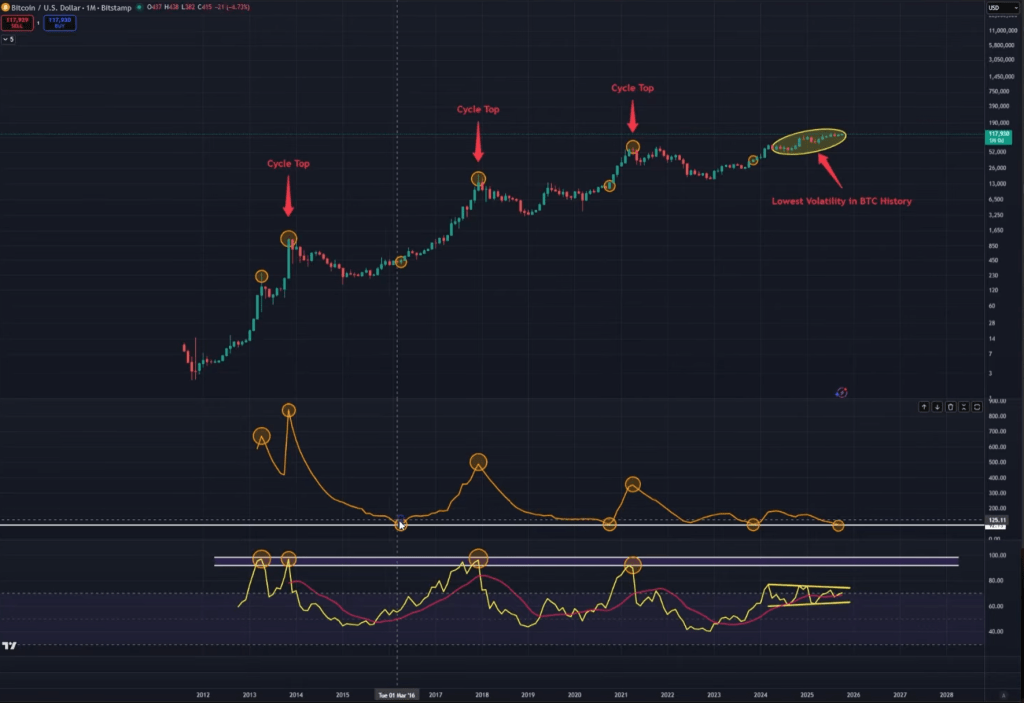

Bitcoin is sitting on the “lowest quantity of volatility of all time” on the month-to-month chart, and that traditionally precedes the cycle’s most forceful upside, in line with crypto analyst Kevin (Kev Capital TA). In an October 1 video evaluation, Kevin tied an all-time low within the Bollinger Bands Width (BBW) to a long-running sample throughout prior cycles and argued that the setup into This fall leaves “no excuses” for the market to not push greater if key helps maintain and the macro backdrop stays benign.

Kevin builds his case round two higher-timeframe indicators: the month-to-month BBW and the month-to-month RSI. BBW tracks the gap between the Bollinger Bands slightly than plotting the bands themselves; compressed width indicators traditionally low realized volatility and the potential for sharp growth. “We’re on the lowest Bollinger Band width we now have ever been at in Bitcoin historical past,” he stated, calling it an inflection that has repeatedly aligned with outsized pattern strikes.

He pairs that with a month-to-month RSI that topped in prior blow-off phases and is at present consolidating in what he describes as a bull-flag construction. “Anytime the Bollinger bandwidth share will get as little as it’s proper now… each single time in historical past on the month-to-month time-frame, we now have skilled large strikes greater out there,” he argued.

For example the cycle rhyme, Kevin pointed to late 2013 and 2017, when month-to-month RSI peaked round 96 and 95 respectively whereas BBW expanded into cycle tops after earlier troughs in volatility. Within the subsequent bear-market basing phases, he says BBW fell to cycle lows earlier than contemporary expansions started. In the latest cycle run-up, he characterizes This fall 2023 into March 2024 because the “actual rally,” noting that RSI topped close to 76 and has since been coiling with “decrease highs and better lows on the month-to-month RSI… very, very good trying.”

