Key Takeaways

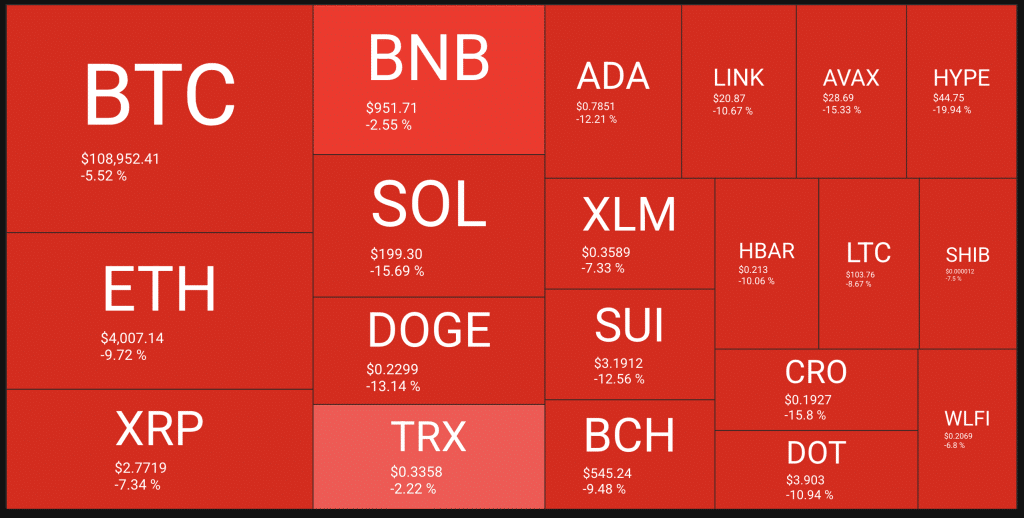

- The cryptocurrency market is experiencing a big decline, with BTC, ETH, and SOL seeing declines of over 5%, 9%, and 14%, respectively.

- The worth of altcoins on the weekly timeframe suggests the worth sits round the important thing demand zone forward of the October pump.

- Specialists stay optimistic about worth positive factors forward of October, suggesting the bull market is rarely over.

This week has been a protracted journey for the crypto market, experiencing large market crashes and cascading liquidation throughout DEX platforms and centralized exchanges, because the market witnessed a drop in its valuation from a area of $4.1 trillion to a area of $3.8 trillion, with extra hypothesis of the market’s steady crash.

With the worth of Bitcoin plunging from its all-time excessive of $124,000 to a weekly low of $108,800, market uncertainties and hypothesis of a possible additional crash towards $98,000 have been raised based mostly on current worth fluctuations.

This triggered a protracted liquidation, with over $170 billion in lengthy liquidations activated in the previous couple of days of the market crash, sparking widespread hypothesis amongst crypto market specialists. Following such a market crash, costs are anticipated to rebound throughout the market, based mostly on the reactions of crypto specialists.

Crypto Skilled Market Reactions

Following the current market crash in the direction of key weekly lows, crypto specialists have taken to their X account (previously Twitter) to recommend that the present market drop is a glimpse of a market response just like the 2017 market cycle, as this dump is anticipated to be adopted by a powerful market response to the upside.

EmperorBTC on X additionally means that merchants and traders concentrate to what’s occurring within the area and the response towards current market worth actions. In response to him, merchants and traders might purchase extra into crypto property if thee are hypothesis of a bear market, as he believes the market has a lot in retailer to supply within the coming months.

Whereas the present market worth motion stays unsure and a fear for a lot of, the altcoin market index stays excessive forward of a brand new month because the market continues to anticipate a bullish market rally forward of October, as traditionally, October has been the most effective buying and selling month for altcoins, with the potential of a 30-45% market rally.

Market Response to Dump

Supply – Market Response to Dump from QuantifyCrypto

The crypto market on the weekly timeframe noticed BTC crash by over 5%, with SOL, ETH, and XRP struggling large declines of 14%, 10%, and eight%, respectively, as costs commerce round a key demand zone for a lot of property.

Consideration will likely be targeted on the response of BTC within the coming days, as a powerful market rally in the direction of the upside of $115,000 might propel the market worth in the direction of new highs. October has been imagined to be a bullish interval for altcoins.

Total market sentiment stays bullish regardless of uncertainties surrounding the current market crash.

FAQs

Will crypto rise once more in 2025?

The market stays bullish, indicating a powerful continuation of the market regardless of the current dip affecting many altcoins.

Is it dangerous to purchase crypto now?

Whereas the market stays optimistic and anticipates an altcoin season across the nook, it’s sensible to conduct thorough analysis earlier than investing in a crypto asset.

Is October a bullish month for crypto?

Traditionally, October has normally been a great month for the market to rally to the upside.

Is crypto going to rise or fall?

There may be robust hypothesis that the market will rally in October relatively than fall, based mostly on previous knowledge.

Associated Learn

Ethereum Loses Key Help at $4k – Ought to I Purchase?