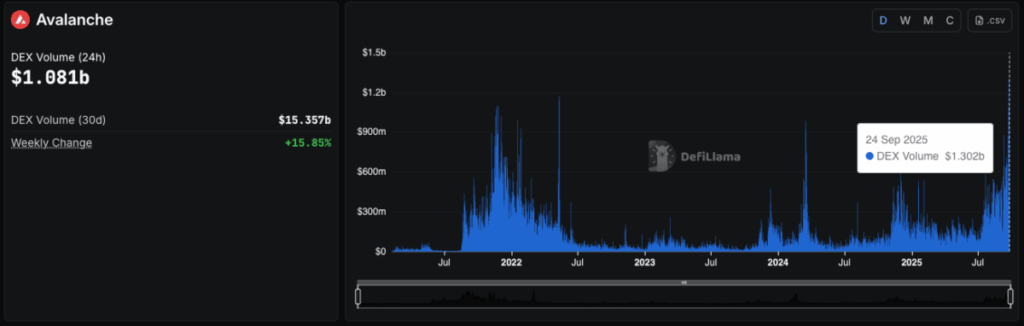

- Avalanche DEX volumes smash data, hitting $1.3B in a single day

- Hivemind Capital launches $550M AVAX One fund with Scaramucci as chair

- AVAX value eyes breakout above $35, with potential run towards $43

Avalanche’s DeFi ecosystem lit up on Sept. 24 as decentralized change volumes ripped to a contemporary all-time excessive of $1.3 billion. That determine not solely shattered the prior day’s peak of $1.18 billion but additionally signaled that merchants weren’t fleeing the community in the course of the broader market dip—they have been rotating capital inside it. Regardless of heavy macro headwinds, together with the Fed’s current fee reduce that weighed on BTC and ETH, AVAX nonetheless climbed 2.5% to consolidate close to $35.

The uptick in volumes highlights a rising choice amongst Avalanche customers to chase yield alternatives inside the ecosystem slightly than cashing out to fiat or transferring to rival chains. That inner rotation has been a significant driver of Avalanche’s resilience, with AVAX rallying almost 47% over the previous three weeks whereas prime belongings like Bitcoin and Ethereum struggled to get better. The information means that DeFi progress, slightly than hype, is underpinning the rally.

Hivemind’s $550M Wager on AVAX One

Fueling the momentum additional, Hivemind Capital Companions revealed a large $550 million fundraising plan for the AVAX One initiative. The venture will concentrate on tokenizing monetary belongings, from fintech merchandise to insurance coverage applied sciences, straight on Avalanche’s blockchain. Anthony Scaramucci, stepping in as Advisory Chair, confirmed his involvement and confused the potential of real-world asset tokenization as a long-term progress driver. This transfer indicators institutional confidence that Avalanche is positioning itself as a key participant in blockchain finance.

The backing of heavyweight traders provides legitimacy to Avalanche’s enlargement narrative. Institutional inflows usually function a catalyst for retail merchants, reinforcing bullish momentum. For AVAX holders, the information couldn’t have come at a greater time, because the token hovers close to seven-month highs and exams important resistance ranges.

Technical Outlook: Resistance at $35

On the charts, AVAX has been holding agency above the 20-day EMA at $33, displaying robust bullish momentum. The MACD line stays above the sign, whereas the Cash Move Index has cooled barely from overbought situations, sitting at 59. A decisive shut above the $35 resistance might unlock a path towards $43, marking a brand new 2025 excessive.

Nonetheless, dangers stay. If assist at $33 falters, AVAX might retest $30, the place the 50-day EMA might present a cushion. But, with DeFi exercise surging and contemporary institutional commitments rolling in, the bulls seem well-equipped to push larger within the close to time period.

AVAX’s Edge in a Shaky Market

What makes Avalanche’s rally stand out is its distinction with the remainder of the market. Whereas Bitcoin stays capped below $115,000 and Ethereum struggles beneath $4,200, AVAX has carved its personal path with ecosystem-driven progress. Merchants are signaling confidence not simply within the token however within the community’s broader monetary infrastructure ambitions.

This mixture of on-chain momentum and exterior capital inflows paints a compelling story for AVAX heading into This fall. If the ecosystem continues to draw liquidity and institutional companions, Avalanche may very well be setting the stage for a much bigger breakout whereas its friends stay below strain.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.