XRP ETF approval odds have surged to 99%, however specialists are predicting that the rise of on-chain investing might render ETFs out of date in 5 years.

The XRP ETF approval has captured market consideration as merchants anticipate the U.S. Securities and Trade Fee (SEC) to provide the inexperienced mild quickly.

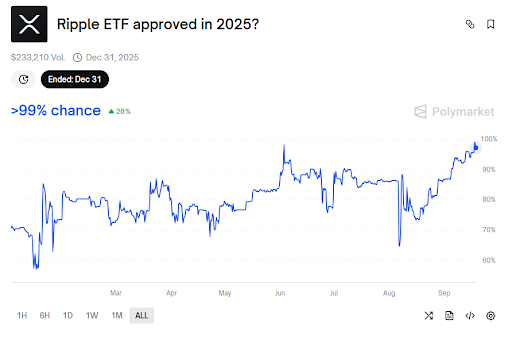

On prediction platform Polymarket, odds for an XRP ETF to be accredited have additionally soared above 99%. But, whereas buyers anticipate a significant milestone, some business leaders consider ETFs might not have a lot of a future in crypto investing.

Older Buyers Drive Demand for Crypto ETFs

Hugo Philion, the co-founder of Flare Community, argues that exchange-traded funds may develop into out of date inside 5 years as extra buyers undertake blockchain-based possession.

🚨 XRP ETF Approval at 99%… However Will It Even Matter?

Whereas the SEC inexperienced mild appears inevitable, one professional says the thrill is short-sighted.

🗣 “ETFs will likely be irrelevant in 5 years,” says Flare Community’s Hugo Philion.

He believes youthful buyers will ditch Wall Road… pic.twitter.com/KL74CtuZK2— Increase Change (@BoomChange1) September 27, 2025

Philion defined on the Paul Barron Podcast that older generations, together with child boomers and Gen X, maintain many of the world wealth at the moment.

They like conventional funding merchandise like ETFs, which makes spot crypto ETFs engaging for them. This desire explains the robust demand for regulated crypto funds that resemble acquainted stock-market merchandise.

Youthful buyers, nonetheless, favor to carry digital belongings instantly in wallets and work together with DeFi platforms.

Philion believes this generational distinction will regularly scale back the necessity for ETFs.

Shift Towards Direct On-Chain Possession

Philion additionally cited monetary challenges as a motive ETFs would possibly fade.

Unfunded retirement liabilities, rising authorities debt, and market uncertainty may encourage buyers to take management of their belongings on blockchain networks.

This method permits for clear and direct possession with out counting on intermediaries like fund managers.

“The rejoicing round ETFs is hilarious as a result of I believe in 5 years, ETFs will likely be irrelevant,” Philion mentioned.

His feedback point out that the present celebration of ETF approvals could also be short-lived.

XRP ETF and Its Significance for the Market

If accredited, the XRP ETF would mark one other milestone within the addition of cryptocurrencies to conventional finance.

Spot Bitcoin ETFs have already attracted billions in inflows, and are proving investor urge for food for regulated merchandise. XRP may comply with an analogous path if the SEC’s resolution aligns with market expectations.

Such an ETF would make it simpler for mainstream buyers to achieve publicity to XRP while not having to arrange crypto wallets or use exchanges. This accessibility may enhance liquidity and worth stability within the close to time period.

Skilled Debate Over ETF Relevance

Not all analysts agree with Philion’s prediction. ETF specialist Nate Geraci believes crypto ETFs may reshape investments as a complete, particularly for firms that maintain giant crypto reserves on their stability sheets.

These embody well-known firms like MicroStrategy, Metaplanet, and Bitmine.

Geraci argues that ETFs, particularly these providing staking choices, may scale back the necessity for buyers to purchase shares in these firms.

Nonetheless, Bloomberg ETF analyst James Seyffart counters that ETFs can not interact with decentralised finance ecosystems the best way crypto-native corporations can. He believes treasury corporations will retain a task, although some might lose enchantment as ETFs mature.

Regulatory Scrutiny on Crypto Treasury Corporations

U.S. regulators, together with the SEC and the Monetary Trade Regulatory Authority (FINRA), are rising their grip on firms with large crypto holdings. Investigations into uncommon buying and selling exercise round crypto-related bulletins have raised questions on potential insider buying and selling.

Former SEC lawyer David Chase notes that these probes typically begin with inquiries into buying and selling patterns and may escalate into extra intensive investigations.

The sharp rise within the inventory costs of corporations like MicroStrategy and Bitmine has drawn explicit consideration and is exhibiting the necessity for clear practices within the sector.