Prime Tales of The Week

Ethereum co-founder shifts $6M of ETH, however whales purchased $1.6B

Ethereum co-founder Jeffrey Wilcke might be seeking to promote a few of his Ether holdings after sending round 1,500 ETH to crypto change Kraken on Thursday.

Wilcke despatched 1,500 Ether, value round $6 million, to the crypto change, based on onchain analytics platform Lookonchain. It got here as the value of Ether dropped from $4,000 to round $3,900.

Transferring cryptocurrency to an change deposit handle doesn’t assure it’s being offered.

In August, Wilcke had deposited $9.22 million value of ETH to Kraken. He had beforehand despatched $262 million value of ETH to Kraken. On the time, Lookonchain speculated that he possible withdrew the identical quantity to eight newly created wallets, moderately than on the market.

Chintai and Splyce goal retail entry to tokenized securities on Solana

Actual-world asset (RWA) protocols Splyce and Chintai have launched a brand new product on Solana designed to offer retail customers entry to institutional-grade tokenized securities, a transfer that would broaden the enchantment of RWA tokenization on one of many world’s largest blockchains.

The product is powered by technique tokens, or S-Tokens, which offer retail customers with publicity to yields generated by Chintai. Whereas customers by no means straight maintain Chintai’s tokenized securities, S-Tokens act as a “mirror” by way of a mortgage construction backed by the underlying property.

S-Tokens are designed to broaden entry to RWA yields past institutional traders. At this time, most institutional RWA merchandise function as “walled gardens” with strict capital necessities and compliance hurdles, limiting retail participation, the businesses informed Cointelegraph.

The S-Token mannequin goals to bridge this hole, providing retail customers entry to institutional-grade yields whereas permitting issuers to stay compliant.

Hashdex expands Crypto Index US ETF below SEC generic itemizing requirements

Asset supervisor Hashdex expanded its Crypto Index US exchange-traded fund (ETF) to incorporate XRP, SOL and Stellar following the generic itemizing rule change from the US Securities and Trade Fee.

The Nasdaq inventory exchange-listed ETF now consists of 5 cryptocurrencies held 1:1 by the fund, together with Bitcoin and Ether, and is buying and selling below the ticker image NCIQ, based on Thursday’s announcement.

The SEC authorised generic itemizing requirements for ETFs in September, paving the way in which for a quicker ETF approval course of for eligible cryptocurrencies.

A number of Solana staking ETFs could win US approval inside two weeks: Analyst

A number of purposes for Solana exchange-traded funds (ETFs) with staking may obtain US approval by mid-October, ETF analyst Nate Geraci mentioned, following recent regulatory filings.

“Guessing these are authorised [within the] subsequent two weeks,” Geraci, the president of NovaDius Wealth Administration, mentioned in an X publish on Friday.

Geraci famous that asset managers Franklin Templeton, Constancy Investments, CoinShares, Bitwise Asset Administration, Grayscale Investments, VanEck, and Canary Capital all filed amended S-1 paperwork for spot Solana ETFs to the US Securities and Trade Fee (SEC) on Friday. The S-1 doc is a complete disclosure outlining the corporate’s financials, threat profile, and the securities they intend to supply.

Hester Peirce discusses her future NFT plans after serving on the SEC

Hester Peirce, a commissioner on the US Securities and Trade Fee (SEC) recognized by many within the trade as “Crypto Mother,” gave a speech laced with non-fungible token metaphors and a evaluation of the company’s method to digital property.

Talking at a Coin Middle occasion on Thursday, Peirce appeared to joke in response to hypothesis that her “days on the SEC [were] numbered,” given her time period formally expired in June. Nonetheless, statutes permit SEC commissioners to serve as much as an extra 18 months till the US Senate confirms a alternative.

Learn additionally

Options

Will Robinhood’s tokenized shares REALLY take over the world? Professionals and cons

Options

The blockchain initiatives making renewable power a actuality

“Lots of people have requested me what’s subsequent,” mentioned Peirce. “I may depart the federal government and do a 180 on crypto, however that profession path is simply too well-trodden for me. My plan has lengthy been to transition to beekeeping—honey is scrumptious and nutritious, and bees sting with much less glee than most of my Twitter commenters.”

