Be a part of Our Telegram channel to remain updated on breaking information protection

The crypto market was rocked by virtually $1 billion in liquidations previously 24 hours, sending complete market capitalization down 2% to $3.84 trillion as Bitcoin slid near $109k and Ethereum fell beneath $4k.

Over 227,000 merchants had been liquidated throughout the downturn, based on CoinGlass knowledge, with altcoins Story (IP), Aster (ASTER), and Avalanche (AVAX) main losers with falls of 24%, 13%, and eight%, respectively.

Market indicators present a downbeat temper, with the crypto common Relative Power Index (RSI) dropping to 35.2, getting into oversold territory, whereas the Crypto Worry & Greed Index plummeted to a ”Worry” studying of 28, down from 44 yesterday.

The Bitcoin value dropped 2% to commerce at $109,427 as of 12:51 a.m. EST, whereas prime altcoin Ethereum misplaced 1% to commerce at $3,952.

Solely a choose few tokens bucked the downtrend, with OKB (OKB), Mantle (MNT), and Kaspa (KAS) main gainers with will increase of seven%, 3%, and three%, respectively.

Amid the carnage, Fundstrat’s Tom Lee advised CNBC in an interview that he nonetheless expects Bitcoin and Ethereum to make a ‘monster transfer’ within the subsequent 3 months.

TOM LEE SAID LIVE ON CNBC THAT #BITCOIN WILL MAKE A “MONSTER MOVE” IN THE NEXT 3 MONTHS 🚀

SUPPLY SHOCK INCOMING pic.twitter.com/si3EoEZN9c

— Vivek Sen (@Vivek4real_) September 25, 2025

He sees ETH and BTC main a rally fired up by international central banks’ easing insurance policies.

