- CleanSpark secured a brand new $100M Bitcoin-backed credit score line with Two Prime, elevating its whole lending capability to $400M.

- The corporate is leveraging its 12,000+ BTC treasury to fund knowledge middle enlargement and HPC initiatives with out diluting shareholders.

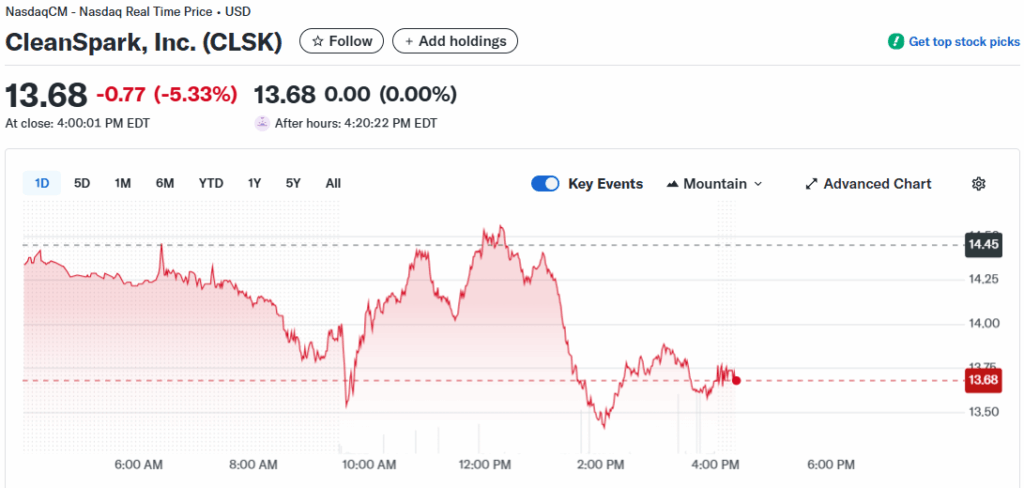

- Regardless of the most important financing information, CLSK shares stayed secure at $13.68, although buying and selling quantity surged above 36M.

CleanSpark, one of many largest US-based Bitcoin mining companies, has locked in a brand new $100 million Bitcoin-backed credit score line with institutional lender Two Prime. This deal, introduced Sept. 25, pushes its whole collateralized lending capability to $400 million, giving the corporate extra flexibility to scale operations. Backed by a treasury of greater than 12,000 BTC, CleanSpark is utilizing its crypto holdings to safe non-dilutive financing, which permits enlargement with out issuing new inventory.

Bitcoin-Backed Lending Positive factors Momentum

The brand new facility with Two Prime follows one other $100 million line of credit score introduced earlier this week with Coinbase Prime. This pattern highlights a rising technique amongst miners—leveraging their Bitcoin reserves to lift capital at favorable charges somewhat than tapping fairness markets. Two Prime’s CEO known as the transfer an indication of rising institutional confidence in Bitcoin as dependable collateral. Different miners, together with Riot Platforms, are adopting comparable approaches, signaling that Bitcoin-backed lending is changing into a mainstream funding mannequin within the trade.

Market Response Stays Subdued

Regardless of the most important credit score bulletins, CleanSpark’s inventory (CLSK) barely moved, closing at $13.68 on Sept. 25 after dipping from highs earlier within the week. Buying and selling volumes surged, however worth motion suggests buyers had already priced in progress expectations. Nonetheless, CLSK has gained greater than 50% over the previous month, supported by optimism that the corporate can develop its hashrate and infrastructure whereas defending shareholder worth. With its market cap close to $3.9 billion, CleanSpark’s monetary technique locations it firmly within the highlight amongst Bitcoin miners navigating aggressive markets.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.