- Avalanche hit $31B DEX quantity in September, alongside a 201% leap in transactions and 22% development in lively wallets.

- Actual-world asset tokenization on Avalanche surged to $726M TVL, backed by massive names like Scaramucci’s Skybridge and Mirae Capital.

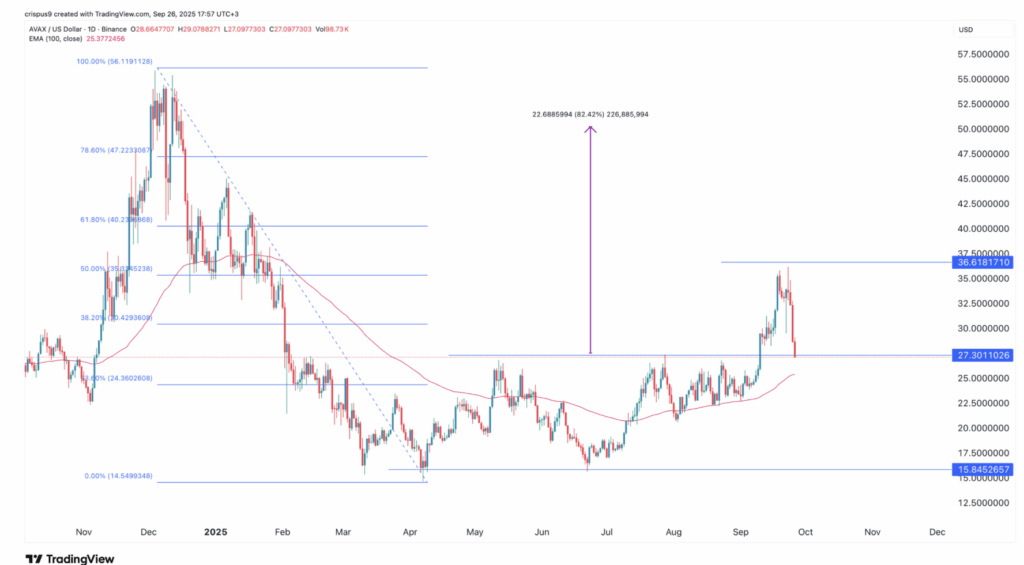

- Technicals present a double-bottom breakout with a goal close to $50, although $20 stays the important assist to look at.

Avalanche simply wrapped up one among its greatest months so far, posting eye-popping numbers throughout a number of metrics. In September 2025, the community clocked in over $31 billion in DEX buying and selling quantity, making it one of many busiest blockchains available in the market proper now.

The momentum wasn’t restricted to buying and selling alone. Transactions on the Avalanche chain surged by greater than 200% over the previous 30 days, with almost 50 million processed. That’s an enormous leap in exercise, placing the community within the ranks of the fastest-growing gamers. On prime of that, lively wallets jumped 22%, reaching greater than 753,000 distinctive addresses, exhibiting that precise person adoption is conserving tempo with the quantity.

Weekly DEX trades additionally spiked to $4.2 billion, the best stage seen in three years. That sort of consistency suggests it’s not simply short-term hype—establishments and retail merchants alike are fueling the expansion. But regardless of all these robust fundamentals, AVAX’s token worth dipped 18% in late September, buying and selling close to $27. Analysts chalk this as much as shaky liquidity and weaker assist ranges available in the market.

Actual-World Belongings Push Avalanche Into High 4

Past buying and selling, Avalanche is carving out a critical identify for itself in real-world asset tokenization. The entire worth locked in RWA merchandise surged 50% to $726 million, putting it fourth total behind Ethereum, ZkSync, and Polygon.

Institutional gamers are taking discover. Anthony Scaramucci’s Skybridge Capital is prepping a $300 million allocation into Avalanche, whereas Mirae Capital Administration—overseeing $316 billion in belongings—just lately inked a partnership with the community. These strikes develop Avalanche’s credibility in conventional finance circles.

Even outdoors of finance, corporations are transferring in. AgriFORCE Rising Methods, beforehand targeted on agriculture tech, introduced plans to lift $550 million by the AVAX One challenge. Backed by Scaramucci and Hivemind Capital, the initiative is geared toward tokenizing conventional belongings on Avalanche—one other robust signal of institutional perception within the platform.

Technical Setup Hints at Breakout Potential

On the charts, Avalanche is flashing bullish patterns. A double-bottom fashioned at $15.84 with resistance (the neckline) close to $27. AVAX broke by that neckline earlier this month after which retested it efficiently—a textbook transfer that always precedes larger breakouts.

The token is holding above its 100-day EMA, a technical marker many merchants see as an indication of sustained bullish momentum. If this sample continues to play out, upside targets level towards the $50 area, almost double from present costs.

Nonetheless, the draw back threat can’t be ignored. A break under $20 would invalidate the bullish outlook and open the door for steeper declines. Merchants are conserving shut watch on that zone because the “line within the sand.”

ETF Buzz and Institutional Accumulation

Including to the bullish case, the U.S. SEC is reviewing a number of purposes for spot AVAX ETFs. If authorized, these might appeal to contemporary capital inflows much like what occurred with Bitcoin and Ethereum earlier this yr.

On the identical time, corporations have began stacking AVAX of their company treasuries, an indication of rising institutional belief. Mixed with Avalanche’s push into DeFi, NFTs, and now RWAs, the ecosystem appears more and more positioned for long-term relevance.

Whereas the market stays risky, Avalanche’s fundamentals are pointing in the wrong way: adoption is climbing, utilization is scaling, and technicals are lining up with bullish targets. If consumers defend key helps, the subsequent leg up could possibly be simply across the nook.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.