Associated Studying

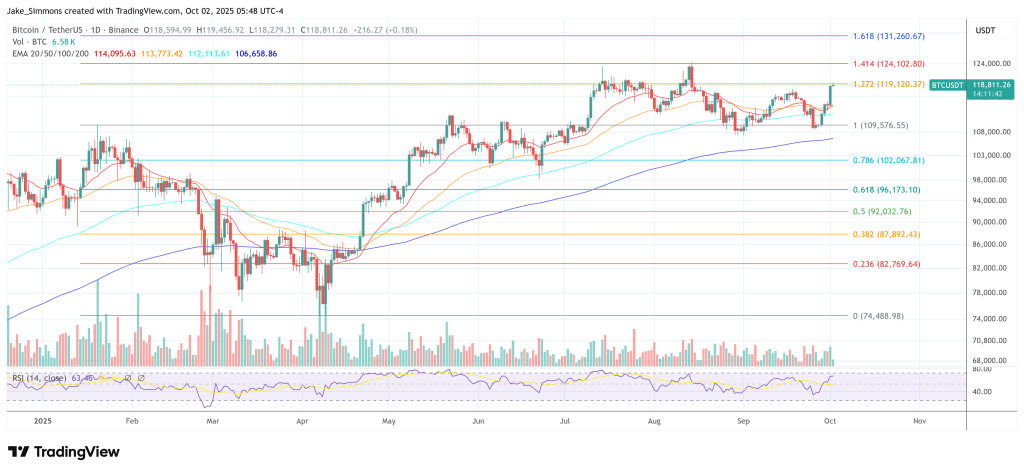

The analyst underlined a key conditional: the technical construction solely resolves bullish if Bitcoin preserves its higher-timeframe assist. He cites the weekly “bull market assist band” and close by horizontal ranges as the road within the sand. “So long as Bitcoin can maintain key ranges, that being the weekly bull market assist band, which at present sits at 109.2K, [and] the 106.8K degree, then there’s no excuses as to why Bitcoin shouldn’t be in a position to press greater in quarter 4,” he stated.

What To Watch Now For Bitcoin

Past chart construction, Kevin layered in macro and on-chain context as corroborating, not main, proof. On macro, his base case is that the coverage setting is popping supportive: “We have now secure inflation, just about flatlined… a weakening jobs market, however not cratering… regular GDP progress, and we now have a Fed who’s seeking to ease.”

Referencing weaker-than-expected ADP employment information and up to date FOMC signaling, he added: “We have now a price reduce projected for October… for December… and [possibly] January,” and prompt the Fed’s quantitative tightening may strategy an finish as financial institution reserves tighten. He was specific that the trail will depend on these situations persisting: “So long as our macroeconomic panorama right here within the US stays favorable… the pathway is laid for crypto to go greater in This fall.”

On valuation and positioning, Kevin turned to a logarithmic regression mannequin of complete crypto market capitalization and a “Bitcoin danger metric.” He stated complete market cap has not but exceeded his mannequin’s fair-value trendline this cycle—putting truthful worth at about $4.38 trillion versus roughly $4 trillion for the present studying in his framework—and argued that earlier cycle-defining blow-offs started solely after crossing above truthful worth.

Associated Studying

“Each single time… we lastly broke previous the truthful worth logarithmic regression line, you’ve gotten seen your greatest strikes of the cycle,” he stated. His danger metric, color-coded from low to excessive, at present sits close to 0.49–0.50 by his depend, nicely under the 0.8–0.9 “pink” zone he associates with sturdy tops. “Not as soon as this complete cycle has Bitcoin hit mainly the pink danger degree,” he famous, including that month-to-month RSI close to the high-60s/low-70s is “not seeing parabolic worth motion… not seeing insane euphoria.”

Change habits is one other pillar of his non-top thesis. In prior cycle peaks, he stated, internet flows of BTC to exchanges surged as contributors ready to promote. “Not solely is that not occurring, however internet flows are going off of exchanges,” he stated. “That isn’t cycle prime habits. That’s accumulation habits.” The mixture—compressed month-to-month volatility, consolidating momentum, sub-threshold danger, and outflows—leads him to a single conclusion: “There’s main volatility coming. If something, it’s beginning now.”

Kevin additionally acknowledged uncertainties round near-term US financial prints and even authorities operations, however he returned to the core of his technique: synthesizing macro, technicals, and on-chain right into a unified cycle view. “We don’t lean in a single path… We put all of it collectively,” he stated. Below that blended framework, he contends, calling a cycle prime at present ranges would “go towards each single piece of data we now have ever used up to now to find out cycle tops,” and would drive a rethink of the mannequin provided that the market proves it fallacious.

The battle traces, in his telling, are clear. Maintain the weekly bands round $109.2K and $106.8K, hold the macro trajectory supportive, and the historic sample of BBW compression resolving in a robust, remaining upside leg ought to play out as This fall progresses. Or, as Kevin put it within the line that outlined his thesis: “Each time this occurred, worth went vertical.”

At press time, BTC traded at $118,811.

Featured picture created with DALL.E, chart from TradingView.com