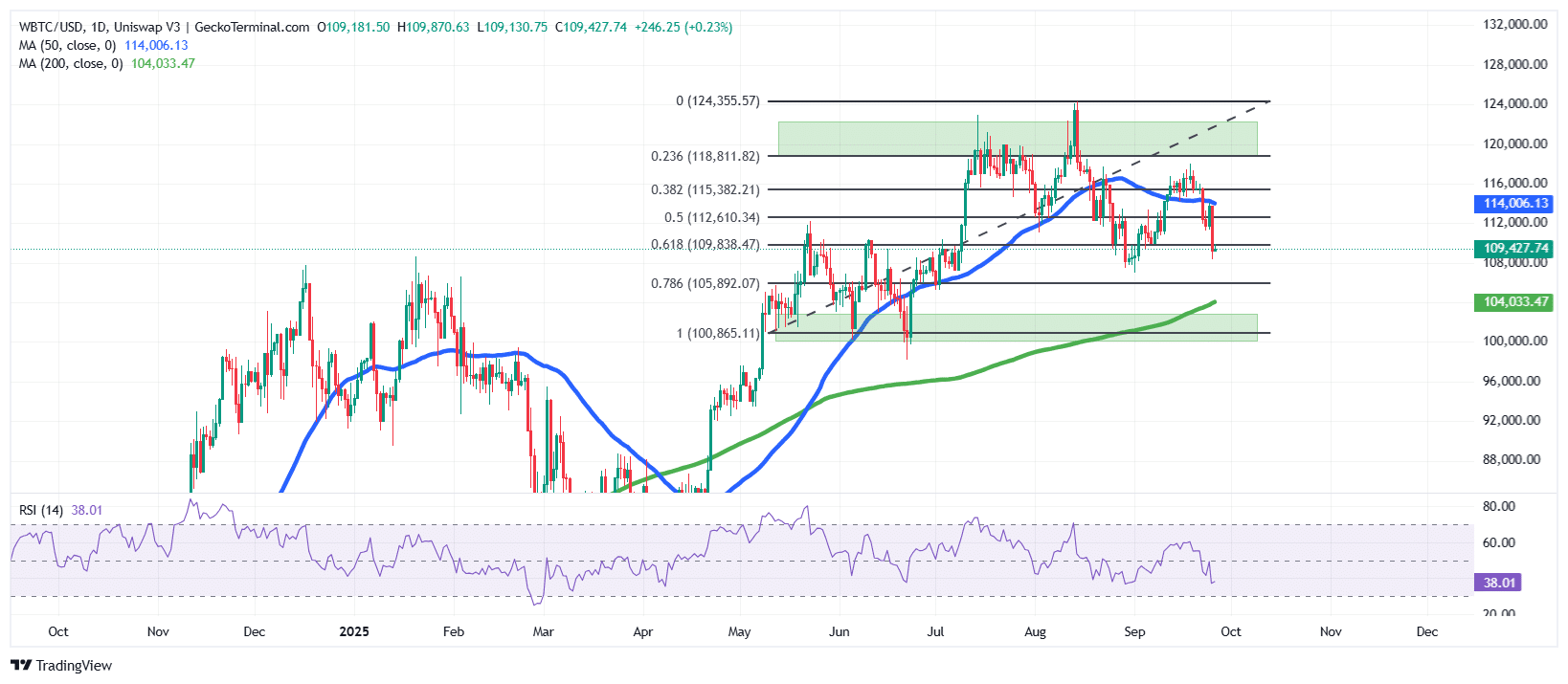

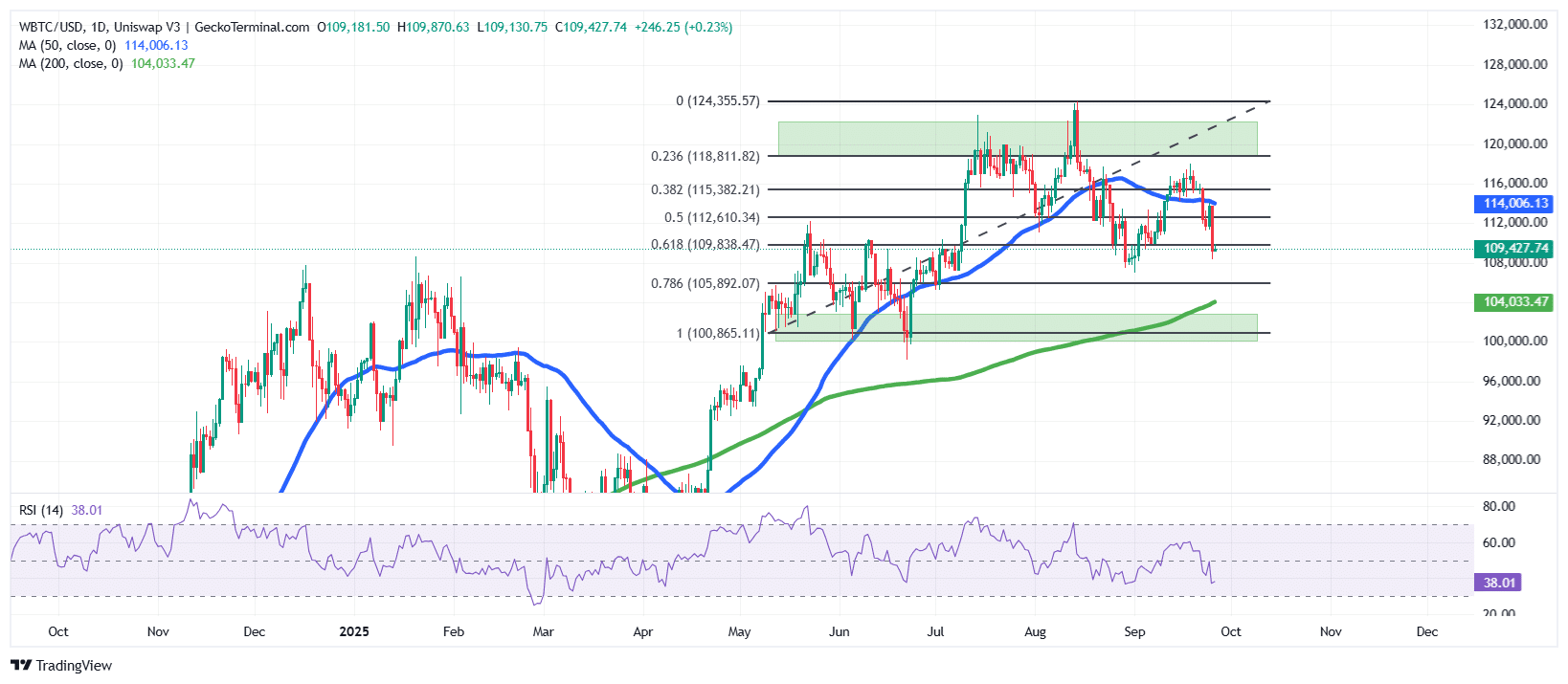

Bitcoin Value Faces Vital Help Check

The BTC value has just lately entered a decisive part as its value retraces towards key assist ranges.

After reaching highs close to $124,000, the asset did not maintain upward momentum and is now hovering round $109,400.

The each day chart exhibits a pullback on to the 0.618 Fibonacci retracement degree at $109,838, typically thought-about a crucial assist zone for pattern continuation. This degree shall be carefully watched to find out if consumers step again in or if additional draw back stress emerges.

In the meantime, the 50-day Easy Transferring Common (SMA), presently round $114,000, which beforehand acted because the assist degree, has develop into the brand new resistance and indicators short-term bearishness.

