- Aster has surged to the highest of DeFi income charts, backed by CZ and YZi Labs.

- Its ASTER token powers governance, rewards, and payment reductions throughout the ecosystem.

- With multi-chain liquidity, MEV safety, and yield-bearing collateral, Aster is redefining decentralized derivatives buying and selling.

Aster, the decentralized perpetuals change that detonated onto the scene in September 2025, has performed extra than simply make noise. It has flipped income charts, hijacked market sentiment, and despatched shockwaves by means of the DeFi derivatives sector.

Backed by YZi Labs and Binance founder CZ, Aster isn’t one other protocol—it’s a full-blown ecosystem engineered to problem centralized exchanges and dominate the perpetuals DEX meta. So, allow us to take a better take a look at the structure, mechanics, and ambitions of the platform that has merchants calling it probably the most explosive launch of the 12 months.

What Is Aster?

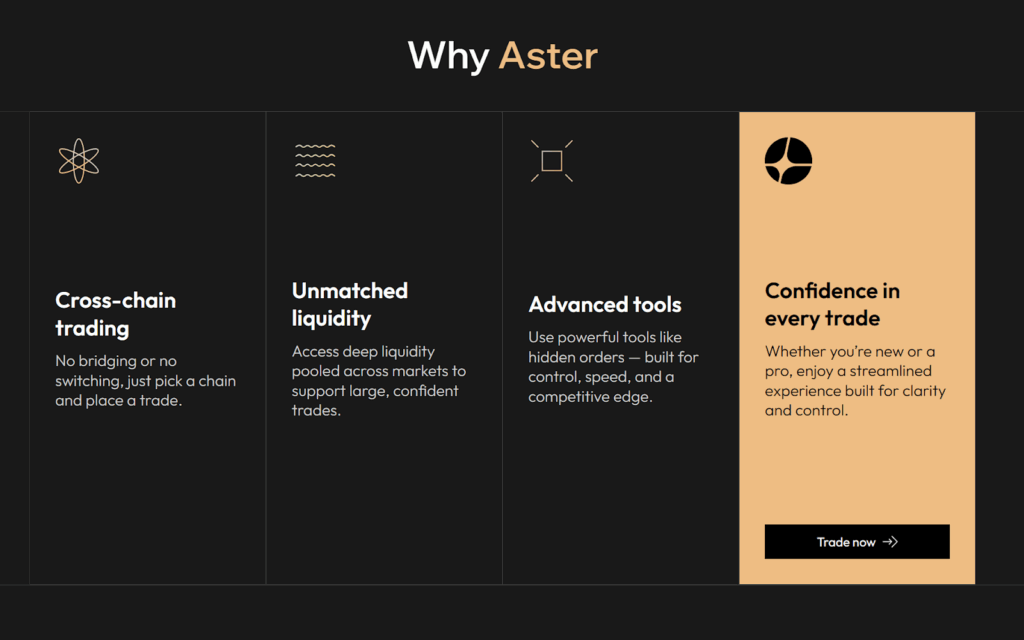

Aster is a decentralized change platform designed to ship professional-level buying and selling with the accessibility and transparency of decentralized finance. It affords each perpetual and spot buying and selling by means of an built-in interface that works throughout 4 main blockchain networks — BNB Chain, Ethereum, Solana, and Arbitrum.

At its core, Aster is powered by ASTER, a utility token that drives governance, rewards, and platform entry. The platform is constructed to mix pace, safety, and effectivity whereas addressing persistent challenges in DeFi buying and selling reminiscent of fragmented consumer expertise, excessive charges, restricted capital effectivity, and poor execution high quality.

Notably, ASTER token is the native utility token of the ecosystem. With a hard and fast provide of 8 billion, ASTER acts because the connective tissue of the Aster platform. It fuels governance processes, unlocks premium options, gives payment optimization, and helps a broader group governance framework. This token serves each as a device for on a regular basis buying and selling optimization and as a mechanism to coordinate long-term development inside the Aster ecosystem.

Core Elements

Aster is constructed on a basis of modular, high-performance parts that work collectively to ship a seamless buying and selling expertise. Core parts embrace:

Twin-Mode Buying and selling System

Aster splits its buying and selling interface into two distinct modes. Easy Mode is constructed for accessibility, providing one-click execution with as much as 1001x leverage and MEV resistance. Professional Mode caters to superior customers with a full orderbook, grid buying and selling automation, hedge mode, and multi-asset margin assist. This bifurcation permits Aster to serve each retail {and professional} merchants with out compromise.

