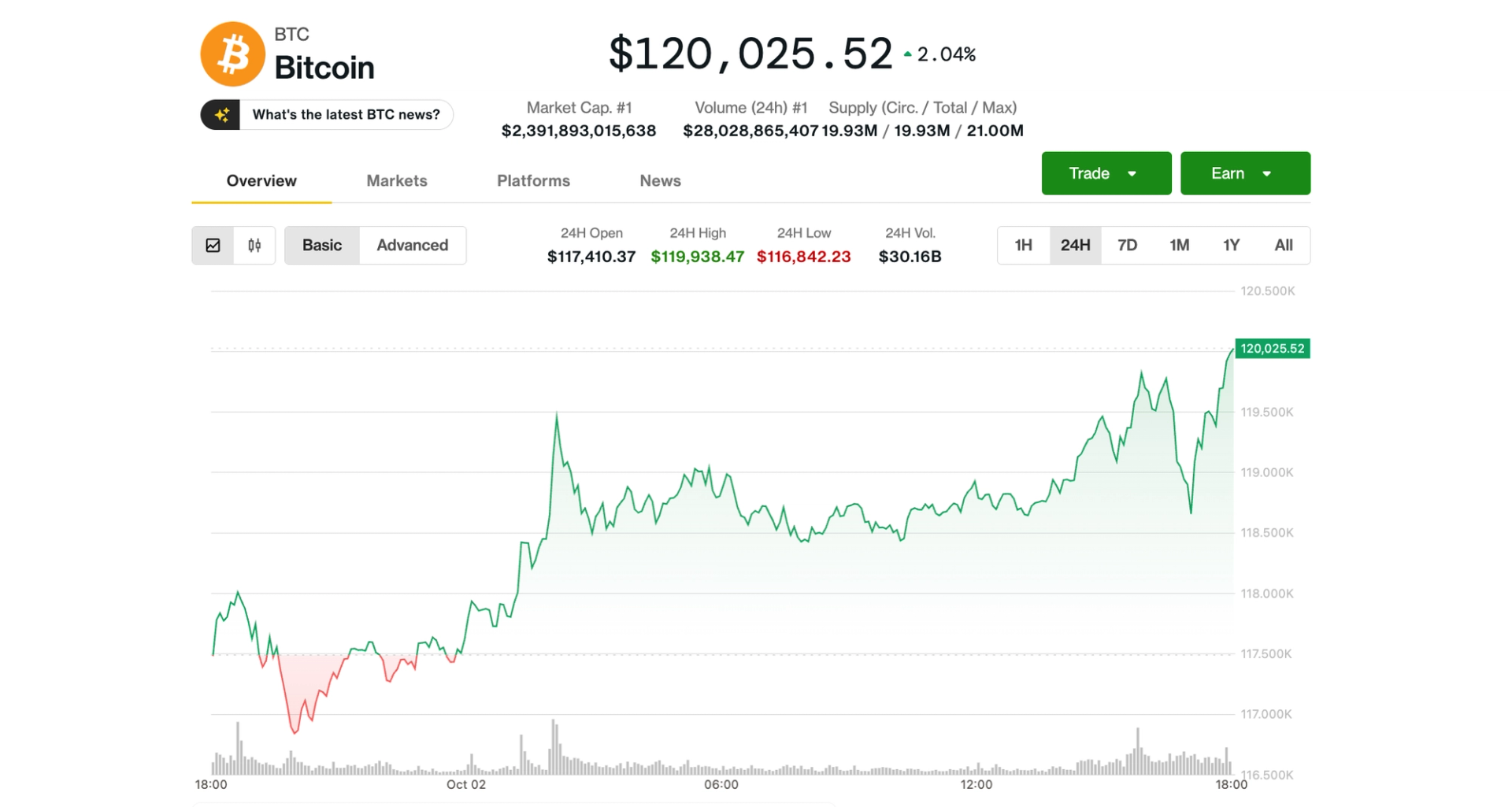

Bitcoin broke above $120,000, a stage not seen since mid-August, as merchants place for a bullish October for danger property.

The token has been climbing steadily over the previous 5 days, recovering from a late September pullback. Analysts level to renewed optimism round macroeconomic tailwinds that would enhance danger property within the closing quarter of the yr.

Within the derivatives market, BTC futures are flashing bullish indicators with open curiosity reaching a report excessive of $32.6 billion, suggesting merchants are positioning for additional upside. On-chain analyst Skew famous that quick positions are additionally piling up, which might create a possibility for a brief squeeze.

Merchants might be notably centered on the following Fed assembly on the finish of this month, which might occur with out entry to a contemporary jobs report amid the federal government shutdown. Treasury Secretary Scott Bessent advised CNBC on Thursday that the shutdown might additional weaken the economic system

“We might see a success to the GDP, a success to progress and a success to working America,” he stated.

Although traditionally the impression of a authorities shutdown on the economic system has been minor, President Donald Trump’s risk to fireside roughly 750,000 federal employees might have an impact within the present local weather.

Urge for food for crypto may be fueled by hopes for an incoming altcoin season as a number of functions for altcoin-related spot exchange-traded funds (ETFs) will seemingly see approval as soon as the federal government reopens.

Canary Capital’s Litecoin ETF is due for a response immediately with others going through deadlines between Oct. 10 and 24. The Securities and Change Fee (SEC), nonetheless, confirmed on Wednesday that it’ll not assessment any functions through the shutdown.

Much like bitcoin, altcoins have been buying and selling increased over the previous 24 hours, led by which was up practically 3%. The CoinDesk 20 Index, which tracks the efficiency of the 20 largest crypto property, is 1.5% increased over the identical interval.

Paul Howard, senior director of crypto buying and selling agency Wincent, was skeptical earlier this week about bitcoin’s rebound, however he flipped bullish seeing the power of the previous days’ advance.

“With $BTC buying and selling again at ranges final seen in mid-July, the full market cap is as soon as once more above $4 trillion,” he famous. “We’ve seen a gradual grind increased breaking above $115,000, indicating we at the moment are extra prone to keep above this stage, with a CME hole to lock within the ground at $110,000.”

“I imagine we at the moment are set to see a sustained rally above $120,000 within the coming weeks,” he added.