Avalanche inks cope with Mirae Asset’s world funding arm

Mirae Asset International Investments has signed a memorandum of understanding with Ava Labs, the developer of the Avalanche blockchain, to tokenize fund merchandise and construct onchain asset administration and settlement methods.

Mirae Asset Group is one among South Korea’s largest impartial asset managers. The whole belongings below administration (AUM) within the group’s umbrella are estimated at 1.024 quadrillion Korean received (over $730 billion). Mirae Asset International Investments, which handles the group’s abroad investments, because the title suggests, contributes 430 trillion received (about $306 billion).

The worldwide funding arm can also be a prime 12 exchange-traded fund issuer on the planet primarily based on estimated income, and fifteenth by AUM, as of Thursday, in response to information from ETFdb.

In the meantime, decentralized finance on Avalanche has been booming. Its DEX quantity was ranked among the many prime 5 on Thursday forward of Hyperliquid and Arbitrum.

Asia’s crypto giants in main acquisition strikes

Hong Kong-based OSL Group introduced on Wednesday that it acquired Koinsayang, a licensed cryptocurrency alternate in Indonesia.

The deal provides OSL regulatory approval to function in Indonesia, the place it plans to broaden into areas like real-world asset (RWA) tokenization. Indonesia was ranked second in RWA curiosity in 2024, and contributed over 10% of worldwide site visitors flows, in response to CoinGecko. It additionally ranked seventh in Chainalysis’ 2025 crypto adoption rankings.

OSL is one among 11 licensed digital asset buying and selling platforms in Hong Kong and was the primary to obtain approval below the town’s regulatory framework. Its transfer into Indonesia comes as South Korea’s web big Naver is reportedly getting ready to accumulate Dunamu, the operator of Upbit, the nation’s largest cryptocurrency alternate.

Naver Monetary, the corporate’s fintech arm, can also be anticipated to launch a won-backed stablecoin and broaden its digital finance choices. Naver already operates the funds platform Naver Pay and is the mum or dad of LINE, Japan’s dominant messaging app. LINE just lately introduced a partnership with Kaia blockchain on a stablecoin initiative.

Learn additionally

Options

Scottie Pippen says Michael Saylor warned him about Satoshi chatter

Options

Crypto, Meet Fiat. You Two Ought to Get A Espresso Someday

HKMA denies stablecoin rumors

The Hong Kong Financial Authority has dismissed rumors that an abroad Chinese language yuan (CNH) stablecoin has been approved within the metropolis.

“Just lately, social media posts have claimed that the world’s first offshore renminbi-pegged stablecoin has been launched in Hong Kong. Please observe, that is faux information,” a machine translation of the HKMA assertion reads.

Hong Kong’s de facto central financial institution didn’t title the challenge in query, however AnchorX, which just lately introduced the launch of its offshore yuan stablecoin, issued a clarification to state that its CNH token is licensed in Kazakhstan, not Hong Kong.

As Journal reported, AnchorX introduced in February that it had obtained in-principle approval to challenge a CNH-pegged stablecoin in Kazakhstan. In June, the Astana Monetary Providers Authority confirmed that AnchorX was granted a stablecoin issuer license.