Commerce and Earn Program

This mechanism transforms idle collateral into productive property. Customers can stake BNB to obtain asBNB, a liquid staking by-product that earns rewards whereas serving as margin. USDF, a yield-bearing stablecoin pegged to USDT, is deployed in delta-neutral methods on Binance, producing passive revenue whereas getting used for leveraged buying and selling.

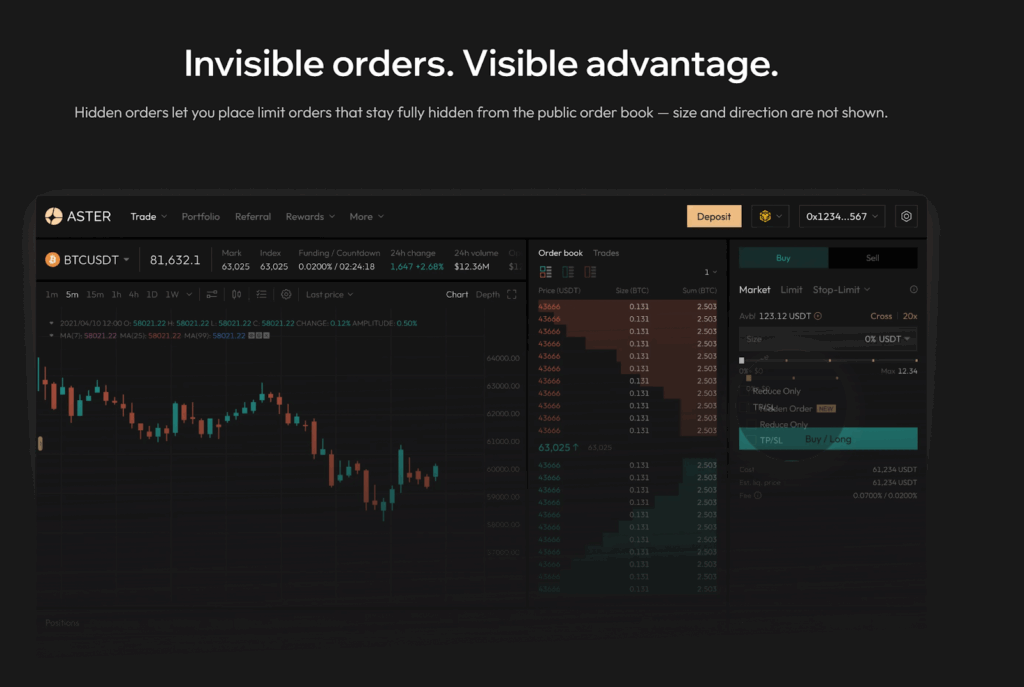

Hidden Orders

To fight front-running and sandwich assaults, Aster introduces Hidden Orders that stay invisible till execution. This function protects massive trades from MEV exploitation and ensures honest pricing, particularly for institutional contributors.

Cross-Chain Liquidity Aggregation

Aster pulls liquidity from a number of blockchains with out requiring customers to bridge property or handle a number of wallets. This native multi-chain structure gives deep liquidity and optimum execution throughout ecosystems.

What Issues Does It Remedy?

Aster is a direct response to the restrictions of current platforms. Some key issues it addresses:

- Fragmented Buying and selling Expertise – Many DeFi merchants should navigate a number of platforms to entry full performance. Aster centralizes spot buying and selling, perpetual contracts, and yield optimization underneath a single interface, eliminating complexity.

- Low Capital Effectivity – Conventional exchanges require capital to be locked with out producing returns. Aster’s Commerce & Earn program permits yield-bearing property as collateral, producing simultaneous buying and selling income and passive revenue.

- MEV Exploitation and Poor Execution – MEV assaults degrade commerce execution high quality. Aster’s MEV-resistant Easy Mode ensures honest pricing and protects merchants from front-running.

- Excessive Charges and Complexity – Superior buying and selling instruments are sometimes expensive and inaccessible. Aster addresses this with low charges, intuitive interfaces, and two modes tailor-made to totally different consumer ability ranges.

Utility and Choices

Aster affords a variety of utilities that transcend primary buying and selling, mixing innovation with performance to ship an entire decentralized buying and selling expertise. This contains:

ASTER Token

ASTER serves a number of features throughout the Aster ecosystem. Token holders can:

- Take part in governance choices, influencing the platform’s future route.

- Entry premium options reminiscent of precedence buying and selling and better place limits.

- Profit from payment reductions and income sharing mechanisms.

- Use ASTER in staking packages to earn rewards.

