High Tales of The Week

Coinbase recordsdata authorized movement over Gensler, SEC lacking textual content messages

Coinbase is escalating its dispute with US regulators over previous communications involving former Securities and Alternate Fee (SEC) Chair Gary Gensler.

Coinbase filed a authorized movement on Thursday requesting a listening to to deal with the SEC Workplace of the Inspector Normal’s investigation, which discovered that the company deleted almost one yr’s price of textual content messages from Gensler and different senior officers in “avoidable” errors.

The alternate mentioned the SEC ought to clarify why it didn’t conduct a full search of company information, together with textual content messages from Gensler and senior SEC officers, when it requested the messages in a number of Freedom of Info Act filings from 2023 and 2024.

In keeping with the movement, Coinbase desires the courtroom to compel the SEC to look and produce all responsive communications initially requested, together with all messages and paperwork from Gensler and the company concerning Ethereum’s shift to proof-of-stake consensus.

Bitcoin in consolidation as treasuries eye altcoins: Novogratz

Bitcoin has doubtless been buying and selling sideways as firms have targeted on stacking altcoins currently, although there might be an upswing coming later within the yr, says Mike Novogratz, CEO of asset supervisor Galaxy Digital.

“Bitcoin’s at a consolidation proper now. Partly since you’re seeing a whole lot of these treasury corporations in different cash take their shot,” mentioned Novogratz throughout an episode of CNBC’s Squawk Field on Thursday.

Blockchain tech agency BitMine Immersion Applied sciences has been main the pack amongst altcoin treasury companies, just lately shopping for $200 million Ether and rising its stockpile to over $9 billion in ETH.

US courtroom to listen to arguments for Sam Bankman-Fried’s attraction on Nov. 4

Former FTX CEO Sam “SBF” Bankman-Fried, serving a 25-year sentence after his conviction on seven felony counts, will take the subsequent step in his appeals course of with a listening to scheduled for November.

In keeping with a Wednesday discover within the US Courtroom of Appeals for the Second Circuit, Bankman-Fried’s appeals case has been calendared for arguments on Nov. 4. The courtroom continuing will mark the primary important motion within the former CEO’s legal case since his switch from a New York Metropolis facility in March to 1 in California.

The listening to within the Second Circuit had been anticipated since Bankman-Fried’s legal professionals filed a discover of attraction in April 2024 over his 2023 conviction and 25-year sentence.

Bankman-Fried’s authorized staff argued in his attraction filed in September 2024 that the previous CEO was “by no means presumed harmless,” additionally claiming that prosecutors introduced a “false narrative” of FTX consumer funds as completely misplaced.

Goldman Sachs CEO doubts 50 foundation level lower is ‘on the playing cards’

Goldman Sachs CEO David Solomon has shot down the notion that the US Federal Reserve will lower rates of interest by 50 foundation factors in September, simply days after Commonplace Chartered Financial institution made the aggressive forecast.

“Whether or not or not we’ve a 50 foundation lower, I don’t suppose that’s in all probability on the playing cards,” Solomon mentioned throughout an interview with CNBC on Wednesday.

Whereas CME FedWatch Software knowledge exhibits simply 7.8% of market contributors anticipate such a transfer on the Sept. 17 Fed assembly, Commonplace Chartered Financial institution just lately raised its forecast to that stage, citing August’s weaker-than-expected jobs report, based on a Reuters report on Monday.

Pseudonymous crypto dealer Mister Crypto mentioned in an X publish on Wednesday, “If that occurs, crypto will explode by earlier ATHs.”

Potential CFTC chair releases personal texts with Winklevoss twins, hours earlier than IPO

Brian Quintenz, US President Donald Trump’s decide to chair the US Commodity Futures Buying and selling Fee (CFTC), has made public a number of texts between himself and Gemini co-founders Cameron and Tyler Winklevoss, suggesting the reason why the brothers might have tried to intrude together with his nomination to the company.

In a Wednesday X publish, Quintenz mentioned he had launched the texts over considerations that Trump “might need been misled” by the Gemini co-founders. The chain appeared to point out Tyler Winklevoss sending Quintenz data on Gemini’s civil case with the CFTC, settled with a $5 million fantastic in January.

Learn additionally

Options

The key of pitching to male VCs: Feminine crypto founders blast off

AI Eye

AI Eye: 25K merchants guess on ChatGPT’s inventory picks, AI sucks at cube throws, and extra

“The CFTC completely abused the deliberative course of privilege amongst many different abuses to stop us from even be [sic] in a position to defend ourselves pretty in courtroom,” Winklevoss texted to Quintenz on July 25.

