Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has tumbled 0.8% within the final 24 hours to commerce at $111,637.11 at 12:45 a.m. EST on a 2.5% improve in buying and selling quantity to $50.71 billion.

Regardless of that, former Goldman Sachs govt Raoul Pal says this cycle might run longer. He predicts a possible prime within the second quarter of subsequent yr as international liquidity and enterprise exercise proceed supporting Bitcoin.

Pal, co-founder of economic media firm Actual Imaginative and prescient, says his financial fashions present a potential stronger surge within the BTC value if US enterprise exercise, as measured by the ISM index, picks up,

Raoul Pal: “The 4-year cycle is now the 5-year cycle… #Bitcoin ought to peak in 2026. Most likely Q2.” pic.twitter.com/0dQI8OA3CT

— $WEN BURN? (@wen_burn_wen) September 25, 2025

Bitcoin Value Dips Under $112K

Bitcoin’s pullback follows an extended rally and comes simply as month-to-month buying and selling choices value $22.6 billion are expiring, creating additional volatility for merchants.

On the worth chart, Bitcoin managed to climb above each the 50-week and 200-week Easy Transferring Averages, which sit at $98,950 and $53,100, respectively. These shifting averages assist merchants spot longer-term instructions and present that Bitcoin remains to be in a bullish section regardless of the latest pullback.

Robust horizontal assist areas stand at $111,000 and simply above $100,000. The 50-week MA close to $99,000 affords additional safety if costs dip additional. Traditionally, September has been a tough month for Bitcoin, with common losses of about -3.77% since 2013.

BTCUSD Evaluation Supply: Tradingview

Market information reveals that fiscal year-end promoting by giant funds can create added stress, resulting in “Crimson September” for cryptocurrencies. Regardless of these dangers, some analysts nonetheless see hidden bullish alerts.

A “hidden bullish divergence” within the RSI suggests the market will not be as weak as easy value charts point out. A number of consultants, together with these at Altcoin Every day, count on that after a interval of re-accumulation and potential dips, Bitcoin might retest its all-time excessive above $124,500 within the coming weeks.

The RSI (Relative Power Index) not too long ago hovered between 55 and 62, pointing to impartial momentum. The MACD (Transferring Common Convergence Divergence) can be exhibiting indicators of cooling, as consumers seem like pausing after an intense run-up.

Bitcoin has hit turbulence after its newest all-time excessive, however analysts nonetheless see a path to new information if assist ranges maintain and macro developments stay optimistic. The following couple of months could possibly be bumpy, however the longer-term outlook stays hopeful, particularly with Pal pointing to 2026 because the almost certainly peak window for this cycle.

Bitcoin On-Chain Metrics Present Market Power

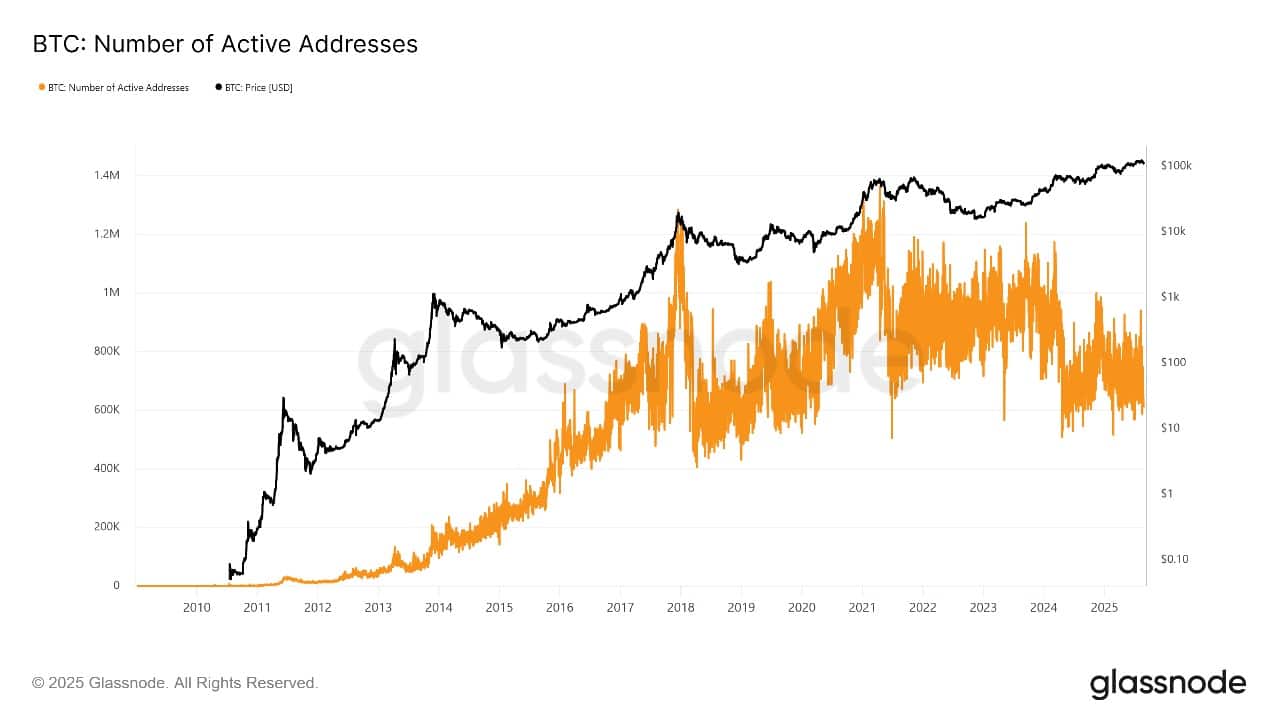

Bitcoin’s on-chain information reveals vital clues about market well being. The variety of energetic addresses not too long ago went as much as almost $110,000, that means extra individuals have been shopping for and promoting. This reveals the worth drop introduced each sellers and new consumers into the market.

Bitcoin Lively Addresses Supply: Glassnode

Over 70% of the Bitcoin provide is held long-term. This implies many holders are assured and never promoting now. On the similar time, Bitcoin saved on exchanges is dropping, as holders transfer cash into personal wallets for long-term security.

Different information, like miner exercise and transaction quantity, are regular, indicating the community is robust. These indicators counsel the latest dip is a pause in an extended bull run. Patrons may discover good entry factors close to $110,000 as robust holders maintain agency, supporting a optimistic outlook towards 2026.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection