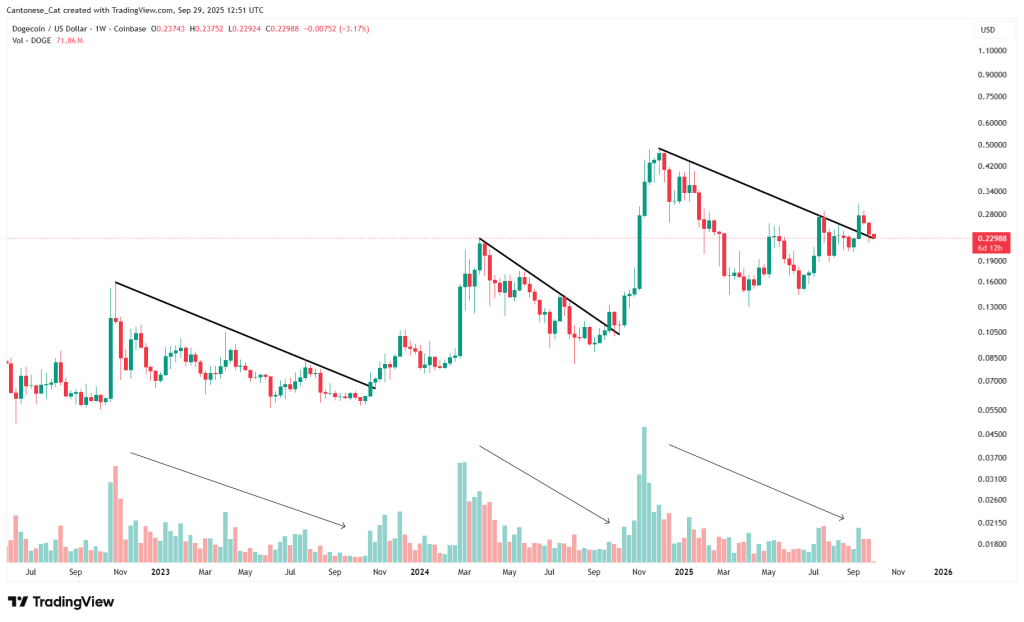

Dogecoin’s multi-month decline could also be approaching a turning level, with market construction and momentum dynamics aligning for a pointy upside decision, in keeping with crypto analyst Cantonese Cat in a video evaluation printed on September 29. He argues that DOGE’s retracement has unfolded on dwindling participation—a setup that traditionally precedes outsized upside as soon as even modest buy-side flows return.

Dogecoin Coiling For An Upside Explosion

“Having a tough time breaking above the 0.618 over right here,” he says of Dogecoin’s main Fibonacci retracement barrier on the higher-timeframe chart, whereas additionally noting that worth stays pinned beneath the weekly Ichimoku cloud. Regardless of these headline resistances, he characterizes the tape as constructive: “It’s mainly been breaking trendline after trendline.”

In his studying, every successive downtrend break—occurring towards a backdrop of fading quantity—tilts the possibilities towards an eventual reversal impulse. “All this downtrend was on declining quantity. So you realize that every one it takes is just a bit little bit of quantity to reverse this downtrend,” he explains. “Every time this trendline will get damaged and a few quantity kicks in, you simply find yourself going rather a lot increased.”

Cantonese Cat frames the present part as an inflection: “Identical factor over right here. You have got a downtrend right here on low quantity and all it takes is just a bit bit [of] quantity right here and this downtrend right here will be reversed. And it definitely seems to be prefer it’s within the technique of doing that proper now as we communicate.” In different phrases, even and not using a wholesale shift in market liquidity, incremental demand could possibly be enough to flip momentum and squeeze worth by way of close by resistance.

Associated Studying

The analyst’s constructive stance rests on a confluence of technical elements quite than a single set off. On DOGE, he highlights repeated trendline violations and methodical back-tests that held, which in his framework are precursors to impulsive continuation.

He additionally factors to the significance of creating and sustaining assist within the present zone: “I believe it’s going to go rather a lot increased, particularly as soon as it’s capable of finding assist right here at this explicit zone.” The speedy hurdles stay unchanged—specifically the 0.618 retracement cap and the weekly Ichimoku cloud ceiling—however he means that worth acceptance above these bands would verify a regime shift from distribution to markup.

Broader Market Context Is Supportive

Context from the broader market reinforces his DOGE view. Cantonese Cat hyperlinks Dogecoin’s setup to bettering higher-timeframe situations throughout crypto. He notes that Bitcoin reclaimed a key degree after a short scare round its 20-week shifting common and closed again above a horizontal degree on his each day Gann framework, tilting his near-term bias increased “so long as worth is about 112,000.”

Associated Studying

Ethereum, he provides, has “mainly damaged by way of the 0.86… lastly this cycle” and efficiently back-tested the breakout, a formation he doesn’t take into account bearish. He additional cites the OTHERS index—whole crypto market cap ex-top-10—breaking above the weekly Ichimoku cloud and back-testing it, with the Tenkan rising.

In his phrases, these indicators “in all probability [are] going to push the cryptocurrency market cap increased,” whereas the current sequence of candles hints on the potential for continuation: “Perhaps just a little little bit of a rising three, possibly just a little little bit of a bullish engulfing candle subsequent week to push issues increased.”

Taken collectively, the mosaic reads like a coiled spring for Dogecoin: a collection of descending-trend breaks on thinning quantity, sticky higher-timeframe resistance that has repeatedly absorbed exams, and a market-wide backdrop that’s turning incrementally supportive. The catalyst, in Cantonese Cat’s view, might not require a dramatic shift in macro liquidity. “Just a bit little bit of quantity” could possibly be sufficient to pressure a violent repricing if sellers are depleted and momentum thresholds give manner.

He concludes with a conditional however assured stance: “I stay bullish till in any other case confirmed at assist.” For Dogecoin, that interprets to a easy playbook. Maintain the present base, appeal to even modest incremental quantity, and convert the 0.618 retracement and the weekly cloud from resistance into assist. If that transition happens, the analyst believes the subsequent part may unfold “in a rush”—a attribute that has outlined DOGE’s historic rallies as soon as technical lids lastly blow off.

At press time, DOGE traded at $0.233.

Featured picture created with DALL.E, chart from TradingView.com