- TRON is holding above $0.30 assist, with $0.36 and $0.42 marked as the following resistance ranges.

- Sturdy fundamentals again value stability: 2.3M every day USDT transfers and over 334M accounts.

- Governance considerations round Justin Solar’s 64% provide management add danger, however merchants stay centered on technicals.

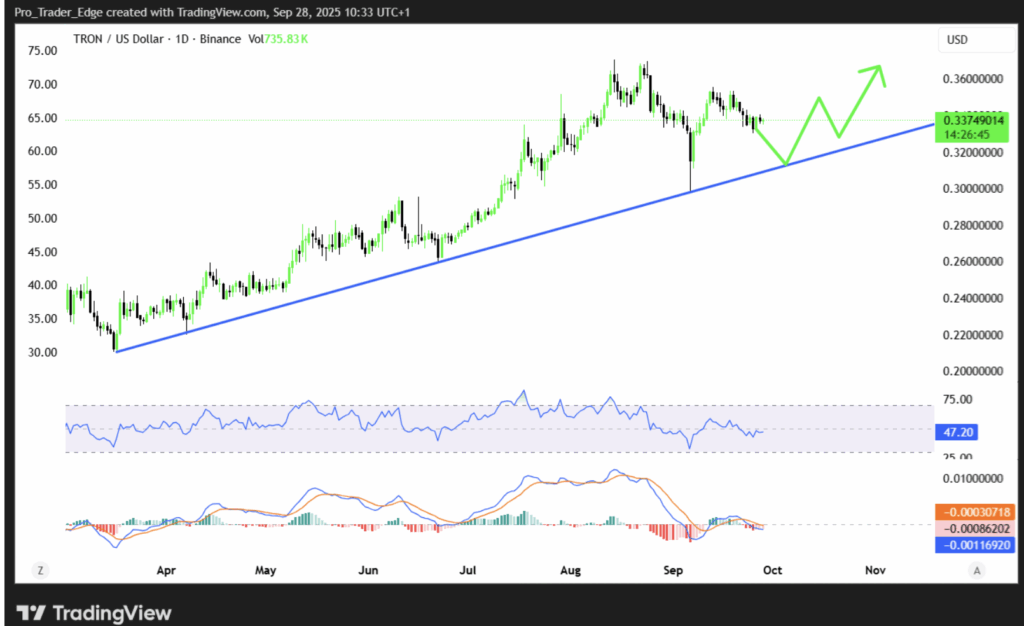

TRON has been clinging to its crucial $0.30 assist zone, and up to now, it’s holding agency. TRX is presently buying and selling round $0.334, exhibiting stunning resilience in a market that’s been something however secure. Each day strikes have been gentle—positive factors of about 0.8% to 1.1%—however the truth that the token retains defending the $0.30–$0.32 vary has merchants paying shut consideration. Many see this basis because the launchpad for a much bigger transfer.

Buying and selling quantity has additionally spiked previous $1.49 billion, suggesting stronger participation despite the fact that the value hasn’t damaged free simply but. Technical eyes are on $0.36 as the following key resistance degree. A clear break above that might set TRX on the right track towards $0.42, whereas the weekly chart continues to point out a gradual higher-low sample—basic indicators of accumulation. With a market cap holding close to $31 billion, TRON stays firmly within the prime 10, cementing its relevance regardless of a stretch of consolidation.

TRON Community Development Helps Worth Stability

Past value motion, TRON’s fundamentals stay sturdy. The blockchain processes over 2.3 million USDT transfers each single day, price roughly $22.5 billion. Its person base has grown to greater than 334 million accounts, making it one of many busiest networks in crypto. Stablecoin settlement on TRON hasn’t flinched regardless of market turbulence, reinforcing its function as a dependable settlement layer.

On-chain knowledge from Lookonchain backs this up, exhibiting that adoption-driven flows have held regular even in downtrends. That form of consistency explains why TRX has managed to defend assist when many different tokens have crumbled. For bulls, the community’s power affords a security web—proof that fundamentals are aligned with the technical story.

Governance Dangers Add Uncertainty

However not the whole lot is clean crusing. Reviews from AssembleAI, citing Bloomberg, recommend Justin Solar controls as a lot as 64% of TRON’s circulating provide. That’s an enormous focus, elevating considerations about centralization and the affect one determine may have over liquidity and value actions. Critics argue this undermines TRON’s decentralization, whereas supporters counter that Solar’s heavy stake reduces the danger of sudden large-scale dumping.

To date, the market hasn’t reacted dramatically to those governance considerations. Worth motion signifies merchants are extra centered on technical assist and resistance zones than long-term decentralization debates. Nonetheless, it’s a danger issue that lingers within the background for anybody eyeing TRX for longer horizons.

Technical Evaluation: Key Resistance and Targets Forward

On the technical aspect, the $0.38–$0.40 band stays the wall to beat. Each try to clear it has triggered profit-taking, pushing TRX again down. Failure to carry present ranges may open a path towards $0.28, with $0.24 as a deeper draw back goal. On the flip aspect, indicators recommend TRX nonetheless has room for upside earlier than momentum overheats.

Lengthy-term, the all-time excessive close to $0.45 is the important thing aim. If TRX can conquer intermediate resistance, there’s little cause it couldn’t retest that degree. For now, the weekly shut confirmed a -3% dip, however assist held sturdy—an indication that consolidation is the dominant pattern quite than breakdown.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.