Bitcoin has reclaimed key ranges above the $118,000 mark, shifting momentum again in favor of the bulls after weeks of uncertainty. The breakout has reinvigorated sentiment throughout the market, with merchants more and more assured that BTC could possibly be on the verge of a serious transfer. Traditionally, October has been one of many strongest months for Bitcoin efficiency, and a few analysts are already calling for an enormous impulse that might carry the asset towards new highs.

Associated Studying

What makes this rally particularly notable is the underlying stability mirrored in market information. Prime analyst Axel Adler shared insights displaying that Bitcoin presently sits in equilibrium, the place shopping for and promoting strain are balanced. This situation usually indicators a wholesome market construction, creating a powerful base for potential upside. If momentum holds, the mix of bullish seasonal patterns and a secure equilibrium might gasoline an aggressive continuation of the cycle.

Nonetheless, analysts warning that the subsequent few days shall be essential. Reclaiming $118,000 is a powerful first step, however Bitcoin might want to construct help above this threshold to substantiate the breakout and maintain its trajectory. With volatility returning, October might as soon as once more show to be a decisive month for Bitcoin.

Bitcoin Dynamics Align With A Key Indicator

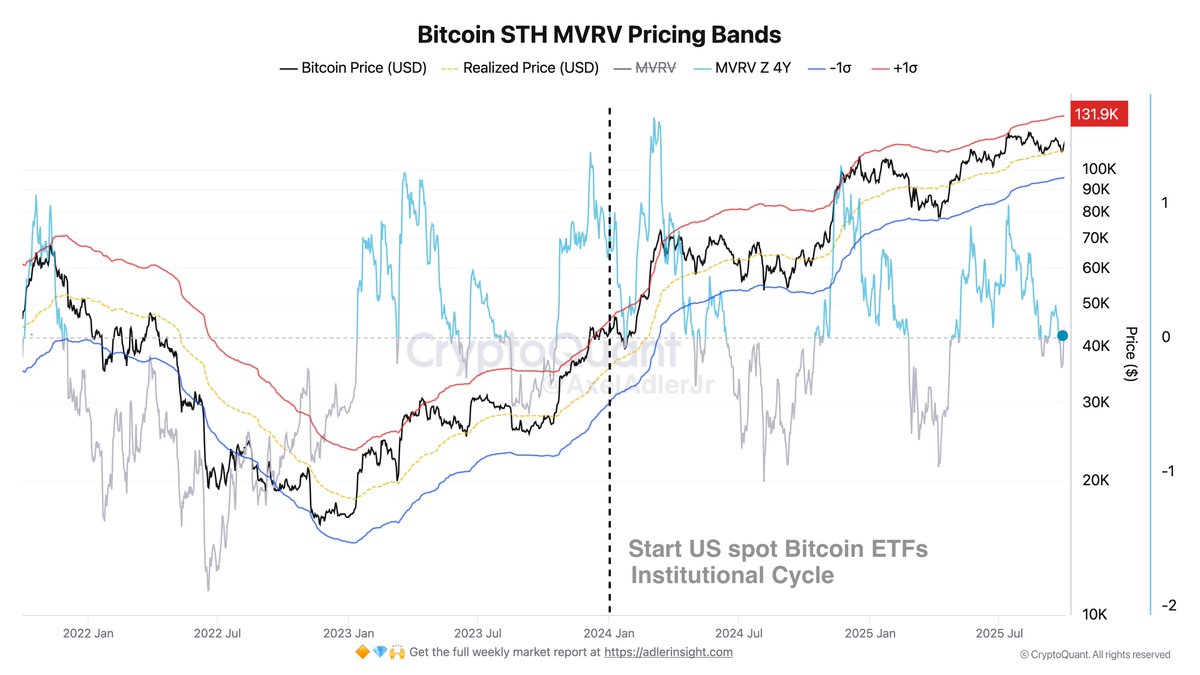

In a CryptoQuant report, Adler explains that Bitcoin’s present value habits aligns carefully with the STH-MVRV pricing hall, a metric designed to mirror the typical profitability of current patrons. This hall offers a framework for evaluating when short-term holders are in revenue and extra prone to promote, versus when they’re at a loss and prone to capitulate. At current, Bitcoin sits comfortably inside this vary, suggesting a wholesome equilibrium in market dynamics.

The higher boundary of the hall, outlined as +1σ, presently hovers round $130,000. Adler notes that this stage represents a zone the place short-term holders usually start to lock in earnings extra aggressively. Traditionally, value approaches to this boundary have triggered waves of promoting, offering a pure cap till stronger demand emerges. However, the existence of this higher sure offers the market a transparent goal, and if present dynamics persist, a transfer towards $130K seems more and more reasonable.

Equally necessary is the baseline of the hall, which displays the typical realized value of short-term holders. Because the starting of 2024, Bitcoin has constantly held above this stage (marked by the yellow line on the chart). This persistent power indicators sustained bullish sentiment, as short-term drops beneath the baseline have been rapidly purchased up, reflecting strong demand.

In impact, Bitcoin stays in a state of equilibrium—neither overheated nor oversold—inside the established volatility hall. This steadiness, mixed with the historic seasonality of October rallies and robust institutional flows, positions the market favorably for potential upside. If shopping for strain continues and volatility contracts, the likelihood of an advance towards the $130K zone turns into a tangible situation within the weeks forward.

Associated Studying

Bitcoin Faces Resistance After A Rally

Bitcoin is buying and selling round $118,800 on the 12-hour chart, extending its breakout from earlier this week. Worth has surged previous the important thing $117,500 resistance, a stage that capped rallies all through September, and is now testing the $119,000–$120,000 space. This zone represents the ultimate hurdle earlier than a possible retest of summer season highs close to $125,000.

The transferring averages present enhancing momentum. BTC has reclaimed the 50-period (blue) and 100-period (inexperienced) transferring averages with robust follow-through, turning them into short-term help zones round $114,000–$115,000. In the meantime, the 200-period (pink) transferring common continues to rise from beneath, reinforcing the longer-term bullish development. The decisive break above a number of averages in just some periods highlights the power of purchaser conviction.

Associated Studying

Nonetheless, the chart additionally means that Bitcoin is getting into overextended territory within the brief time period. After 4 consecutive bullish candles, a interval of consolidation round $118,000–$119,000 wouldn’t be shocking. A failure to carry above $117,500 might see a pullback towards $115,000, whereas sustained shopping for might verify a path to $120,000 and past.

Featured picture from ChatGPT, chart from TradingView.com