Stories have disclosed that 16 wallets picked up 431,018 Ether between September 25 and 27, spending about $1.73 billion to take action. The buys got here by way of names like Kraken, Galaxy Digital, BitGo, FalconX and OKX.

Associated Studying

That scale of accumulation pushed consideration again to who’s shopping for the dip, and why bigger gamers appear prepared so as to add publicity whereas costs wobble.

Change Balances Fall To 9-12 months Low

Based on Glassnode information, the quantity of ETH held on exchanges has plunged from roughly 31 million to about 14.8 million ETH — a drop of 52% from 2016 ranges.

A lot of these cash are seemingly in staking contracts, chilly wallets or institutional custody, and the latest launch of the primary Ethereum staking ETF has helped pull extra provide off exchanges.

Decrease change balances imply fewer cash able to be bought immediately on exchanges, which may make worth strikes sharper when huge orders hit the market.

ETH Hovers Close to $4,000 As Volatility Rises

Based mostly on TradingView readings, ETH is buying and selling round $4,011, down roughly 0.33% during the last 24 hours and greater than 10% over the previous week.

The token briefly slipped beneath $3,980 earlier within the session earlier than climbing again, and it stays beneath a latest shut of $4,034.

This two-week pullback has returned ETH to a key $4,000 assist space, and short-term swings have turn out to be extra pronounced as holders reposition.

$3,700 Turns into A Line In Sand

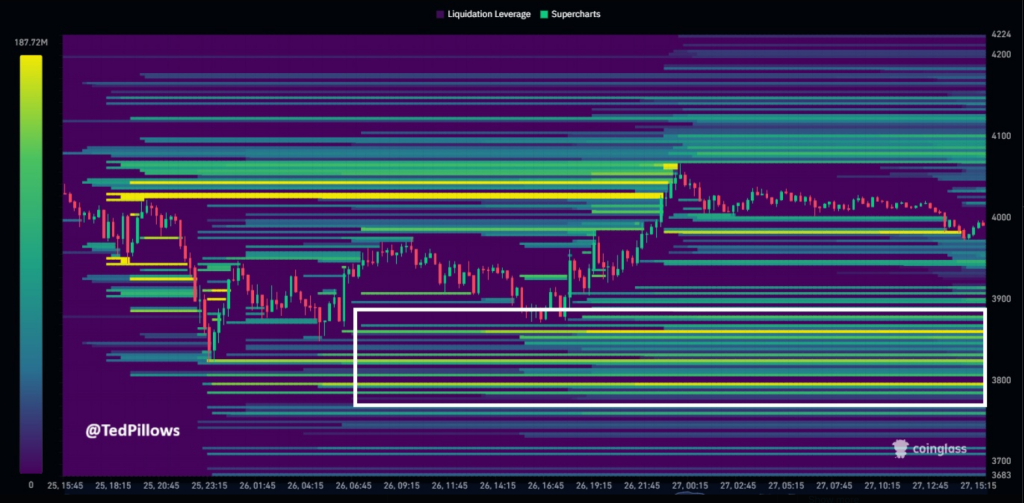

Crypto analyst Ted Pillows has warned that the $3,700 to $3,800 zone may face heavy strain. Stories word that if ETH falls beneath $3,700, many margin positions could possibly be worn out and spark pressured promoting that pushes costs decrease.

$ETH liquidity heatmap is displaying first rate lengthy liquidations across the $3,700-$3,800 degree.

This degree could possibly be revisited once more earlier than Ethereum reveals any restoration. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

With fewer cash on exchanges and concentrated margin publicity, the short-term outlook is extra fragile at the same time as longer-term demand indicators look strong.

ETF Outflows Present Institutional Temper Can Flip

US-listed ETH funds recorded practically $800 million in outflows this week, their largest redemptions thus far. Nonetheless, roughly $26 billion sits in Ethereum ETFs, equal to five.37% of complete provide.

Whales preserve accumulating $ETH!

16 wallets have acquired 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX prior to now 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Associated Studying

These numbers underline how shortly institutional sentiment can change: huge inflows can vanish simply as quick, and ETF flows now add a brand new, sizable layer to cost dynamics.

Lookonchain information additionally highlighted a previous accumulation of roughly $204 million in ETH, displaying comparable patterns of enormous gamers stepping up throughout dips.

Retail merchants seem extra cautious for now. However the sequence of massive buys from institutional-grade custodians suggests some patrons view dips as shopping for possibilities whereas others select to attend on the sidelines.

Featured picture from Unsplash, chart from TradingView