- Ethereum ETFs noticed $795.6M in outflows, led by Constancy’s FETH ($362M) and BlackRock’s ETHA ($200M).

- ETH slipped under $4K, buying and selling at $3,990.17 after a ten.78% weekly drop, reflecting short-term volatility.

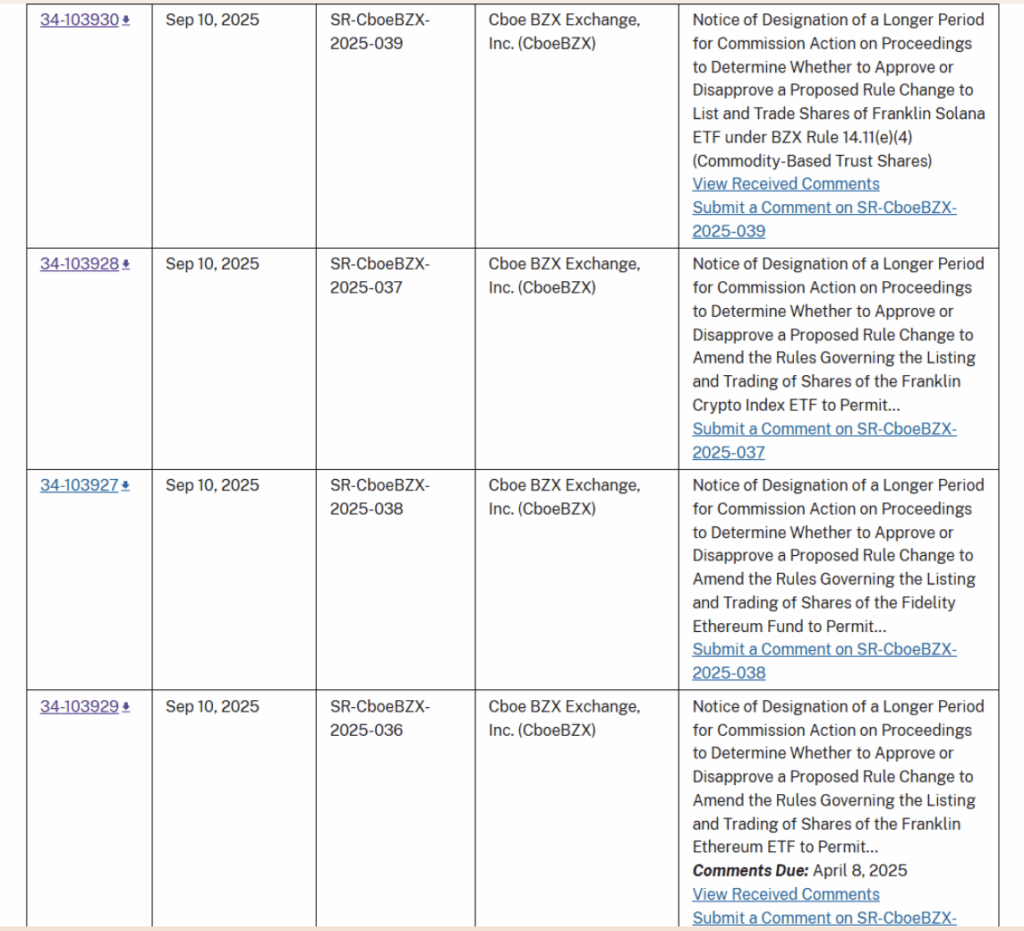

- SEC delays on a number of crypto ETF purposes added stress, although new filings like a Dogecoin ETF stored market optimism alive.

Ethereum ETFs had a tough week, logging their greatest outflows on report. Knowledge from Farside Traders confirmed that for the week ending September twenty sixth, spot Ethereum funds misplaced about $795.6 million. That’s a hair greater than the $787.7 million drained earlier in September, which on the time was the biggest weekly drop. Buying and selling quantity nonetheless topped $10 billion, however the redemptions despatched a transparent sign of warning.

The Constancy Ethereum Fund (FETH) was hit the toughest, with over $362 million leaving in just some days. BlackRock’s ETHA fund, which nonetheless holds greater than $15.2 billion in property, noticed $200 million pulled. Grayscale’s ETHE additionally bled capital, underscoring how widespread the withdrawals have been throughout totally different issuers. This all lined up with Ethereum’s value slipping beneath $4,000, touchdown at $3,990.17—down 0.58% on the day and almost 11% for the week.

Ethereum Value Struggles Amid ETF Redemptions

The timing couldn’t be ignored. As buyers yanked money from ETH merchandise, Ethereum itself mirrored the sentiment. Falling beneath the $4K mark rattled merchants who have been hoping ETH’s sturdy community exercise may cushion the dip. As an alternative, the charts confirmed weak spot, with weekly losses nearing double digits. Analysts famous the transfer mirrored short-term volatility relatively than a structural breakdown, nevertheless it nonetheless stung.

The pullback additionally echoed what was taking place throughout broader crypto ETFs. Bitcoin merchandise weren’t spared both. Spot BTC funds noticed $902.5 million exit throughout the identical week. Constancy’s FBTC led these outflows, whereas Bitcoin itself held at $109,352—flat on the day however down 5.53% on the week.

Broader Market and Regulatory Pressures

Behind the scenes, regulatory delays added gasoline to the cautious temper. The SEC pushed again choices on a number of crypto ETF and staking purposes, shifting deadlines into late October and November. Main issuers like BlackRock, Constancy, Franklin Templeton, Grayscale, and 21Shares are all ready on inexperienced lights. These extensions probably weighed on sentiment, as merchants dislike uncertainty nearly as a lot as dangerous information.

Nonetheless, optimism hasn’t fully vanished. Ripple futures hit report highs throughout the identical stretch, exhibiting selective bullishness. On high of that, VanEck filed for a Spot Hyperliquid ETF, and the first-ever U.S. Dogecoin ETF utility entered the pipeline. Even with cash leaving Ethereum ETFs, the broader market retains testing new methods to broaden entry.

Outlook for Ethereum ETFs and Value

For now, Ethereum is caught between heavy outflows and its personal sturdy fundamentals. The $4,000 degree stays a psychological barrier, and whether or not ETH can reclaim it could depend upon how ETF flows stabilize within the weeks forward. Merchants are watching intently—if the $795 million bleed was only a shakeout, ETH might rebound shortly. If redemptions proceed, although, value may wrestle to remain afloat in This autumn.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.