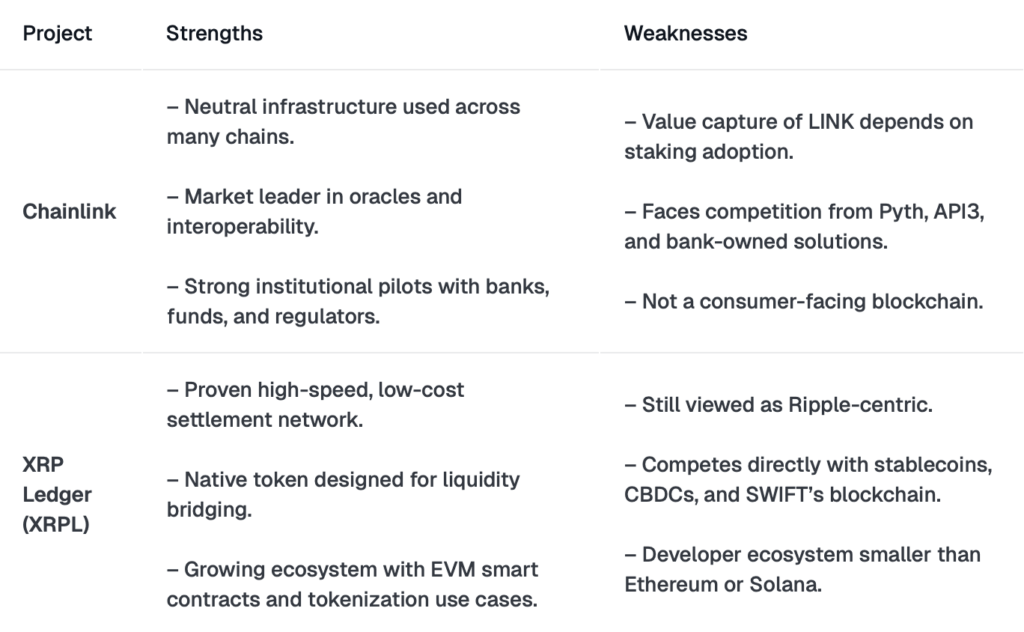

- Chainlink offers impartial infrastructure for tokenization and cross-chain information, whereas XRPL focuses on funds and native asset issuance.

- Establishments like JPMorgan, SWIFT, and DTCC are testing Chainlink, whereas Ripple is driving XRPL adoption with funds, funds, and stablecoins.

- XRPL has a narrower path on account of competitors, however Chainlink might scale throughout all the tokenization house, giving it broader upside.

In crypto, two names hold developing in conversations about institutional adoption and tokenization — Chainlink and the XRP Ledger (XRPL). They sit in the identical dialog however play very totally different roles. The massive debate now’s whether or not Chainlink can finally grow to be extra vital than XRPL, or if each will merely carve out their very own house.

Chainlink vs XRP Ledger: Totally different Roles in Blockchain

Chainlink isn’t even a blockchain. It’s an oracle and interoperability community — mainly the middleware that pipes exterior information into blockchains. Assume fund valuations, financial studies, or compliance feeds being despatched straight into good contracts. Its Cross-Chain Interoperability Protocol (CCIP) additionally helps belongings transfer between totally different chains.

XRPL, however, is a full-blown Layer-1 blockchain constructed for funds and tokenization. It makes use of XRP as its native asset, providing quick settlement and virtually no charges. Tokens, stablecoins, and even CBDCs could be issued straight on its ledger. It’s sensible and payment-focused, however not as impartial as Chainlink since its historical past is tied to Ripple.

Institutional Adoption of Chainlink and XRPL

Chainlink has leaned into being infrastructure-first. It’s been operating pilots with giants like JPMorgan, DTCC, and SWIFT to convey fund information and cross-chain settlement into the actual world. Even the U.S. Division of Commerce has tapped Chainlink to publish official stats on-chain. That offers it credibility as a “commonplace” that sits throughout blockchains.

XRPL’s institutional story appears a bit of totally different. Ripple has teamed up with Franklin Templeton and DBS for tokenized cash market funds on XRPL. In Japan, SBI Ripple Asia is utilizing it for funds and NFTs. Ripple’s RLUSD stablecoin additionally lives natively on XRPL, giving the ledger extra utility in settlement and liquidity.

Tokenization, DeFi Progress, and Regulation Dangers

In terms of tokenization, Chainlink is the layer that makes positive all the pieces works throughout blockchains — pricing, compliance, information feeds. Worth flows again into LINK via staking and utilization charges.

XRPL handles tokenization straight on its ledger, with builders issuing stablecoins, NFTs, and DeFi belongings. Its new EVM sidechain opens the door for Ethereum-style apps, and its TVL has already handed $120M. However XRP’s historical past with the SEC lawsuit reveals how regulatory threat has formed its narrative, even after readability was achieved. Chainlink doesn’t face the identical strain as a result of it’s not issuing belongings, simply offering information infrastructure.

Future Outlook for Chainlink and XRP Ledger

On the finish of the day, Chainlink received’t “change” XRPL. They’re constructed for various functions. XRPL will probably keep related in fee corridors and liquidity use circumstances, particularly the place pace and value are key. However competitors from stablecoins, CBDCs, and even SWIFT limits how a lot it will probably develop.

Chainlink, against this, has the prospect to scale throughout all the tokenization trade. If it cements itself because the impartial commonplace for information and cross-chain connections, it turns into tougher to dislodge than any single blockchain. That’s why many analysts argue its upside with establishments is greater.

Remaining Take: Chainlink or XRPL for the Way forward for Crypto?

Chainlink won’t ever be the subsequent XRPL — it’s not a funds blockchain and doesn’t purpose to be. Nevertheless it might surpass XRPL in institutional relevance by turning into the glue that holds tokenization collectively. XRPL nonetheless issues, particularly in funds and liquidity, however Chainlink’s function as infrastructure offers it a a lot wider ceiling.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.