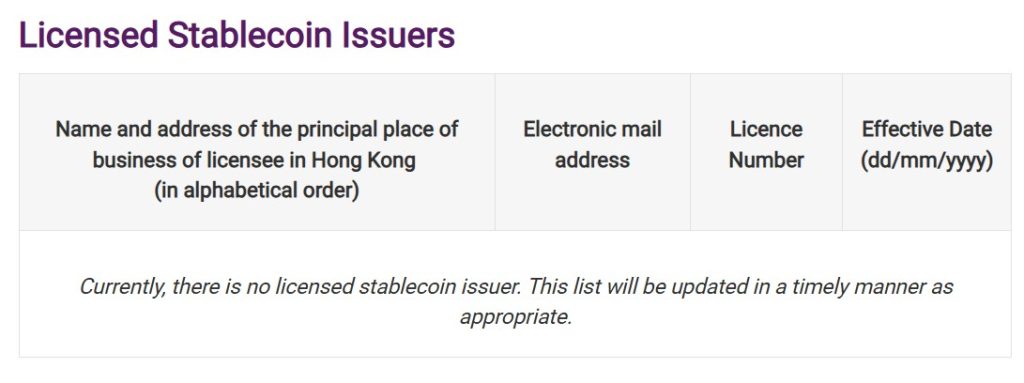

Hong Kong’s Stablecoin Ordinance took impact on Aug. 1, however no licenses have been issued to this point. For the reason that guidelines got here into power, the trade has speculated about the opportunity of a licensed stablecoin pegged to the Chinese language yuan, notably the offshore yuan (CNH).

Learn additionally

Options

E For Estonia: How Digital Natives are Creating the Blueprint for a Blockchain Nation

Options

Programmable cash: How crypto tokens may change our whole expertise of worth switch

The yuan operates on two distinct markets. The onshore yuan (CNY) circulates inside mainland China below strict controls, whereas the offshore yuan (CNH) trades exterior the mainland, with Hong Kong serving as its largest market. A CNH-backed stablecoin in Hong Kong wouldn’t require direct entry to the onshore market, however it could nonetheless be a delicate step given Beijing’s broader restrictions on cryptocurrencies.

The HKMA is predicted to undertake a cautious strategy within the early phases and approve solely a handful of licenses, mirroring the Securities and Futures Fee’s administration of its crypto alternate licenses.

Singapore sidesteps questions on GENIUS Act

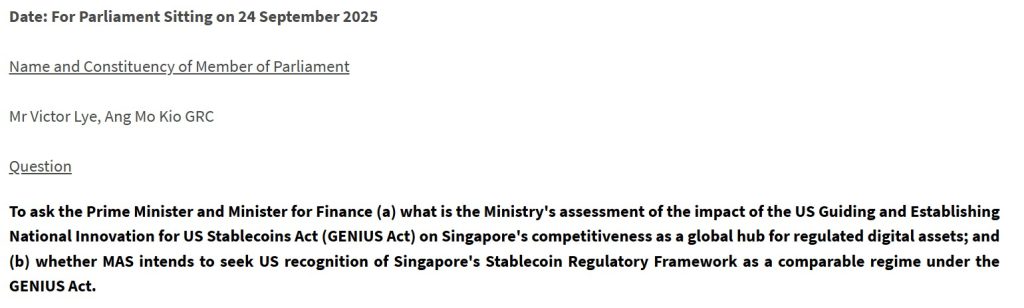

Singapore’s central financial institution has stopped in need of saying how the brand new US stablecoin regulation will have an effect on the city-state’s competitiveness, or whether or not it should pursue equivalence with American guidelines, in a written parliamentary reply.

Responding to a query from MP Victor Lye, Deputy Prime Minister and Financial Authority of Singapore (MAS) chairman Gan Kim Yong mentioned the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act is predicted to spice up adoption of stablecoins, however added that “it’s too early to inform the dimensions and scope” at this level.

Gan mentioned Singapore’s personal framework, finalized in 2023, goals to make sure worth stability and distinguish regulated stablecoins from speculative crypto tokens. Legislative amendments to formalize the framework are nonetheless pending, with a public session deliberate later this yr.

The GENIUS Act features a international equivalence clause that permits the US to acknowledge stablecoin issuers from jurisdictions with comparable regulatory requirements. Gan didn’t say whether or not Singapore will search such recognition, signaling that MAS is taking a wait-and-see strategy to stablecoin developments.

“Stablecoin regulatory developments within the US and Europe are nonetheless comparatively new. MAS is following these developments intently, and can take into account acceptable regulatory cooperation on the protected and safe cross-border use of regulated stablecoins,” Gan mentioned.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.