- Decentralized alternate volumes surged previous $10 billion in September 2025, reflecting each retail and institutional progress.

- SEI value broke its lengthy downtrend, with consumers defending help between $0.22–$0.26 and eyeing resistance at $0.38–$0.44.

- Dangers stay if SEI fails to carry help, however the DEX increase and enhancing sentiment may gas a sustained rally.

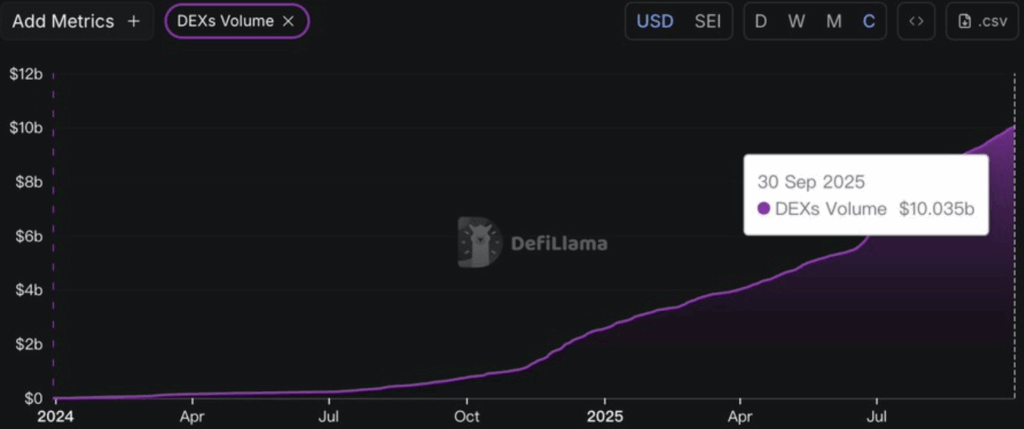

Decentralized alternate volumes have taken off, crossing $10.03 billion on September 30, 2025, based on DeFiLlama. On the identical time, SEI has lastly managed to interrupt free from its drawn-out downtrend, hinting that market sentiment could be turning. Collectively, these strikes paint a much bigger image: decentralized platforms aren’t simply area of interest anymore, they’re beginning to reshape how crypto buying and selling really works.

DEX Development Indicators Greater Shift in Buying and selling Conduct

The rise in DEX exercise hasn’t been in a single day. It’s been climbing step by step since mid-2024, after a fairly flat begin earlier that 12 months. However by early 2025, the curve actually steepened, displaying liquidity flowing in sooner than earlier than. Crossing the $10B mark alerts not simply retail merchants enjoying round, but in addition greater cash coming in.

A part of this progress is as a result of centralized exchanges are beneath heavy regulatory fireplace, and merchants don’t like ready round. DEXs give extra transparency, sooner execution, and self-custody — which is changing into a non-negotiable for lots of customers. With networks scaling higher and prices dropping, it appears to be like like decentralized platforms are lastly shifting from being “options” to changing into predominant pillars of the market.

Establishments Convey Weight to DEX Volumes

It’s not simply retail making noise both. Establishments have been displaying up extra typically, they usually deliver within the sort of liquidity that drives parabolic progress. Large trades want deeper markets, and that appears to be what’s fueling this spike. Establishments additionally care about clear value discovery, which DEXs are slowly however certainly enhancing.

In the meantime, retail demand continues to be robust — individuals love the number of tokens and the truth that you don’t must depend upon a intermediary. This mix of institutional muscle and retail urge for food is shifting the steadiness away from centralized platforms. If momentum retains up, DeFi volumes would possibly even cross $12 billion earlier than the 12 months closes.

SEI Worth Breaks Out of Downtrend

On the opposite facet of the charts, SEI has lastly cracked above its descending trendline after months of boring sideways motion. That’s normally a sign the tide is popping, particularly when paired with the buildup section merchants have been watching. These setups typically construct strain for weeks earlier than popping increased.

The chart highlights robust demand zones between $0.22 and $0.26, areas the place consumers maintain stepping in. So long as SEI holds above that band, bulls keep in management. If momentum builds, the subsequent actual targets sit round $0.38 to $0.44 — each zones that acted as resistance earlier than. Nonetheless, it’s unlikely to maneuver in a straight line; pullbacks are a part of the method when a pattern reversal kicks off.

Dangers That May Derail SEI’s Bounce

After all, nothing’s assured. If SEI slips again beneath its help ranges, the breakout may fizzle and drop the token again into its previous vary. Merchants will probably use those self same ranges as cease zones or invalidation factors.

And whereas the expansion in DEX volumes reveals actual confidence in decentralized platforms, market-wide volatility can nonetheless drag SEI down with the pack. Sustained upside will rely not solely on how robust consumers are, but in addition on whether or not exchanges can maintain scaling and managing liquidity with out hiccups.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.