The worth of Bitcoin has been below intense bearish stress over the previous week, falling under the $110,000 mark on Thursday, September 25. Whereas the premier cryptocurrency has managed to cease bleeding up to now day, the BTC worth has struggled to reclaim the psychological $110,000 degree. Curiously, the newest readings of a technical evaluation indicator recommend that the Bitcoin worth may need simply reached a backside and may very well be prepared for a rebound.

Has The Bitcoin Value Reached A Backside?

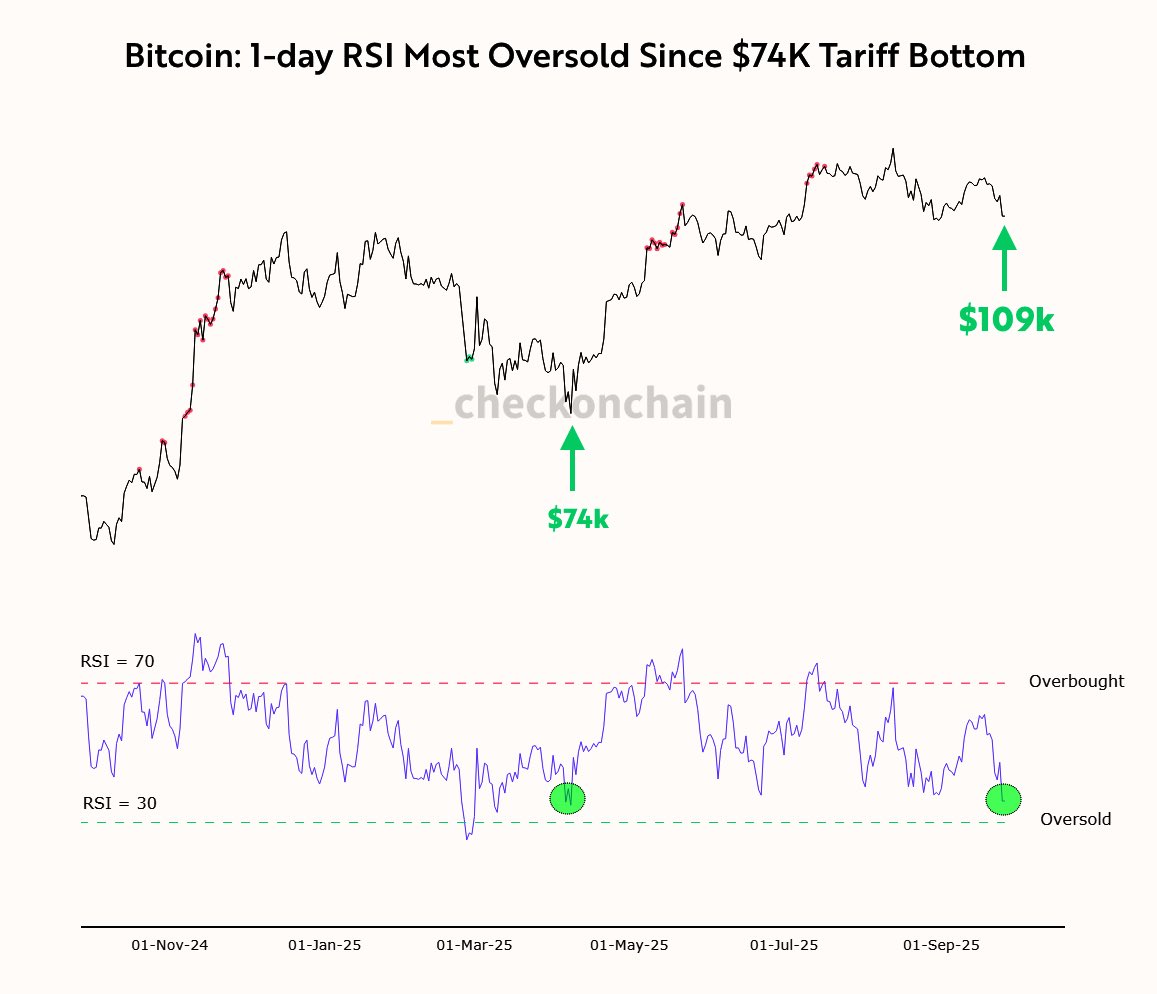

In a September 26 publish on the X platform, a crypto analyst named after the famend economist Frank Fetter revealed that the value of Bitcoin may need simply entered a purchase zone. This worth projection is predicated on the relative energy index (RSI) indicator on the each day BTC worth chart.

Associated Studying

The relative energy index is a momentum indicator utilized in technical worth evaluation to evaluate the magnitude and pace at which an asset’s worth adjustments. The RSI oscillator is normally used to research whether or not a crypto asset (Bitcoin, on this case) is being overbought or oversold, suggesting a attainable worth or pattern reversal.

When the relative energy index breaks above 70, it sometimes signifies an overbought market situation, with the asset’s worth prone to face promoting stress. In the meantime, an RSI worth under 30 implies that the market is in an oversold situation, with worth on the verge of a possible rebound.

In line with Fetter, the Bitcoin relative energy index on the each day chart has fallen to its lowest degree for the reason that April worth backside of $74,000. This worth downturn, which was triggered by the tariff warfare between the US and China, noticed the RSI oscillator fall beneath the 30 threshold in March.

Since bottoming out on the $74,000 mark and the RSI low in April, the Bitcoin worth has since gone on to set a number of all-time highs. If historical past is something to go by, there’s a likelihood that the flagship cryptocurrency might discover help at its present worth and run as much as a brand new excessive.

As of this writing, BTC is valued at round $109,331, reflecting a mere 0.2% leap up to now 24 hours. In line with information from CoinGecko, the premier cryptocurrency is down by greater than 5% on the weekly timeframe.

Crypto Market Enters ‘Concern’ Zone

The crypto Concern & Greed Index is one other sign suggesting a purchase alternative within the Bitcoin market in the mean time. In line with the newest on-chain information from Alphractal, this metric has dropped to twenty-eight, signaling sturdy concern amongst digital asset traders.

Associated Studying

In the meantime, the Concern & Greed Index of the inventory market is at a impartial degree, that means that pessimism has but to hit the normal markets. With the crypto Concern & Greed Index at its lowest degree since April 2025, the divergence from the normal markets suggests potential accumulation alternatives within the digital asset market.

Featured picture from iStock, chart from TradingView