Furthermore, the 200-day SMA sits decrease at $104,000, suggesting {that a} deeper correction might discover extra substantial assist there.

The RSI has dropped to 38, getting into bearish territory, which signifies that momentum is weak and sellers are presently dominating the market within the quick time period.

If the 0.618 Fibonacci degree holds, BTC might stage a rebound towards the $115,000–$118,000 resistance vary.

Nonetheless, failure to keep up this zone might trigger the value of BTC to float towards the 200-day SMA, presently close to $104,000.

With BTC already falling beneath the $110,176 assist, Ali Martinez believes that the subsequent assist zone is across the $108,531 degree.

Two key ranges of assist for Bitcoin $BTC: $110,176 and $108,531. pic.twitter.com/wfgo7jSmRP

— Ali (@ali_charts) September 25, 2025

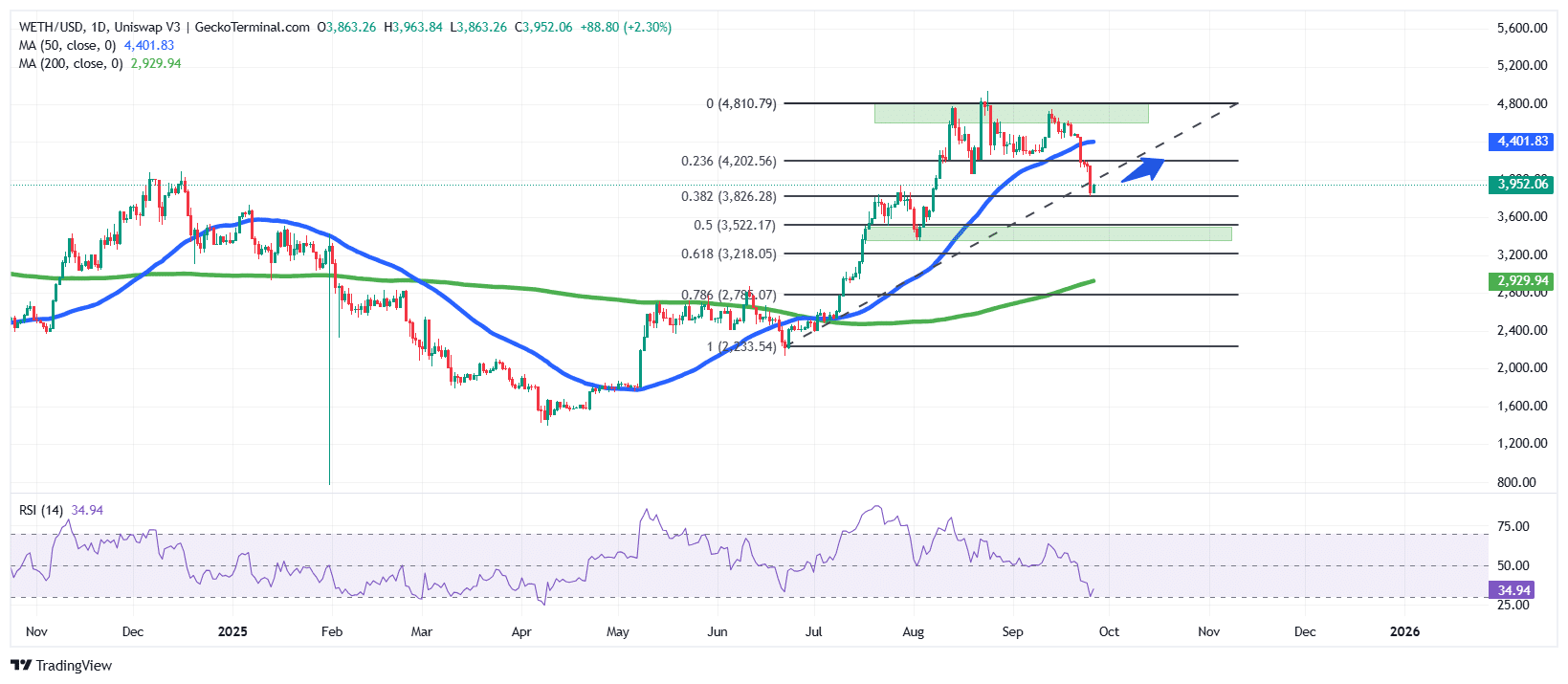

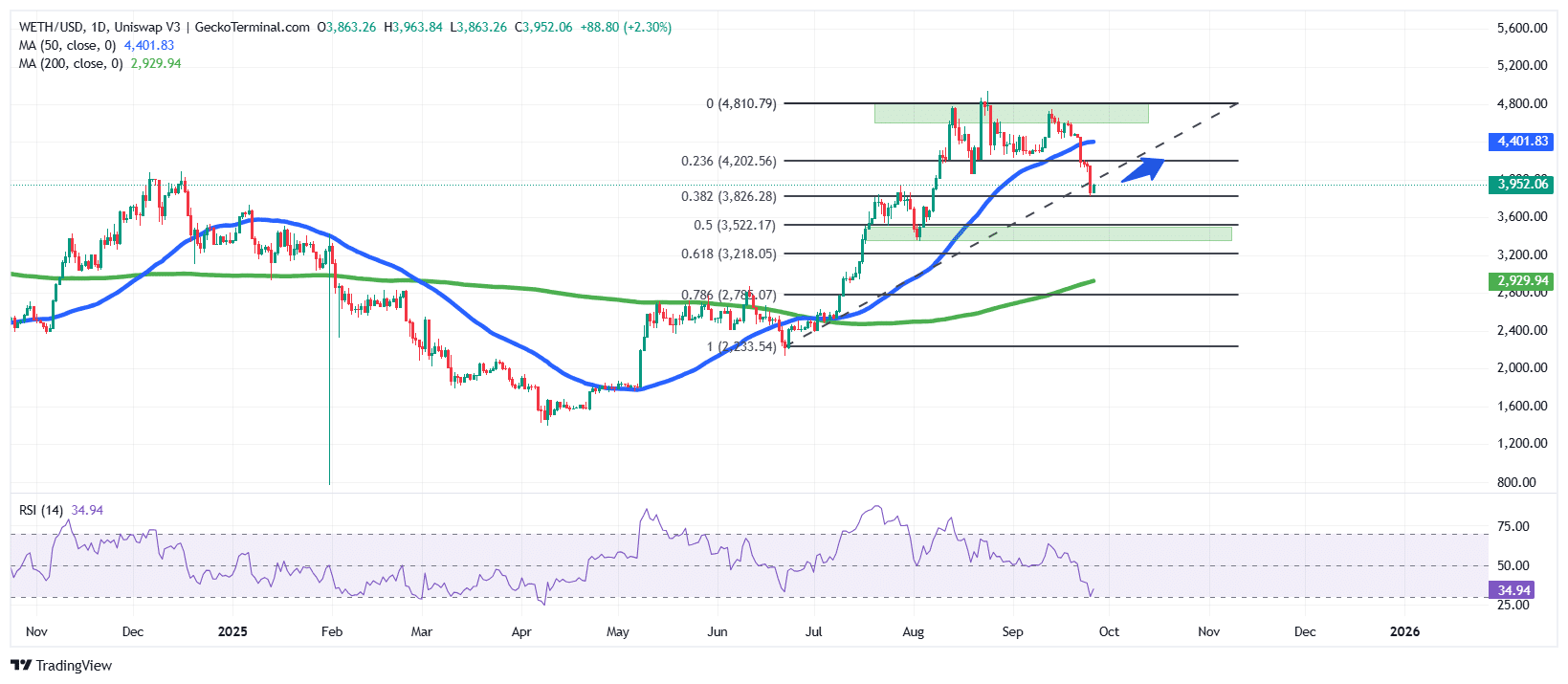

Ethereum Value Seeks Stability After Sharp Correction

The ETH value has been underneath stress following its rejection from the $4,800 resistance zone, with the value now buying and selling close to $3,950.

This marks a notable retracement that has pulled the Ethereum value beneath its 50-day Easy Transferring Common (SMA), presently at $4,401, which has flipped from assist to resistance.

Nonetheless, the value of ETH stays effectively above the 200-day SMA at $2,930, sustaining a broader bullish construction regardless of current weak spot.

ETH is presently hovering across the 0.382 degree at $3,826, with extra assist at $3,522 (0.5) and $3,218 (0.618).

Holding above these ranges is essential to forestall a deeper correction. The RSI sits at 34, nearing oversold situations, which means that draw back momentum could also be slowing and a aid bounce may very well be on the horizon.

If ETH can stabilize round present ranges and reclaim the $4,200 zone, a renewed push towards the $4,800 resistance can be attainable.

However, a failure to defend $3,800 might ship the token towards $3,500 and even $3,200, aligning with deeper Fibonacci assist.

Based on crypto analyst Michaël van de Poppe, who has over 800k followers on X, “we’re across the backside of this correction,” and it could be the most effective time to purchase ETH.

An enormous hole to the 20-Every day EMA on $ETH.

The weekly 20-EMA is getting nearer.

I believe we’re across the backside of this correction.

Simply purchase it. pic.twitter.com/CZBLADXR5f

— Michaël van de Poppe (@CryptoMichNL) September 25, 2025

If the RSI continues to drop, sellers might quickly develop into exhausted, permitting the bulls to regain management of the value.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection