With the Stablecoin-as-a-Service (SCaaS) mannequin, any enterprise or platform can problem its stablecoin with out constructing a posh infrastructure.

The chance is huge, but it surely comes with dangers of liquidity fragmentation, reserve transparency, and evolving world regulatory frameworks.

Sponsored

Sponsored

Anybody Can Challenge Stablecoin

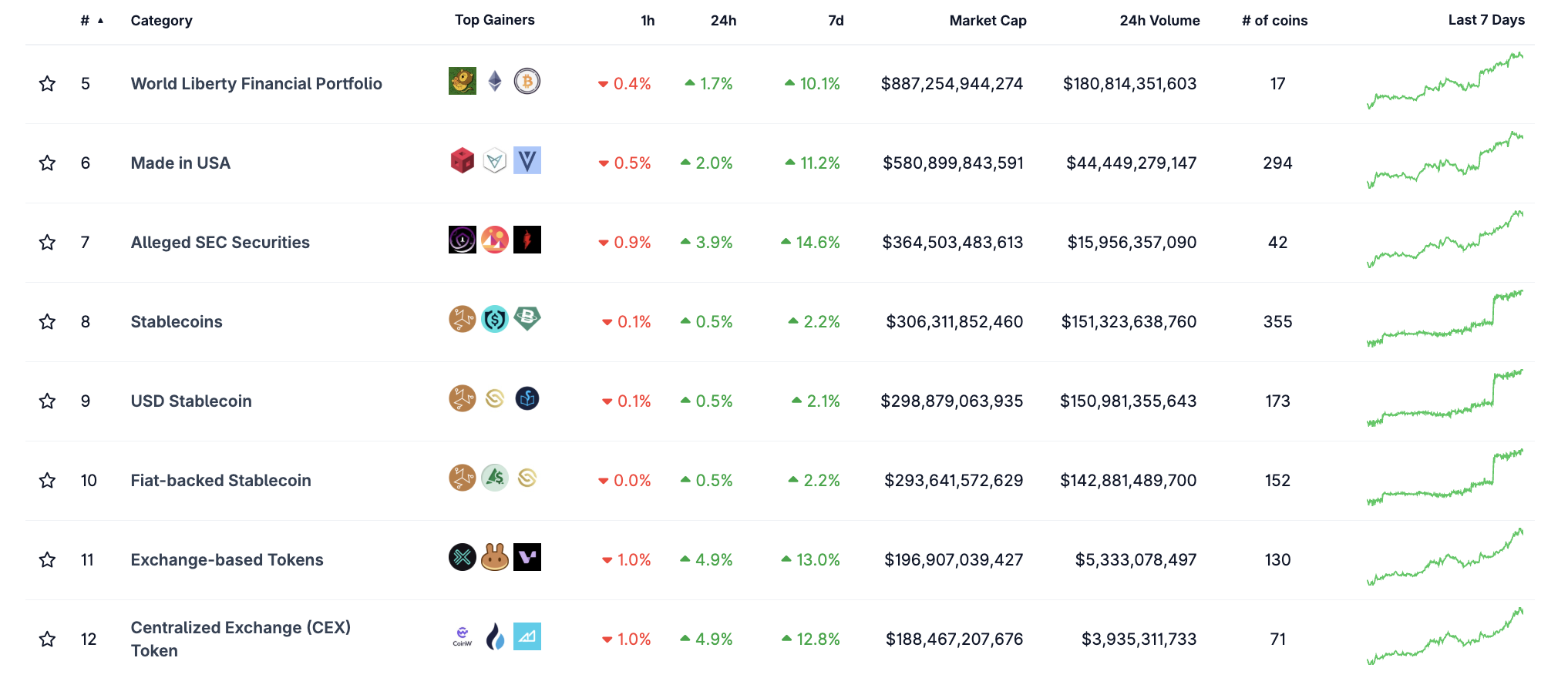

Knowledge from CoinGecko reveals that the stablecoin phase at the moment has a market capitalization of round $306 billion and 355 totally different cash. Though fairly standard at the moment, not everybody can problem and handle stablecoins successfully.

Nevertheless, a brand new stablecoin mannequin permits companies, platforms, or organizations to problem and handle stablecoins with out constructing the complete infrastructure from the bottom up.

This mannequin consists of standardized mint/burn, customizable reserve mechanisms and charges, and third-party working interfaces. That is Stablecoin-as-a-Service (SCaaS).

The latest instance is Stripe’s Open Issuance program (launched in September 2025). It permits companies to mint/burn stablecoins freely and customise charges and reserve allocations whereas sharing income from yield after a sure payment. Ethena Labs offers a white-label answer for functions or blockchains. Tech giants like Google have reportedly examined a fee protocol for AI brokers utilizing stablecoins, whereas custodians akin to BitGo have additionally entered the market.

“Stripe proclaims Stablecoin as a Service. Any firm can deploy stablecoins with just some strains of code. BlackRock, Constancy, or Superstate manages reserves. An X consumer commented about Stripe’s SCaaS.

Sponsored

Sponsored

The SCaaS mannequin lowers entry boundaries by permitting nearly any enterprise to problem its stablecoin. It additionally helps tailor-made stablecoins for particular merchandise or goal markets and provides wallets/exchanges/chains further instruments to distribute merchandise with yield potential.

Some customers on X argue that SCaaS will turn out to be more and more necessary as stablecoins turn out to be commodities and distributors (wallets, exchanges, chains) search yield alternatives. Others counsel that SCaaS may very well be a lifeline for a lot of blockchains struggling to attain token-market-fit.

Excessive Potential, Excessive Threat

Nonetheless, the dangers are vital. Multi-issuance fashions create the potential for liquidity fragmentation. For example, a number of “USD-pegged” stablecoins could coexist however differ in reserves, transparency, or redemption reliability.

Market dynamics may flip SCaaS right into a yield-driven guess: issuers would possibly optimize reserve income to remain aggressive, typically taking up liquidity dangers or investing in much less liquid belongings. This leaves vulnerabilities when redemptions abruptly surge.

From a authorized and operational perspective, SCaaS calls for absolute transparency on reserve composition, insurance coverage/redemption mechanisms, and impartial auditing processes.

Regulatory choices at nationwide or regional ranges may drastically reshape the multi-issuance panorama.

Even so, SCaaS remains to be anticipated to be a pure step ahead as stablecoins steadily evolve into a worldwide fee instrument.