US Jobs information type the majority of financial occasions that would affect Bitcoin (BTC) and crypto market sentiment this week.

The labor market has progressively crept up as a vital macro sign for Bitcoin, with the potential to sidestep inflation and different information factors on the calendar.

US Jobs Information That Might Transfer Bitcoin This Week

With the labor market presenting as a vital macro for Bitcoin, 4 associated information factors may affect market sentiment this week.

Sponsored

Sponsored

JOLTS

First in line for the highest US jobs information to affect Bitcoin sentiment this week is the Job Openings and Labor Turnover Survey (JOLTS), launched by the Bureau of Labor Statistics. This information level produces month-to-month and annual estimates of the nation’s job openings, hires, and separations.

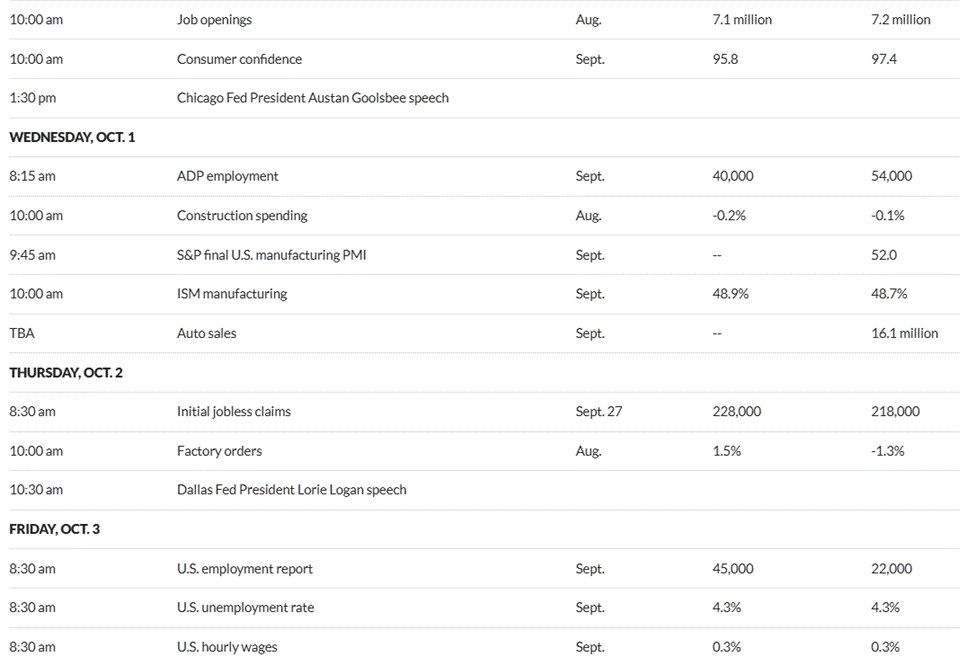

This macroeconomic occasion is due on Tuesday, September 30. The earlier JOLTS report indicated 7.2 million job openings in July, 7.4 million in June, and seven.8 million in Might.

Based mostly on this development, economists surveyed by MarketWatch anticipate an prolonged decline to 7.1 million in August.

In accordance with economists surveyed by MarketWatch, July information on US job openings, hires, and separations may are available at 7.4 million, similar to in June.

4 successive months of declining JOLTS would sign a cooling labor market, easing wage pressures, and inflation.

In opposition to this backdrop, the US Federal Reserve (Fed) could also be inclined to chop rates of interest additional. This might increase liquidity and, by extension, the Bitcoin worth as it could encourage risk-on sentiment.

Sponsored

Sponsored

Nevertheless, if the development reverses and JOLTS information is available in greater than anticipated, the notion of a development reversal may mood rate-cut bets, doubtlessly stalling the Bitcoin rally amid delayed easing.

ADP Employment

One other US jobs information to observe this week is the ADP employment report. This labor market information level is extra complete and broadly thought to be the official measure. It’s a non-public sector survey primarily based on payroll information from its shoppers.

The ADP employment report, due on Wednesday, October 1, may present that US non-public sector jobs elevated by 40,000 in September, in comparison with the 54,000 enhance seen in August. Nonetheless, it could signify an prolonged drop after 104,000 in July.

Nonetheless, the expectation of a continued droop to 40,000 in September suggests a continued outlook of a slowdown in hiring.

Just like the JOLTS information level, this indicators cooling labor demand. Softer labor markets weaken the greenback and ease yields, boosting liquidity-sensitive belongings like Bitcoin and crypto.

Sponsored

Sponsored

Merchants usually interpret weaker ADP prints as bullish for digital belongings, anticipating risk-on flows and stronger demand for alternate options to conventional markets.

Nevertheless, if the slowdown sparks recession fears, short-term volatility might hit crypto earlier than liquidity expectations drive longer-term upside.

Preliminary Jobless Claims

Additionally, the preliminary jobless claims are on the watchlist, bringing forth a weekly jobs information level each Thursday. It determines the variety of US residents who filed for unemployment insurance coverage for the primary time.

Within the week ending September 20, there have been 218,000 preliminary jobless claims, with economists now anticipating extra filings to 228,000 final week.

An uptick in jobless claims might sign financial weak spot. This might enhance the probability of the Fed adopting a extra accommodative financial stance.

Such a shift may result in a weaker greenback, enhancing Bitcoin’s attractiveness in its place asset. Nevertheless, if the rise in claims is seen as a brief fluctuation, the affect on Bitcoin could also be restricted.

Sponsored

Sponsored

In the meantime, analysts say a resilient labor market, coupled with sticky inflation, may enable rates of interest to stay elevated. Nevertheless, indicators of a cooling job sector may mood the Fed’s path.

Employment Report

Lastly, Friday’s US employment and unemployment studies may additionally transfer the crypto market this week. Each information factors are vital indicators of the financial system’s well being.

The employment report is forecasted to indicate 45,000 new jobs, up from 22,000 within the earlier month, whereas the unemployment price is anticipated to carry regular at 4.3% in September, much like the August studying.

Such an final result within the employment information would recommend hiring is bettering barely, displaying resilience within the labor market. In the meantime, the expectation of regular unemployment would level to extra folks in search of work than jobs created, pointing to underlying slack.

Markets usually see this as neutral-to-dovish, the place development exists, however rising unemployment hints at softening circumstances.

For Bitcoin and crypto, it may help rate-cut expectations (liquidity-friendly), providing a mildly bullish tilt regardless of the headline job positive aspects.