The Ethereum derivatives market has seen a notable surge in whale exercise as costs submit large will increase.

On Wednesday, October 1, an unknown pockets transferred a large 198,289 ETH ($852.4 million_ to crypto futures and choices alternate Deribit, in accordance with knowledge from on-chain monitoring platform Whale Alert.

The big Ethereum switch, which occurred in a single transaction, has raised eyebrows because it got here at a time when the crypto market skilled a broad resurgence within the costs of main cryptocurrencies, together with Ethereum. The surge in exercise spans throughout the Ethereum derivatives market, with whales making massive strikes.

Though the character of the transaction was not particularly acknowledged, market watchers have perceived the transfer to be bearish for Ethereum, suggesting that the whale is perhaps making ready to promote.

What are Ethereum whales as much as?

Whereas subsequent Ethereum transfers involving main ETH withdrawals to the identical alternate had been noticed a couple of minutes after the preliminary deposit, the transfer has already stirred discussions throughout the crypto neighborhood.

Many commentators have speculated that the transfer is perhaps an institutional try and reposition holdings or a hedging technique. Others imagine the whale might be making ready for a large-scale selloff.

In the meantime, with Deribit being a famend cryptocurrency choices and futures alternate, the transfer means that the big Ethereum holder could have dedicated its funds to derivatives contracts in a bid to handle threat publicity.

Though Ethereum is presently buying and selling on the bullish aspect, the sudden influx of almost $1 billion value of ETH may imply that whales are gearing up for heightened volatility amid the market rebound.

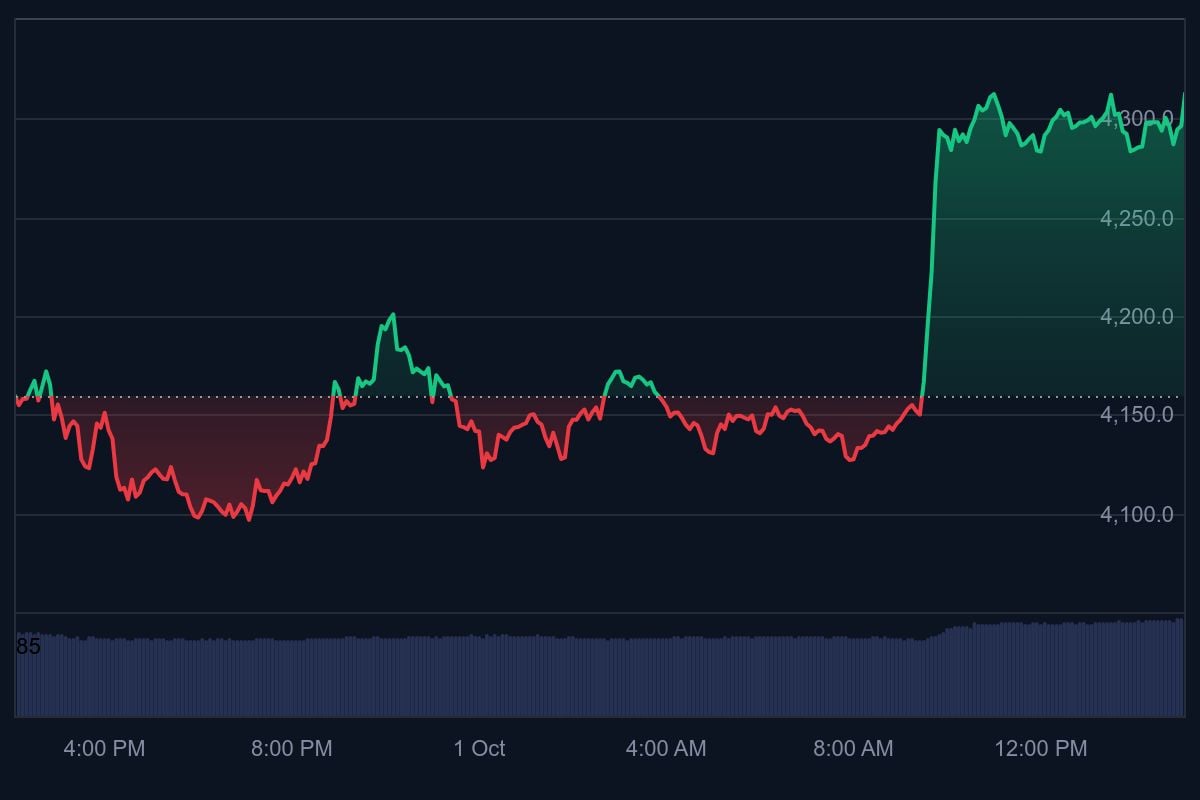

Simply sooner or later into the “Uptober” season, Ethereum has already seen its value surge by over 5%, sitting at round $4,329 as of press time.

Notably, the regulatory readability presently going through the crypto market has continued to draw institutional curiosity within the area. Therefore, buyers have proven little concern over the high-volume ETH deposits, anticipating greater value surges for Ethereum within the new month.