Whereas Bitcoin (BTC) is getting purged once more, seasoned analyst Chris Burniske displays on the alternatives to “repair revenue” safely. The CEO of Tether incubee Rumble sees $1 trillion in USDT coming regardless of crypto skilled Nic Carter being skeptical in regards to the USDT/USDC duopoly on the stablecoin scene.

Bitcoin (BTC): It is time to guide some income, analyst Burniske says

The worth of Bitcoin (BTC), the most important cryptocurrency, has hit a two-month excessive amid the information of the U.S. authorities shutdown. Whereas the value motion positively seems to be robust, high analyst Chris Burniske says that he wouldn’t rule out having some income fastened at this stage.

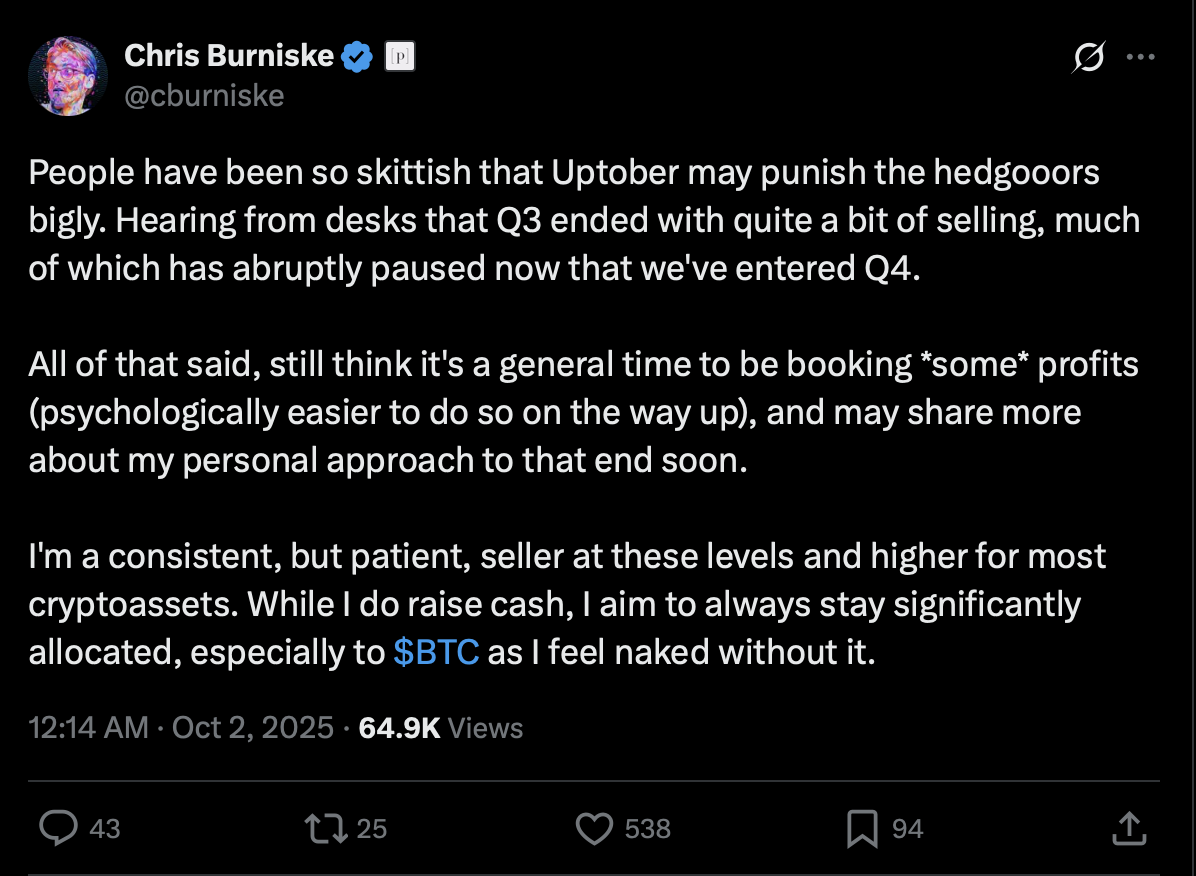

The very best time to promote, no less than a part of one’s Bitcoin (BTC) holdings, is when costs are nonetheless surging, he identified in a tweet:

All of that mentioned, nonetheless assume it is a common time to be reserving *some* income (psychologically simpler to take action on the best way up), and should share extra about my private method to that finish quickly.

Burniske admitted that some audio system are positive that Bitcoiners (BTC) is perhaps completed promoting in late Q3, 2025, because the cryptocurrency markets are again to rallying. On the identical time, merchants needs to be optimistic about “Uptober” guarantees at this level.

This assertion counts not just for Bitcoin (BTC), as Burniske considers himself a “constant, however affected person, vendor at these ranges and better” for BTC and all main cryptocurrencies. However, he nonetheless raises the money and maintains allocations to Bitcoin.

The Bitcoin (BTC) value hit an area excessive over $119.450 on main spot exchanges right now, after including 1.84% in a single day.

USDT, USDC duopoly on borrowed time: Three causes by researcher Nic Carter

The “duopoly” – the dominance of the U.S. Greenback Tether (USDT) and Circle’s USDC as the 2 important stablecoin belongings – would possibly finish quickly. Such a forecast was shared by Nic Carter, Constancy’s alum, a associate at Fortress Island Ventures and the cofounder of blockchain information aggregator Coinmetrics.

Carter indicated three potential catalysts for the remainder of the stablecoins. First, many TradFi “intermediaries” could have their very own stablecoins rolled out in the end. The chance to get some income at present shared between the issuers of USDC and USDT will likely be a core motivation catalyst right here.

Then, the accelerated competitors in numerous yield-bearing stablecoins may also usher in new gamers. Giants like USDT and USDC won’t be able to supply yields aggressive with these of early-stage smaller-cap stablecoins.

The expansion of bank-issued stablecoins would be the third pillar of the approaching revolution on this rising phase. The banks will launch their cryptos on an unlimited liquidity and infrastructure foundation, pushing ahead the adoption of stablecoins as an asset class.

Presently, USDT and USDC mixed are answerable for $243 billion out of $300 billion, a complete market cap of the stablecoin phase. Its greatest competitor, Ethena’s USDe, is sitting at a $14 billion market cap.

$1 trillion in USDT “prior to everybody thinks”

In the meantime, Tether’s USDT routinely hits a brand new ATH in circulating provide, with $175 billion in equal issued throughout numerous blockchains. Chris Pavlovski, founder and CEO of Rumble content material distribution platform, foresees this quantity hitting $1 trillion quickly.

Pavlovski harassed that the rally of USDT’s circulating provide to the 13-digit zone is nearer than everybody might imagine.

Final 12 months, the USDT provide surged from $119 billion to $175 billion, whereas its important rival, USDC, greater than doubled its provide from $35 billion to $73 billion.

As coated by U.Right this moment beforehand, Tether made headlines in December 2024 by investing $775 million in Rumble. It stays the most important funding in Tether’s historical past.

The USDT issuer itself is in search of funding now. Submit-fundraising, the corporate valuation would possibly exceed $500 billion, which can enable Tether to outshine OpenAI as probably the most valued non-public firm on this planet.