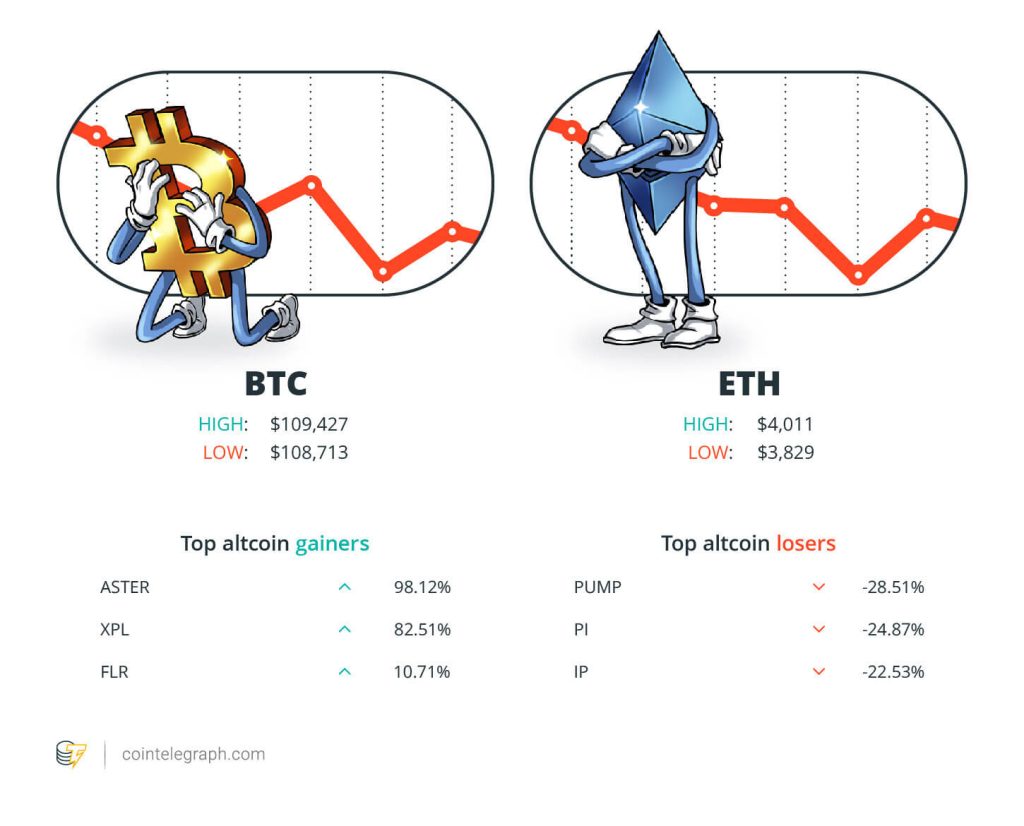

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $109,427, Ether (ETH) at $4,011 and XRP at $2.78. The entire market cap is at $3.78 trillion, based on CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Aster (ASTER) at 98.12%, Plasma (XPL) at 82.51% and Flare (FLR) at 10.71%.

The highest three altcoin losers of the week are Pump.enjoyable (PUMP) at 28.51%, Pi (PI) at 24.87% and Story (IP) at 22.53%.

For more information on crypto costs, make sure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“This comes at a time when many are positioned for a This fall rally — making the larger shock not a surge larger, however a correction as an alternative.”

Markus Thielen, CEO of 10x Analysis

“The civilizations that gained probably the most from new waves of expertise aren’t those who consumed the expertise, however the ones who produced it.”

Vitalik Buterin, co-founder of Ethereum

“I believe that as we work by way of the resistance of late and a few macro headwinds, we’ll really see Bitcoin begin to transfer up well once more towards the tip of the yr.”

Michael Saylor, govt chairman of Technique

“It’s a giant deal. With these two bookends of laws, it’s going to unleash an amazing quantity of latest participation in crypto.”

Mike Novogratz, founder and CEO of Galaxy Digital

“We’re pondering by way of [. . .] whether or not or not there’s the opportunity of reversibility of transactions, proper, however on the identical time, we would like settlement finality.”

Heath Tarbert, president of Circle

“Treasuries are stacking ETH, change provide hits 9-year low, and Tom Lee’s calling $10K to $15K by year-end.”

