Pantera Capital founder Dan Morehead believes a geopolitical shift in reserve administration will push adversaries of america into Bitcoin at large scale, calling it “inevitable” that China and Russia ultimately maintain “trillions of {dollars}” price of the asset.

Talking on Blockworks’ Empire podcast launched this week, the billionaire framed the prediction as a part of a longer-term rotation in world reserve property and a response to sanction threat embedded in dollar-denominated holdings. “I believe it’ll take a decade or two,” Morehead stated, including that the primary movers will probably embody US-aligned Gulf states earlier than “the massive one” arrives with nations “antagonistic to america, like China or Russia.”

Why Russia And China Will Undertake Bitcoin

Morehead anchored his argument within the historic cadence of reserve transitions and the vulnerability of holding claims on a rival’s monetary system. “You gotta keep in mind, the reserve forex’s modified each 80 or 100 years… nobody’s ever actually lasted for greater than, let’s name it 100, 110 years,” he stated.

Whereas calling it “inconceivable that the greenback will probably be supplanted” in a single day, he warned that nations with giant US Treasury positions face concentrated political threat. Citing China’s portfolio, he argued: “It’s actually fairly loopy to have your complete nation’s life financial savings in an asset that your potential adversary may actually simply cancel.” In his view, that calculus makes it “inevitable” that such nations “could have began to avoid wasting in Bitcoin and different cryptocurrencies” inside the subsequent decade.

Associated Studying

The provocation lands amid measurable modifications in how main economies maintain US debt. Official Treasury knowledge for July 2025 present China’s reported Treasury holdings at $730.7 billion, the bottom since 2008 and down markedly over the previous decade, a decline typically learn as gradual diversification of reserves fairly than abrupt abandonment.

JUST IN: BILLIONAIRE DAN MOREHEAD JUST SAID IT’S “INEVITABLE” CHINA AND RUSSIA WILL HOLD TRILLIONS OF DOLLARS IN #BITCOIN

NATION STATE GAME THEORY. IT’S HERE 🚀 pic.twitter.com/tOQO9tHYNi

— The Bitcoin Historian (@pete_rizzo_) September 23, 2025

Japan stays the biggest holder at roughly $1.15 trillion, with the UK close to $900 billion. The broader pool of foreign-held Treasuries nonetheless hit a document in July. These figures illustrate that whereas the greenback system stays deep and liquid, China’s share is slipping on the margin—the precise dynamic Morehead argues may speed up different reserve methods over time.

Morehead’s timeline additionally intersects with a flurry of coverage proposals that, if enacted, would normalize sovereign Bitcoin publicity. In March, US President Donald Trump signed an government order establishing a Strategic Bitcoin Reserve and a nationwide digital asset stockpile. Wyoming legislators individually superior a invoice to allow restricted Bitcoin investments—capped at 3%—inside sure state funds, an incremental step towards institutional reserve administration in digital property on the state stage.

Associated Studying

Exterior the US, Gulf governments are already experimenting on the edges of sovereign crypto publicity—one other plank in Morehead’s thesis. The United Arab Emirates’ has launched state-backed mining initiatives and disclosures suggesting a number of thousand BTC gathered on the stability sheet by way of these operations.

Skeptics will observe that shifting “trillions” of {dollars} into Bitcoin would require not solely coverage shifts but in addition market construction able to absorbing sustained sovereign demand with out disorderly volatility. Liquidity depth has improved with US spot ETF adoption and rising derivatives markets, but Bitcoin’s free float, custody frameworks, and cross-border fee rails nonetheless face periodic stress.

Morehead, nevertheless, situates the thesis in a protracted arc fairly than a short-term commerce. “I don’t assume it’s gonna occur in a single day,” he stated, emphasizing a horizon of “a decade or two” and a phased path by which US-aligned adopters pave the way in which for politically non-aligned states that prize censorship resistance and sanction insulation.

For China and Russia particularly, the impetus can be as a lot strategic as monetary. China’s willingness to chip away at Treasuries aligns with its broader push to diversify reserves into gold and different property, whereas Russia’s post-2014 and 2022 sanctions expertise has already pushed a dramatic reconfiguration of its reserve composition.

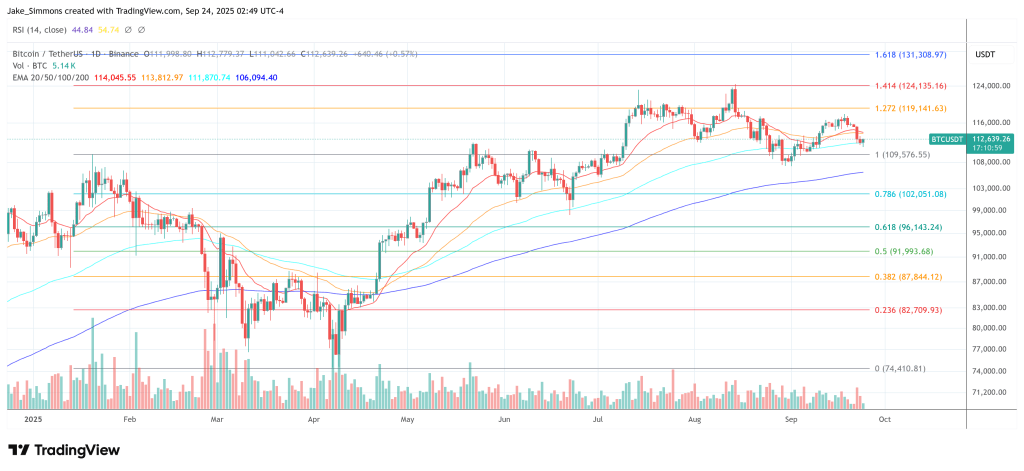

At press time, Bitcoin traded at $112,639.

Featured picture created with DALL.E, chart from TradingView.com