Buying and selling Infrastructure

Aster affords a professional-grade buying and selling ecosystem with excessive leverage, deep liquidity, and a variety of order varieties. These options are tailor-made to fulfill the wants of each retail and institutional merchants.

Commerce & Earn

This program permits customers to maximise capital effectivity by utilizing yield-generating property as collateral. This creates a novel layer of profitability for merchants, merging lively and passive revenue methods in a single platform.

Cross-Chain Buying and selling

Aster’s multi-chain functionality permits buying and selling with out the necessity for bridges or switching networks, making it a seamless atmosphere for merchants holding property throughout varied ecosystems.

Key Milestones and Highlights

Aster has exploded in reputation since its launch, capturing market share and mindshare at a blistering tempo. Key highlights embrace:

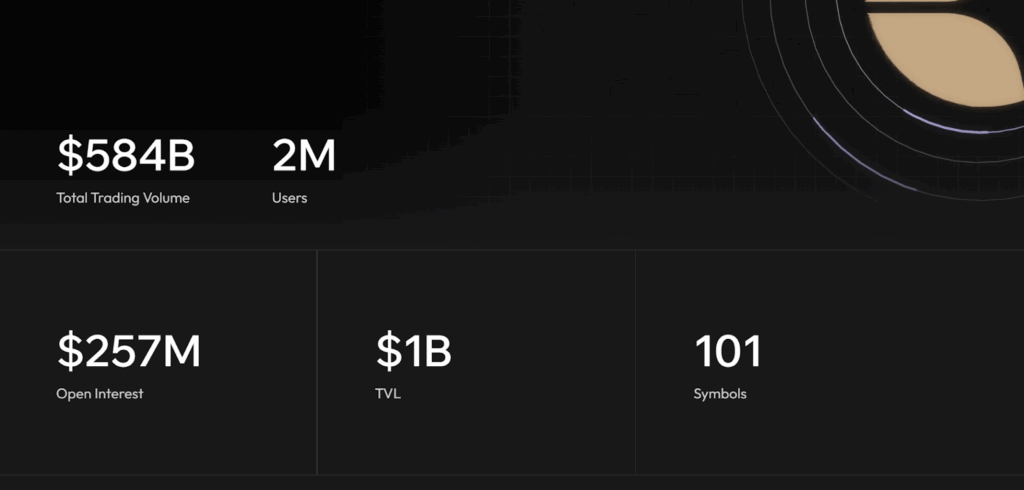

- Income Supremacy – Aster lately surpassed Hyperliquid in each day income, producing $4.58 million in comparison with Hyperliquid’s $2.82 million.

- Market Efficiency – The ASTER token surged over 7000% since launch, reaching a excessive of $2.12. Its market cap hovers close to $3.5 billion, inserting it among the many prime 50 cryptocurrencies.

- Institutional Curiosity – Backed by YZi Labs and endorsed by CZ, Aster enjoys credibility and entry to the Binance ecosystem.

- Large Airdrop – Stage 2 of the airdrop reserves 40 p.c of the ASTER provide—price over $5.5 billion at present costs—for lively merchants.

- Person Adoption – With over 2 million customers and billions in each day quantity, Aster has grow to be the go-to platform for decentralized derivatives.

Roadmap and Plans Forward

Trying forward, Aster plans to execute a number of transformative developments that goal to cement its management in decentralized derivatives buying and selling. This contains:

- Aster Chain – A purpose-built Layer 1 blockchain optimized for high-frequency buying and selling and sophisticated DeFi methods. It should function sub-second transaction finality and minimal gasoline charges.

- Zero-Information Proof Integration – It will convey enhanced privateness and scalability to the platform, permitting institutional merchants to execute massive positions with out revealing delicate technique particulars.

- Intent-Based mostly Buying and selling System – A extremely bold innovation designed to automate cross-chain methods. It should allow merchants to outline their desired consequence and have the system execute the optimum pathway.

- Expanded Multi-Chain Liquidity – Steady enhancements to cross-chain integrations will be certain that liquidity stays deep and execution stays environment friendly.

Last Ideas

In conclusion, Aster represents a daring step ahead in decentralized finance, merging superior perpetual buying and selling with yield optimization and multi-chain accessibility. By addressing vital shortcomings reminiscent of fragmented liquidity, inefficient collateral, and MEV exploitation, it delivers a unified, capital-efficient, and safe buying and selling atmosphere. So, because the roadmap unfolds, it is going to be attention-grabbing to see how the mission navigates rising demand, institutional adoption, and aggressive stress within the evolving DeFi panorama.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.