Rachael Lucas, analyst at BTC Markets

Prime Prediction of The Week

‘Stablecoins will save the US greenback’: Eric Trump

Eric Trump, son of US President Donald Trump and a businessman with a number of crypto ventures, mentioned stablecoins may protect the US greenback’s energy.

In an interview with The New York Put up revealed Friday, Eric Trump mentioned he’s satisfied stablecoins will “save the US greenback.” He highlighted USD1, the stablecoin tied to the Trump household’s crypto venture, World Liberty Monetary, which has drawn scrutiny in Washington.

When plans by World Liberty Monetary (WLFI) — the Trump family-backed crypto venture — have been revealed in late March, critics raised battle of curiosity issues. Legal professional Andrew Rossow informed Cointelegraph on the time that the stablecoin is “a direct affront to constitutional safeguards meant to forestall conflicts of curiosity.”

In April, US Consultant Maxine Waters, rating member of the US Home Monetary Providers Committee, went so far as to counsel that Donald Trump was seeking to exchange the US greenback together with his stablecoin.

Prime FUD of The Week

Aster reimburses customers after XPL perpetual glitch sends worth to $4

BNB Chain derivatives decentralized change (DEX) Aster accomplished reimbursements to merchants harm by a glitch in its Plasma (XPL) perpetual market that briefly drove costs above market ranges.

Based on Abhishek Pawa, the CEO of Web3 company AP Collective, the problem stemmed from a misconfigured index hard-coded at $1. With the mark worth cap lifted earlier than the repair, XPL futures on Aster spiked to just about $4 whereas different venues remained $1.30.

Learn additionally

Options

Crypto within the Philippines: Necessity is the mom of adoption

Options

Ethereum is destroying the competitors within the $16.1T TradFi tokenization race

The sudden Friday worth discrepancy triggered sudden liquidations and irregular charge fees, inflicting losses to customers. Nonetheless, the platform moved rapidly, assuring its customers that each one funds have been secure and promising to compensate them for any losses.

Simply hours later, the DEX mentioned the reimbursements for the incident had been totally distributed to their accounts. Shortly after, Aster deployed one other spherical of compensation, together with buying and selling and liquidation charges.

Crypto wants twin pockets administration, AI monitoring of North Korean hackers

Cryptocurrency firms must strengthen defenses towards North Korean hackers who’re in search of jobs at main Web3 companies to stage large-scale exploits, safety consultants informed Cointelegraph.

Hiring North Korean builders could open a crypto venture’s infrastructure to the specter of hacks and knowledge breaches much like the Coinbase knowledge breach in Could, which uncovered the pockets balances and bodily areas of about 1% of the change’s month-to-month customers, probably costing the change as much as $400 million in reimbursement bills.

To struggle this rising risk, the trade must undertake enhanced pockets administration requirements, real-time AI monitoring for the early prevention of exploits and safer worker vetting practices, crypto safety consultants informed Cointelegraph.

Crypto treasuries threat 50% draw back on PIPE promoting stress

Crypto treasury firms which have raised capital in personal funding in public fairness (PIPE) offers may see their shares fall by half with promoting stress, based on analytics platform CryptoQuant.

Crypto treasury firms which have raised capital by way of PIPE offers “have suffered main drawdowns, with share costs usually gravitating towards their PIPE issuance ranges,” CryptoQuant mentioned in a market report on Thursday.

It added that shares in some firms “could face additional declines of as much as 50%” as shares commerce above PIPE providing costs, and traders nearing the tip of their lock-up intervals are possible seeking to promote.

PIPE offers permit personal traders to purchase new shares under market worth, and have been fashionable amongst crypto treasury firms to rapidly increase money amid a crowded sector.

Prime Journal Tales of The Week

‘Assist! My robotic vac is stealing my Bitcoin’: When good gadgets assault

Your robotic vacuum and different good dwelling gadgets can simply be hacked to document you typing in passwords or your seed phrase.

Avalanche in take care of ETF big, yuan stablecoin ‘faux information’: Asia Categorical

Avalanche companions with Mirae Asset to tokenize funds. Hong Kong’s OSL acquires Indonesia’s Koinsayang change.

How do the world’s main religions view Bitcoin and cryptocurrency?

A more in-depth have a look at how Christianity, Islam and Judaism view Bitcoin and cryptocurrency.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.