Dogecoin’s day by day chart is coiling right into a technically clear inflection, in line with dealer IncomeSharks, who posted a rising channel and an on-balance quantity (OBV) wedge that collectively map an easy path to increased ranges. “DOGE – Not a foul setup. Apparent channel and clear OBV wedge. Ideally OBV will escape earlier than value,” the analyst wrote, sharing the chart that frames the present advance.

Dogecoin Breakout Watch: $0.33 Set off On Deck

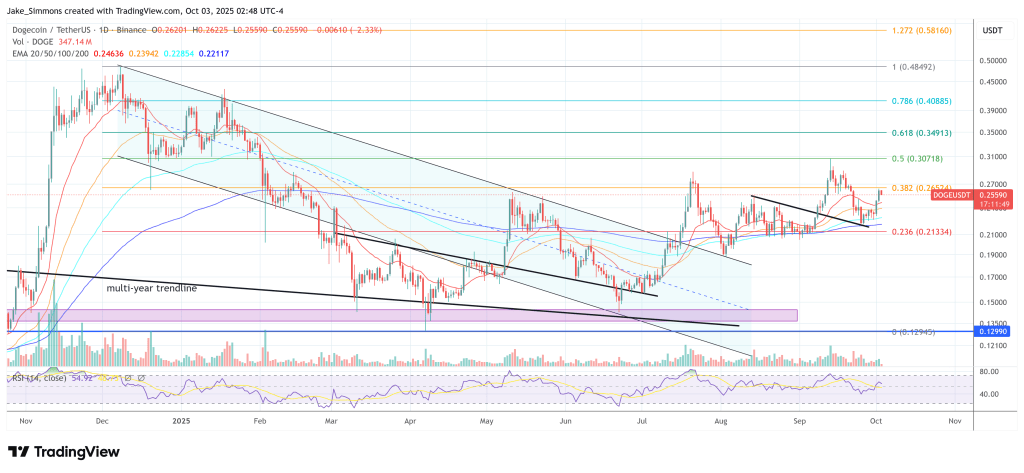

Worth has been respecting a well-defined ascending channel that has ruled commerce since early summer time. A number of touches on each boundaries validate the construction: increased lows alongside the decrease trendline from July by way of early October, and lower-high rejections in opposition to the higher rail by way of mid-July, late August, and late September.

After a recent rebound off the rising help space at the beginning of October, DOGE has pushed again into the channel’s mid-range, the place it sometimes pauses earlier than the following impulse. IncomeSharks’ path sketch envisions a quick consolidation or shallow pullback contained in the channel, adopted by a drive towards the ceiling.

Associated Studying

The vacation spot is specific on the chart. The higher boundary at the moment intersects within the low-to-mid $0.30s, and the drawing marks a breakout try between roughly $0.32 and $0.33. That zone represents confluence: it’s the place the rising channel’s resistance comes into play and the place late-September provide capped the prior thrust. A decisive day by day shut by way of that band would affirm a bullish channel breakout and go away the door open for a run in the direction of the early December 2024 excessive at $0.4843.

Quantity dynamics are the inform to observe. The decrease panel plots OBV, a cumulative measure of purchase/promote strain, compressed right into a symmetrical wedge: a gently rising base since mid-July and a descending lid drawn off the July and September OBV peaks. This type of narrowing vary in OBV usually precedes a directional enlargement.

Associated Studying

IncomeSharks’ remark underscores that sequencing: an OBV breakout forward of value would sign recent accumulation and enhance the chances that value follows with a push to the channel’s high. Conversely, failure of OBV at its wedge help would warn that the rebound lacks sponsorship, rising the danger of one other check of the decrease channel line.

Structurally, the setup is simple. So long as DOGE continues to carry the rising help that has outlined the pattern since July, the trail of least resistance stays up throughout the channel. A clear OBV break of its wedge would strengthen that view.

If bulls can then clear overhead provide and convert the $0.32–$0.33 band into help, the chart would affirm the breakout roadmap IncomeSharks outlined. If as a substitute value loses the ascending base, the channel thesis can be invalidated and the market would doubtless revisit prior higher-low areas alongside the decrease rail earlier than making an attempt one other pattern leg.

At press time, DOGE traded at $0.2559.

Featured picture created with DALL.E, chartfrom TradingView.com