- Bitcoin slipped 5% beneath $110K, however US spot ETFs nonetheless pulled in $241M of inflows led by BlackRock.

- DCC Enterprises added 50 BTC, lifting its holdings to 1,058 because it targets 10,000 by year-end.

- Technicals level to additional draw back with $101.5K and $91K as key helps until bulls reclaim $114K.

Bitcoin slid beneath $110,000 for the primary time in weeks, logging a 5% drop on Thursday as international markets stumbled. Even with the pullback, establishments saved stepping in—US spot ETFs alone absorbed $241 million in contemporary inflows, softening the sting from earlier outflows. Company treasuries like DCC Enterprises additionally added to their stacks, with the agency’s newest 50 BTC buy bringing its holdings previous 1,000.

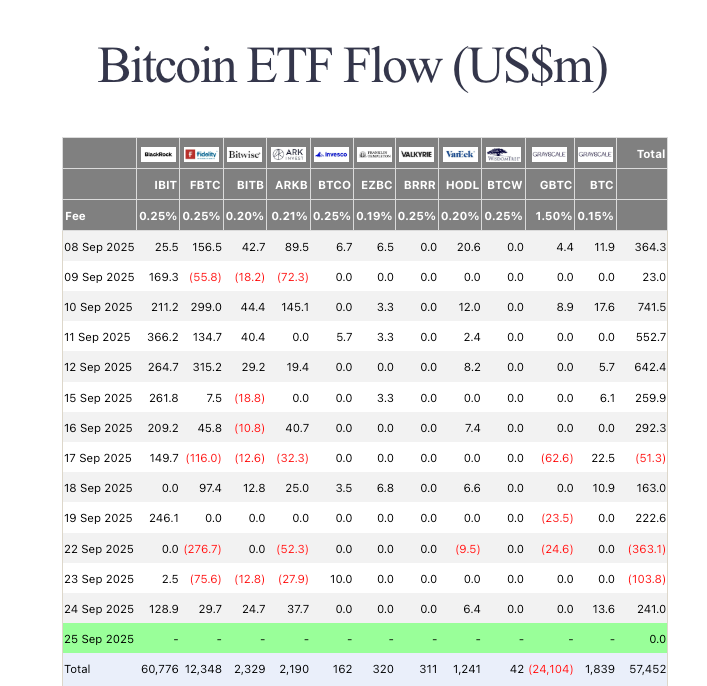

ETFs Bounce Again After Heavy Outflows

The midweek ETF flows highlighted robust demand within the face of volatility. BlackRock’s IBIT led the cost with almost $129 million in inflows, adopted by Ark Make investments’s ARKB at $37.7 million and Constancy’s FBTC at $29.7 million. This got here after $466 million in redemptions earlier within the week, an indication that large cash merchants are benefiting from dips moderately than fleeing. Analysts say this regular pipeline of institutional demand is cushioning Bitcoin’s draw back, even when it will possibly’t absolutely counteract macro headwinds.

Company Shopping for Push Continues

DCC Enterprises is a kind of companies aggressively stacking sats. On Thursday, it added one other 50 BTC, value round $5.5 million at present costs, lifting its treasury to 1,058 BTC. CEO Norma Chu doubled down on their 2025 goal of 10,000 BTC, emphasizing Bitcoin as a long-term strategic reserve. Since launching its program in Could, DCC claims a staggering +1,556% yield on its positions. Strikes like this are more and more shaping market construction, with firms performing as stabilizers when volatility spikes.

Technicals Level Towards $100K

From a charting perspective, the image isn’t as rosy. BTCUSD broke underneath the $110,000 assist, with RSI all the way down to 37 and Elliott Wave evaluation hinting at extra ache. The present setup completes a five-wave cycle and factors towards an (a)-(b)-(c) correction, concentrating on $101,500 as the subsequent main assist. If that fails, bears may push value towards $91,352. On the upside, bulls must reclaim $114,100 to flip momentum and intention for $118,600. For now, the development tilts bearish, however institutional inflows might preserve the market from spiraling deeper.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.