MicroStrategy introduced a $22 million Bitcoin buy as we speak, highlighting rising fears of shareholder dilution. The agency has refused to reinstate guardrails that would forestall this.

MicroStrategy is caught between two bearish situations. If it stops shopping for BTC, it may collapse market confidence. Nevertheless, if it dilutes shareholders to fund these buys, the agency will proceed underperforming the asset it holds.

Sponsored

Sponsored

MicroStrategy’s Dilution Disaster

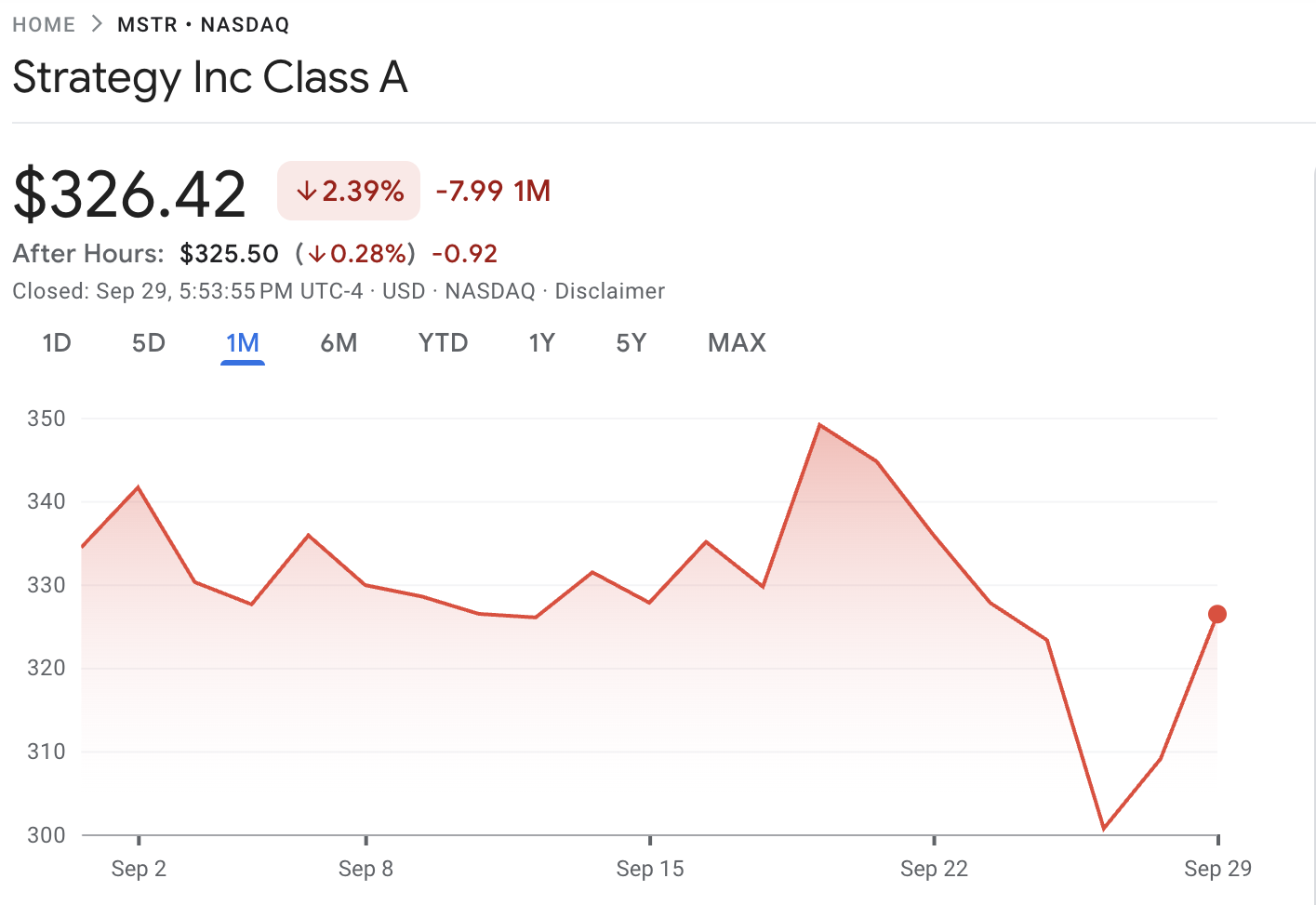

MicroStrategy has earned plenty of success with its Bitcoin accumulation plan, however a couple of cracks have been forming in latest weeks. Lately, the agency’s buy dimension has been diminishing, with Chairman Michael Saylor saying a $22 million BTC acquisition as we speak:

In comparison with a few of its earlier buys, this sum is downright paltry. Furthermore, new studies assist clarify an pressing dilemma for MicroStrategy: the agency is more and more leaning on shareholder dilution to fund these buys.

This sample may bubble into an explosive disaster if it diminishes shareholder confidence.

Harmful Warning Indicators

Though Michael Saylor claimed in July that MicroStrategy wouldn’t dilute shareholders’ Bitcoin publicity, he took measures to vary this coverage final month.

Particularly, he introduced that the agency may promote inventory for brand new causes apart from shopping for BTC, and likewise eliminated guardrails to guard buyers’ positions.

Sponsored

Sponsored

Since MicroStrategy enacted these measures, the agency diluted frequent shareholders by 3,278,660 shares to fund over $1.1 billion in new Bitcoin purchases. This 1.2% of shareholder float due to this fact immediately funded round 94% of the corporate’s BTC acquisitions within the final month.

MicroStrategy’s inventory dilution is harmful for a couple of causes, however one is especially vital: it immediately undermines the motivation to put money into MSTR as a substitute of shopping for BTC. Though the agency bought round 10,000 bitcoins since August, it has considerably underperformed the token.

No Clear Approach Out

Despite the fact that the corporate lately prevented a class-action lawsuit, it is a large warning signal. MicroStrategy’s inconsistent earnings have already price it large accolades, and shareholder dilution might be even worse.

The agency has a fiduciary accountability to maximise shareholder worth, which can be in battle with its acquisition objectives.

Very like the Crimson Queen from Alice in Wonderland, a BTC digital asset treasury has to maintain working quicker and quicker to remain in the identical place. MicroStrategy is a pillar of company confidence in Bitcoin; if it stops shopping for, the token worth will drop, dilution be damned.

There isn’t a straightforward approach out of this disaster. Michael Saylor doesn’t must solely maintain making a living; he has to outperform Bitcoin. Shareholder dilution is likely to be the one approach to maintain MicroStrategy on prime for now. Nonetheless, it may set off a fair greater implosion.