- Aptos is partnering with Trump-linked WLFI to launch the USD1 stablecoin on Oct. 6, with instant DeFi and trade help.

- The community is concentrating on Ethereum and Tron’s stablecoin dominance, already processing $60B in month-to-month quantity.

- New merchandise like “Decibel” DEX and “Shelby” storage purpose to strengthen Aptos’ place within the coming years.

Layer-1 blockchain Aptos has stepped into the highlight once more, this time asserting a partnership with the Trump household–linked World Liberty Monetary (WLFI) to roll out its USD1 stablecoin.

Aptos co-founder and CEO Avery Ching revealed that discussions with WLFI had been ongoing for a while, noting that the challenge “sees us as a number of the greatest tech companions they may work with.” Talking on the TOKEN 2049 convention in Singapore, Ching defined that WLFI is constructing merchandise not only for retail but additionally banking and broader monetary use instances. The primary milestone, he mentioned, is launching a stablecoin the place yield flows again to customers.

USD1 is scheduled to go reside on Aptos Community on October 6, full with ecosystem-wide help. Liquidity swimming pools, rewards, and incentives shall be built-in throughout key Aptos DeFi platforms reminiscent of Thala, Hyperion, Echelon, and Tapp. Main wallets and exchanges together with Backpack, OKX, Petra, Bitget Pockets, Nightly, OneKey, and Gate Pockets are additionally lined as much as help the launch.

Ching highlighted Aptos’ effectivity because the deciding issue, calling it “extremely low-cost” at lower than a hundredth of a cent per transaction and “method quicker than any blockchain on the market” with sub–half-second processing instances.

Concentrating on Tron’s Stablecoin Dominance

Aptos’ technique is evident: chip away on the dominance of Ethereum and Tron within the stablecoin recreation. Earlier this yr, Tether (USDT) launched on Aptos and shortly noticed “great development,” in response to Ching. At present, Aptos hosts $1.3 billion in Tether, although that’s nonetheless tiny in comparison with Tron’s $78.6 billion and Ethereum’s $94.8 billion in circulation.

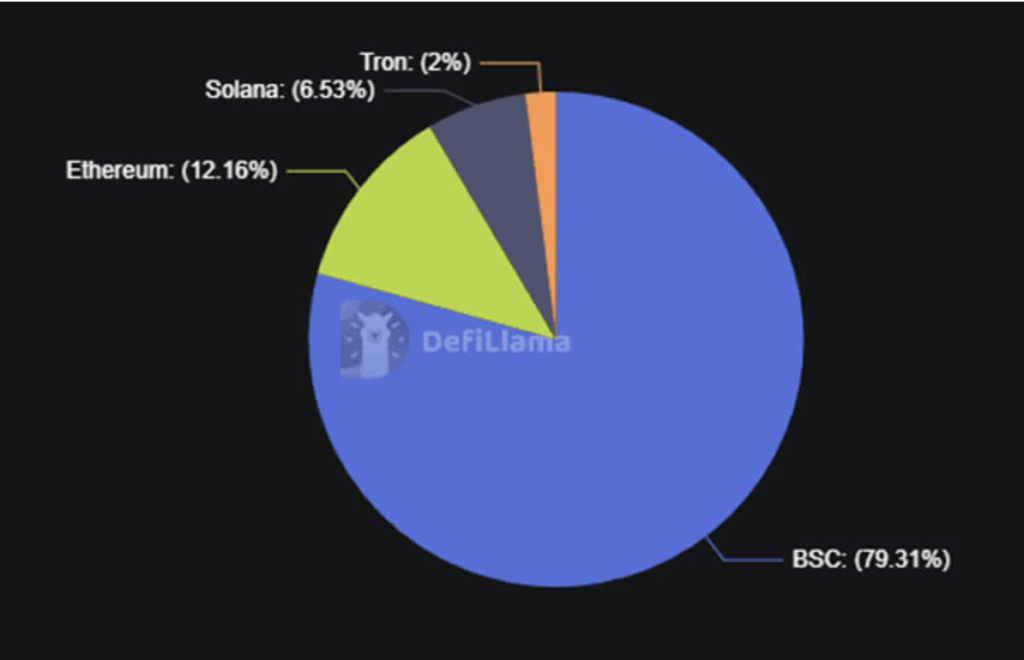

For context, USD1’s market cap sits at $2.68 billion, with most of that also on BNB Chain, per DefiLlama. Aptos hopes this new partnership will assist draw extra liquidity onto its personal chain.

Rising Market Share, New Ambitions

Regardless of solely holding about 0.35% of the general stablecoin market share (RWA.xyz information), Aptos has quietly been constructing momentum. Alongside USDT and USD1, Aptos already runs different stablecoins like USDC, Ethena USD (USDE), and PayPal’s PYUSD, processing over $60 billion in month-to-month quantity.

Ethereum stays king with round 59% of the stablecoin pie — or practically 70% if you happen to embrace L2s and different EVM-compatible chains. Nonetheless, Aptos is betting that effectivity and pace will carve out a distinct segment, particularly for institutional use instances.

Aptos’ New Initiatives on the Horizon

Past stablecoins, Aptos is cooking up extra merchandise. Ching launched “Decibel,” a decentralized trade targeted on stablecoins, spot buying and selling, and perpetuals, with testnet anticipated this month and a full mainnet launch earlier than yr’s finish.

He additionally teased “Shelby,” a decentralized storage system being constructed with Leap Crypto, geared toward dealing with real-time social apps and AI coaching information. Shelby is slated for launch in 2026.

It’s value noting that Ching was beforehand the pinnacle of Meta’s Diem crypto challenge. Since then, Aptos has attracted heavy backing from main names like Andreessen Horowitz, Apollo, Franklin Templeton, Circle Ventures — and even FTX Ventures earlier than its collapse.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.