Winners and Losers

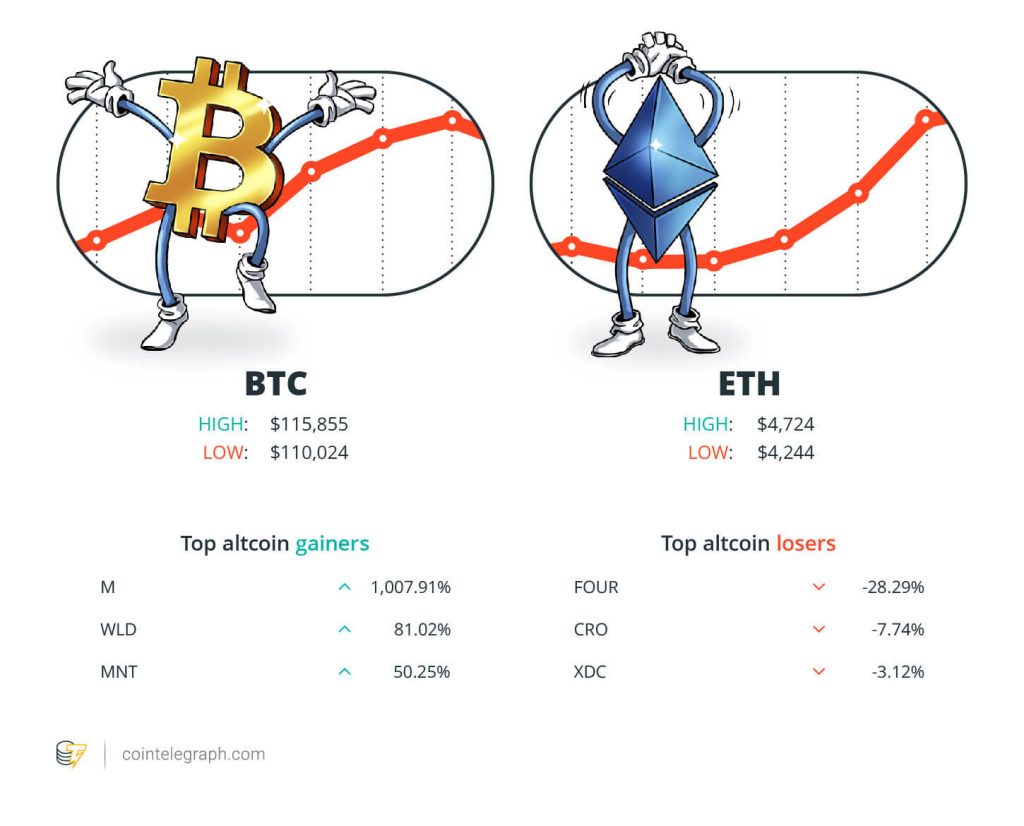

On the finish of the week, Bitcoin (BTC) is at $115,855, Ether (ETH) at $4,724 and XRP at $3.11. The whole market cap is at $4.07 trillion, based on CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are MYX Finance (M) at 1,007.91%, Worldcoin (WLD) at 81.02% and Mantle (MNT) at 50.25%.

The highest three altcoin losers of the week are 4 (FOUR) at 28.29%, Cronos (CRO) at 7.74% and XDC Community (XDC) at 3.12%.

For more information on crypto costs, be sure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Bitcoin’s at a consolidation proper now. Partly since you’re seeing a whole lot of these treasury corporations in different cash take their shot.”

Mike Novogratz, founder and CEO of Galaxy Digital

“If we discover, at some date sooner or later, that you just’ve held n LINEA tokens for m days, that simply would possibly result in one other token touchdown in your account.”

Joseph Lubin, founder and CEO of Consensys

“All of the cool children are speaking in regards to the ‘fats app’ thesis. Looks like that might be a dominant theme within the coming months.”

Matt Hougan, chief funding officer at Bitwise

“Coverage will not be set by advert hoc enforcement actions.”

Paul Atkins, chair of the US Securities and Alternate Fee

“The rolling 30-day efficiency of Bitcoin is detrimental and that implies we’ve already gone by a correction, which may have shaken out a whole lot of weak palms since we hit the $124,000 prime.”

Pav Hundal, lead market analyst at Swyftx

“Whether or not or not we’ve a 50 foundation lower, I don’t suppose that’s in all probability on the playing cards.”

David Solomon, CEO of Goldman Sachs

High Prediction of The Week

XRP flirts with $3 amid ETF approval hope: Is $3.60 the subsequent cease?

XRP value confronted rejection on Tuesday after reaching its highest stage in almost two weeks at $3.04. The transfer was pushed by hypothesis round a possible XRP exchange-traded fund approval in america and elevated institutional participation in XRP derivatives, elevating expectations about whether or not XRP would possibly revisit the $3.60 stage seen in July.

