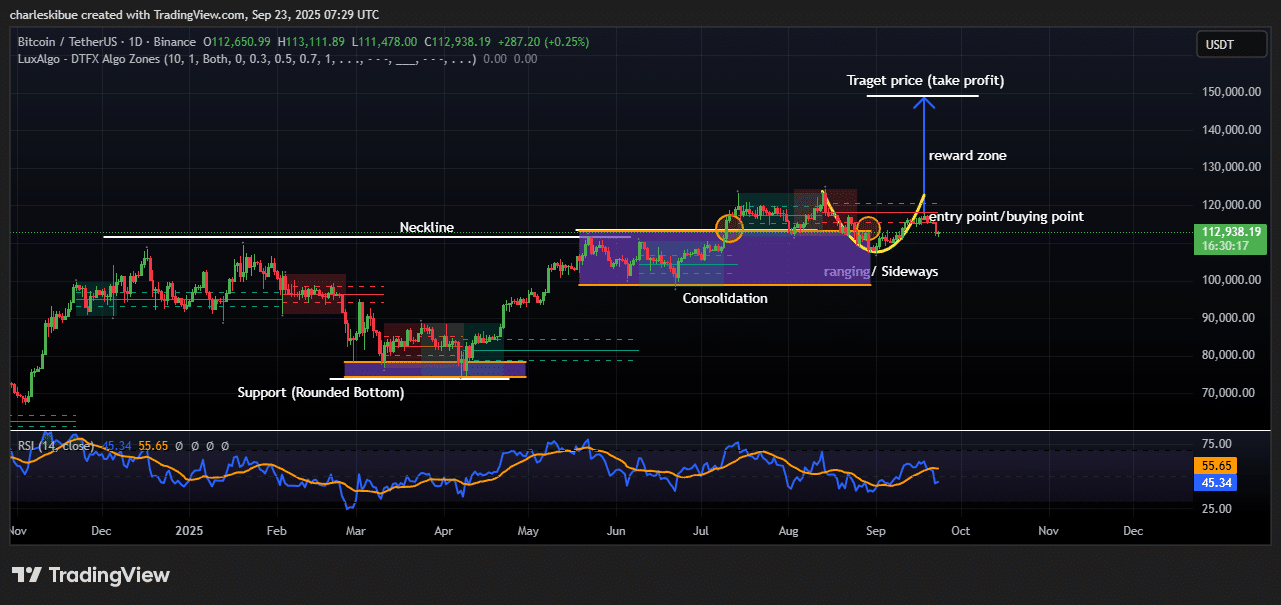

Bitcoin Worth Targets $150K As Chart Indicators Bullish Breakout

Bitcoin (BTC) is buying and selling at about $113,025 after small positive aspects, and merchants are watching intently for a potential large breakout. The chart reveals that Bitcoin has constructed robust help and could possibly be making ready for a transfer towards $150,000 if the pattern holds.

Earlier this 12 months, Bitcoin shaped a rounded backside sample close to $90,000, which acted as a robust help degree. From there, the value moved into an extended consolidation part earlier than breaking above the neckline round $113,000. This breakout is vital as a result of it reveals that patrons are regaining power and will push costs a lot larger.

Proper now, Bitcoin is shifting sideways, testing the $113,000 space as a brand new help degree. Many merchants see this as a wholesome retest after the breakout. If Bitcoin can keep above this zone and construct momentum, the following goal could possibly be within the $130,000 to $150,000 vary.

BTCUSDT Evaluation Supply: Tradingview

The Relative Energy Index (RSI) is sitting close to 55, which is neither overbought nor oversold. This implies there may be nonetheless room for the value to climb with out triggering heavy promoting stress. Nevertheless, the RSI additionally warns that Bitcoin might face short-term pullbacks earlier than making its subsequent large transfer.

For merchants, the important thing entry level stays across the $113,000 degree, the place shopping for stress is predicted to return. If Bitcoin can break above $120,000, it could affirm the bullish outlook and will deliver extra patrons into the market, together with bigger institutional gamers. On the draw back, failure to carry above help might see Bitcoin drop again to the $100,000–$105,000 vary.

General, the technical outlook for Bitcoin appears optimistic. The rounded backside sample, consolidation breakout, and secure RSI all level to larger costs forward. Merchants are aiming for a possible reward zone as much as $150,000, however they’re additionally preserving an in depth eye on help ranges in case of a pullback.

If the present breakout holds, the market might see a robust rally within the weeks forward. But when help fails, sideways buying and selling might proceed for longer earlier than the following large transfer.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection