- Institutional adoption and DeFi infrastructure gave Ethereum the sting.

- Tron reduce charges to defend its stablecoin lead, with TRX displaying relative power.

- Regardless of value weak point, Ethereum noticed report $164B inflows in 4 weeks.

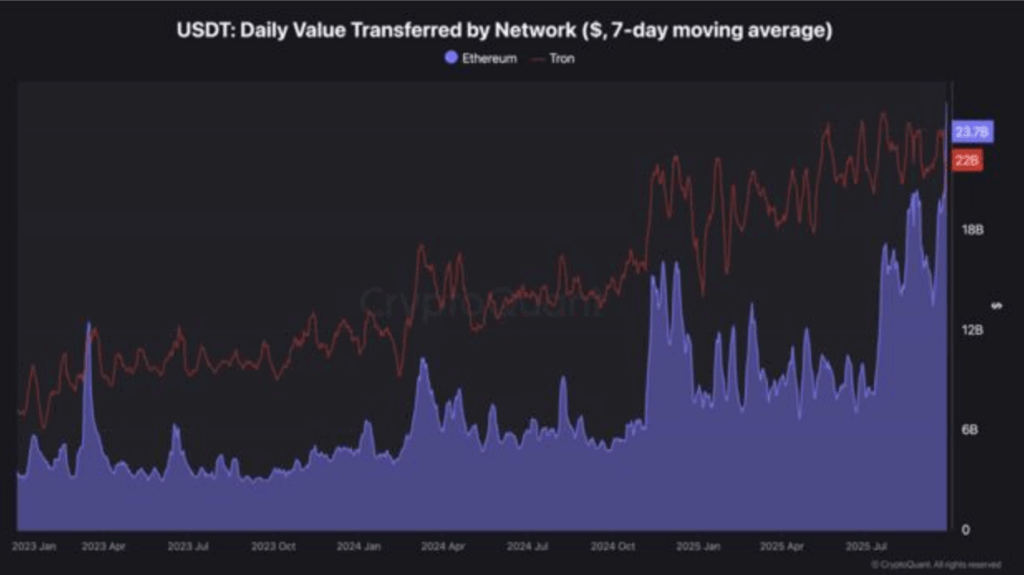

The crypto market could have cooled off final week, leaning bearish, however DeFi stayed sizzling. Ethereum and Tron discovered themselves in a head-to-head conflict, battling for stablecoin dominance. For years Tron wore the crown in USDT transfers, however that modified lately. Ethereum lastly pulled forward, overtaking Tron in USDT exercise for the primary time in additional than two years—a milestone many within the area had been ready for.

Contemporary information confirmed Ethereum’s weekly USDT transfers reached $23.7 billion, whereas Tron managed about $22 billion. At first look, the numbers look shut, however they mark a shift in momentum. In response to DeFiLlama, Ethereum now holds roughly 77.76 billion USDT, equal to 44.48% of provide. Tron sits simply behind with 76.23 billion USDT, about 43.77%. The margin is slim, however Ethereum’s edge is evident.

Why Ethereum Is Outpacing Tron in USDT Transfers

Tron constructed its dominance on velocity and low prices, making stablecoins simple to maneuver for on a regular basis customers. However Ethereum’s newest power comes from some other place solely: establishments. Banks and conventional finance gamers have turned to Ethereum to deploy stablecoin options and experiment with tokenized belongings. Add that to Ethereum’s highly effective DeFi ecosystem—the place liquidity consistently rotates in instances of volatility—and the momentum shift is smart. Tron, whereas sturdy in stablecoins, hasn’t captured the DeFi-driven flows with the identical depth.

Nonetheless, Tron isn’t standing nonetheless. It reduce charges by 60% in a push to draw extra adoption, and its token TRX has proven resilience, holding a long-term uptrend. In September, TRX fell lower than 2%, whereas ETH dropped greater than 8%. Tron’s stablecoin-first technique may preserve it related, however Ethereum’s mix of DeFi infrastructure and institutional backing is difficult to beat.

Ethereum DeFi Efficiency: TVL Outflows and Document Inflows

Trying nearer at Ethereum’s DeFi efficiency, the final 4 weeks have been a mixture of highs and lows. Its whole worth locked (TVL) fell by round $10 billion, reflecting shaky investor confidence in a unstable month. ETH’s value adopted go well with, slipping greater than 8% over the identical stretch. But exercise on the chain held sturdy. Energetic addresses reached 14.2 million—barely down from August, however nonetheless elevated in comparison with earlier months.

Transaction ranges instructed the identical story: regular and sturdy regardless of the market’s dips. However the actual headline was inflows. Ethereum noticed $164 billion in internet inflows over the past 4 weeks—the very best in its historical past. That surge in capital means that whereas costs corrected, severe cash was nonetheless flowing into Ethereum, positioning it for long-term power in DeFi and stablecoins.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.