Demand for XRP futures climbed 5% from the earlier month, totaling 2.69 billion XRP — equal to $7.91 billion at prevailing costs. Extra notably, the variety of excellent XRP futures contracts listed on the Chicago Mercantile Alternate jumped 74% throughout the identical 30-day span, reaching 386 million XRP. The rise highlights stronger participation from skilled fund managers and market makers.

Whereas greater futures exercise usually signifies curiosity, lengthy and brief positions are all the time balanced. Nonetheless, month-to-month futures contracts can present alerts of leverage imbalances. Below impartial market circumstances, XRP futures sometimes commerce 5% to 10% above spot markets to account for the longer settlement interval.

High FUD of The Week

Auditor flagged situation earlier than $2.59M Nemo hack, staff admits

Sui-based yield buying and selling protocol Nemo misplaced about $2.59 million attributable to a recognized vulnerability launched by non-audited code being deployed, based on the venture.

In keeping with Nemo’s autopsy evaluation of the Sept. 7 hack, a flaw in a operate meant to scale back slippage allowed the attacker to vary the state of the protocol. This operate, named “get_sy_amount_in_for_exact_py_out,” was pushed onchain with out being audited by sensible contract auditor Asymptotic.

Learn additionally

Options

Actual AI use circumstances in crypto: Crypto-based AI markets, and AI monetary evaluation

Options

Story Protocol helps IP creators survive AI onslaught… and receives a commission in crypto

Moreover, Asymptotic’s staff recognized the difficulty in a preliminary report. Nonetheless, the Nemo staff admits that its “staff didn’t adequately deal with this safety concern in a well timed method.”

Deploying new code solely required a signature from a single deal with, permitting the developer to push unaudited code onchain with out disclosing the modifications. Moreover, he didn’t use the affirmation hash offered within the audit for the deployment, breaking the process.

Blockstream sounds the alarm on new e mail phishing marketing campaign

Blockstream, an infrastructure and {hardware} pockets supplier, issued a warning a couple of new e mail phishing marketing campaign making an attempt to focus on Blockstream Jade {hardware} pockets customers.

The corporate confirmed on Friday that it by no means sends firmware recordsdata by e mail and mentioned that no knowledge has been compromised within the assault.

Phishing assaults are designed to steal crypto and delicate consumer data by seemingly authentic communication. In keeping with Blockstream, the e-mail featured a easy message directing customers to obtain the newest model of Blockstream Jade pockets firmware by clicking on a hyperlink, which was malicious.

Phishing scams price crypto customers over $12 million in August and affected over 15,000 victims — a 67% improve from July, based on anti-scam service Rip-off Sniffer.

Kalshi ‘able to defend’ prediction markets amid Massachusetts lawsuit

Prediction market platform Kalshi has vowed to battle a brand new lawsuit from the US state of Massachusetts, which accuses the corporate of providing unlicensed sports activities betting to residents.

“We’re proud to be the corporate that has pioneered this expertise and stand able to defend it as soon as once more in a courtroom of legislation,” a spokesperson for Kalshi informed Cointelegraph on Friday.

“Prediction markets are a vital innovation of the twenty first century, and all Individuals ought to have the ability to entry them,” the spokesperson added.

The civil lawsuit, filed on Friday by the Commonwealth of Massachusetts in Suffolk County Superior Courtroom, alleged that Kalshi disguises sports activities wagering as “occasion contracts” and violates the state’s strict playing legal guidelines.

High Journal Tales of The Week

Meet the Ethereum and Polkadot co-founder who wasn’t in Time Journal

The creator of Ethereum’s Solidity language doesn’t like crypto conferences however does need to make the world a greater place with Polkadot and Parity.

Thailand’s ‘Huge Secret’ crypto hack, Chinese language developer’s RWA tokens: Asia Categorical

Thailand’s SEC probes crypto hack rumors reported by “The BIG Secret” Fb channel, Chinese language personal property developer turns to RWAs, and extra.

What individuals nonetheless get flawed about VeeFriends: Andy Krainak, NFT Creator

VeeFriends President Andy Krainak says Gary Vaynerchuck constructed the NFT ecosystem to final.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Asia Categorical

$308M crypto laundering scheme busted, Hashkey token, Hong Kong CBDC: Asia Categorical

ZhiyuanSun

5 min

November 2, 2023

Asia Categorical: Ringleaders of $308M P2P crypto laundering scheme jailed in China, Visa’s Hong Kong CBDC trial a hit, Hashkey token.

Learn extra

Hodler’s Digest

Binance, Coinbase head to courtroom, and the SEC labels 67 crypto-securities: Hodler’s Digest, June 4-10

Editorial Workers

6 min

June 10, 2023

The SEC sues Binance and Coinbase, and labels dozens of cash as securities. Each the crypto exchanges paused companies whereas promising authorized battles in courts.

Learn extra