Ripple’s stablecoin desk is taking part in lively provide video games, with the newest sequence exhibiting either side of the ledger. First, there was an eight million RLUSD mint, then an eleven million burn, after which one other three million tokens spun out of the treasury.

The sample is just not random; it’s managed biking that reveals Ripple is adjusting liquidity round dwell flows somewhat than simply letting provide drift.

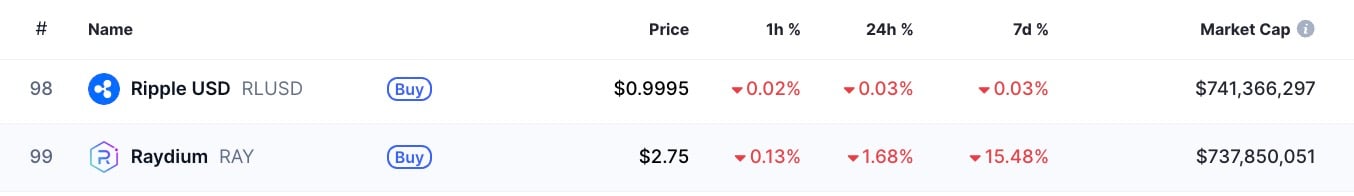

The entire float is now round $741 million, which is sufficient to push Ripple USD above Raydium — the token of Solana’s principal decentralized change — available in the market cap rankings. The soar is necessary as a result of RLUSD remains to be fairly younger, solely launching months in the past, however it’s already shifting $150 million in each day quantity.

Which means it has a turnover price of over 20% of provide each single day. For a stablecoin that’s nonetheless discovering its distribution rails, that type of velocity is a press release.

What’s so particular about Ripple USD stablecoin?

What makes RLUSD stand out is how effectively establishments are already plugging in. Buyers can swap tokenized fund shares like BlackRock’s BUIDL into RLUSD utilizing Securitize, closing the loop between tokenized treasuries and {dollars}.

DBS Financial institution is itemizing RLUSD alongside sgBENJI in Asia, enabling buying and selling, borrowing and collateralizing utilizing Ripple’s stablecoin in the identical setting as tokenized cash market funds.

The mint-burn-mint cycle reveals that Ripple is treating RLUSD like a dwell financial instrument, not a one-way issuance machine. In case you have a look at the market measurement of Raydium, it’s already overtaking a few of the large names in DeFi.

Connections with massive establishments present the goal is greater than crypto buying and selling pairs; Ripple needs RLUSD to be on the heart of worldwide tokenized finance.