Key Takeaways

Why is $2.5M a sensible goal for Bitcoin by 2050?

By 2050, Bitcoin’s mounted 21M provide and modest international wealth allocation of simply 5% may push valuations past $2.5M.

What position will establishments and governments play?

Institutional ETFs and potential authorities reserves may create large demand, accelerating Bitcoin’s path to multi-trillion-dollar valuations.

Since its launch in 2009, Bitcoin [BTC] has persistently trended increased, regardless of periodic drawdowns.

The long-term chart highlights how every cycle has pushed BTC into new territory, with increased highs following each halving.

Immediately, with Bitcoin buying and selling above $110K, the trajectory displays over a decade of exponential progress fueled by shortage, halving occasions, and rising adoption.

This structural uptrend kinds the muse of forecasts suggesting that by 2050, Bitcoin may attain valuations as soon as thought unattainable, together with the much-debated $2.5 million per coin goal.

Supply: TradingView

From shortage to scale

Bitcoin’s provide mechanics are hardcoded. By 2050, over 99.99% of the entire 21 million cash shall be mined, successfully cementing its shortage.

With no vital new provide coming into circulation, value appreciation shall be tied on to demand.

At that time, Bitcoin’s valuation hinges on how a lot international wealth it captures. If BTC instructions simply 5% of projected international wealth (~$1,050T), its market cap would attain $52.5T, putting every coin close to $2.5M.

At a ten% share, BTC may climb to $5M, and at 20%, a staggering $10M. These eventualities underscore how shortage can drive scale in valuation.

Sustainable progress forward for Bitcoin

On-chain knowledge reinforces the long-term potential.

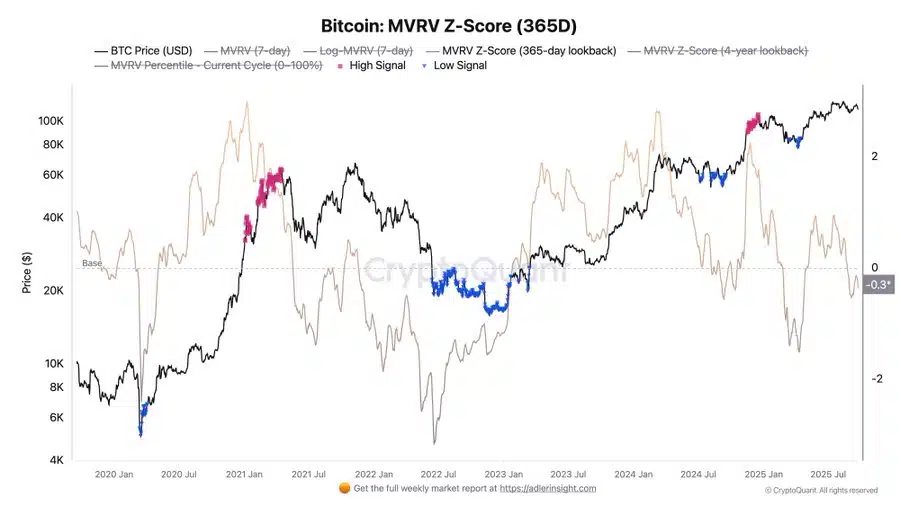

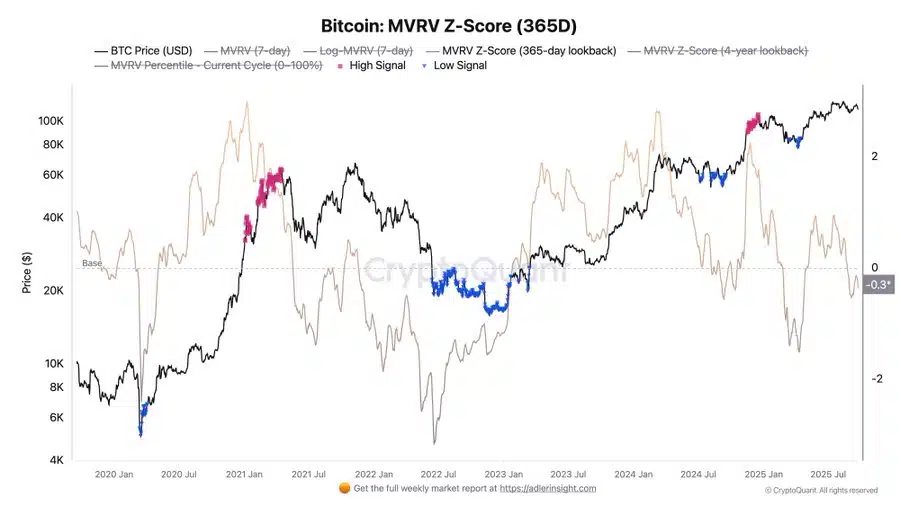

For example, the MVRV Z-Rating, a key metric evaluating market worth to realized worth, just lately dipped to -0.3, signaling that Bitcoin trades near its “honest” valuation with out indicators of overheating.

Traditionally, low MVRV zones have coincided with long-term accumulation alternatives.

As cycles progress, MVRV tends to reset earlier than launching into new progress phases, illustrating how on-chain fundamentals act as a stress valve for sustainable growth.

This ensures that BTC’s trajectory towards multi-million valuations shouldn’t be purely speculative however grounded in structural market conduct.

Supply: CryptoQuant

Establishments, governments may very well be the catalyst

Past on-chain knowledge, macro forces and institutional involvement will form Bitcoin’s 2050 path.

Asset managers like BlackRock have already moved to launch spot ETFs, accelerating accessibility for pension funds, sovereign wealth funds, and retirement accounts.

If establishments allocate even a fraction of their holdings into BTC, demand may eclipse provide many instances over.

Moreover, governments exploring Bitcoin reserves as a hedge towards fiat debasement may additional legitimize its position as a world retailer of worth.

With debt ranges ballooning and inflationary dangers persisting, Bitcoin stands poised to profit as a scarce, non-sovereign asset.

Why $2.5M Bitcoin could also be conservative, not bold

By 2050, Bitcoin’s capped provide shall be absolutely realized, leaving demand as the only driver of value.

With even modest wealth allocation, the $2.5M goal seems possible, and extra aggressive adoption eventualities level to far increased valuations.

On-chain fundamentals such because the MVRV Z-Rating show sustainability, whereas institutional adoption and macroeconomic headwinds create fertile floor for Bitcoin’s continued rise.

What as soon as appeared unbelievable now suits inside the framework of Bitcoin’s historic progress and future potential.