Prime crypto commentator CryptoinsightUK argues that market consensus has misinterpret the setup for XRP and altcoins, contending that sentiment, liquidity positioning, and cross-asset relationships level to an imminent section during which XRP may outperform even a resurgent ETH.

In his newest Weekly Perception (Week 161, Sept. 27, 2025), the analyst opens with a blunt reset of stance: “I’m bullish.” He acknowledges the psychological toll of current chop and public pushback—“I get pushback from all sides for staying bullish… However I additionally do not likely care”—but he frames the present drawdown because the form of fear-laced inflection that traditionally precedes a pattern resumption increased.

Why Is Everybody Incorrect About XRP?

The word situates the decision towards a loud backdrop. He cites well-followed merchants who both known as a high or de-risked into weak point, and the victory laps of dominance-maxi voices after a bounce in Bitcoin dominance. The riposte is data-driven: sentiment gauges close to “concern” readings of 40 or beneath, a zone that has repeatedly coincided with native lows or pre-reversal circumstances. Whereas he concedes that “we may see a slight additional correction,” the burden of proof, he argues, skews to upside.

Associated Studying

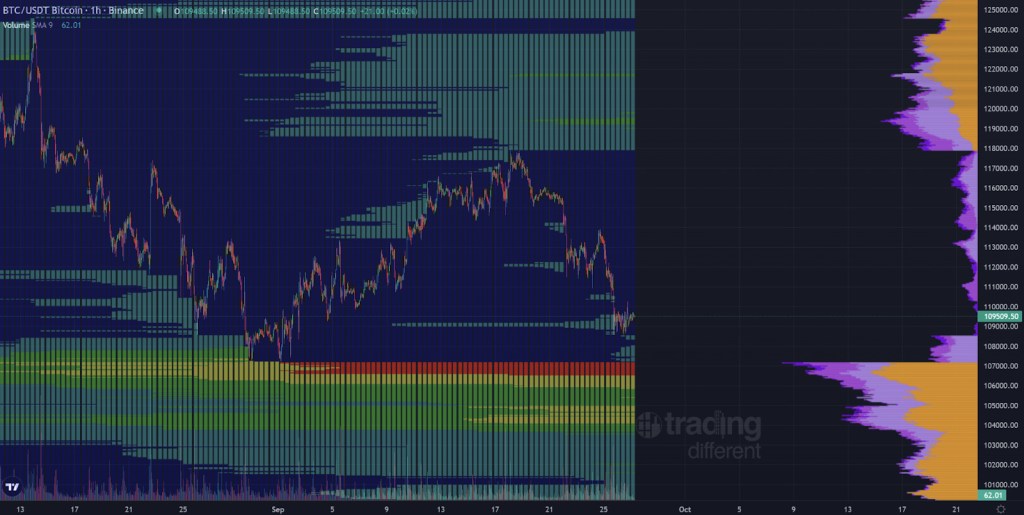

A key pillar is liquidity mapping. On Bitcoin, he highlights sizeable resting liquidity round $106,000—a pool that has continued since mid-July and stays uncollected regardless of spot advances as excessive as $123,000. “I’d count on this 106k space of liquidity to be taken, possibly even all the way down to 104k with a wick,” he writes, emphasizing {that a} tag into that zone wouldn’t invalidate the higher-timeframe bull construction.

Crucially, he says, the “largest quantity of liquidity ever” sits above worth, implying that if a serious high had been in, “market makers… would [not] enable that a lot liquidity to stay untouched.” Against this, lower-side liquidity down round $70,000 is drying up, suggesting lowered gravitational pull to the draw back as stale longs and shorts have been flushed or realized.

That skew, he says, is much more pronounced throughout majors and large-cap alts. On day by day time frames for ETH, Cardano, XRP, and SUI, “vital liquidity” has rebuilt above spot, whereas “minor” pockets stay beneath—an asymmetry that makes exact dip-buy ranges onerous to pre-declare but retains the “final final result” biased to a leg increased.

The timing cue rests on two oscillators that usually mark rotation home windows: ETH is now as oversold on the 4-hour because it was on the actual cycle backside round $1,400—a setup not seen once more throughout its run towards $5,000—whereas Bitcoin Dominance (BTC.D) has reached overbought on the 4-hour. “The final thrice this occurred, it marked both an area excessive, the precise excessive, or got here simply earlier than a bigger drawdown in Bitcoin Dominance,” he notes.

Associated Studying

On the weekly, he expects the structural final result to be an acceleration decrease in dominance later within the cycle, and he leaves open whether or not that second is now. The mosaic—ETH deeply oversold, BTC.D closely overbought, liquidity stacked above alts—helps his conclusion that “very quickly it’s more likely to be the altcoin present.”

Inside that rotation, XRP vs. ETH is his sharpest edge. On the 4-hour XRP/ETH chart, he sees an area backside construction—“a sequence of lows, increased lows, and better highs”—with a set off degree at 0.00071 ETH per XRP: “We’re on the lookout for closes above the 0.00071 degree, and the bigger the timeframe of the shut above that degree, the higher the chance of reversal.”

On the weekly XRP/ETH, he sketches two Elliott-wave roadmaps: a conservative five-wave path again to the prior highs towards ETH, and a higher-beta different that begins from the candle construction shift and implies “exponential progress” in relative phrases this cycle. The mixed thesis is specific: “ETH seems to be poised to carry out nicely… [and] XRP seems to be able to outperform ETH on high of that. Use your creativeness for what may occur if these two issues play out collectively.”

At press time, XRP traded at $2.86.

Featured picture created with DALL.E, chart from TradingView.com