Be part of Our Telegram channel to remain updated on breaking information protection

Robinhood CEO Vlad Tenev says tokenization is a “freight prepare” set to take over the monetary system, predicting crypto and banks will converge on-chain, with shares, deposits, and different monetary merchandise represented as digital tokens.

“Finally, it’s going to eat your entire monetary system,” he mentioned, highlighting how blockchain might deal with every part from trades to funds, making conventional and crypto techniques indistinguishable.

Crypto and conventional finance have been dwelling in separate worlds till now, Tenev mentioned on the Token2049 convention in Singapore. However that’s set to vary as they start to “totally merge” and every part goes on-chain “in some kind,”

“I feel that crypto know-how has so many benefits over the standard means we’re doing issues that sooner or later there’s going to be no distinction,” Tenev mentioned, estimating it might take a decade or extra for nearly your entire world to take part in tokenization.

US Might Take Longer To Embrace Tokenization

The US might take longer to completely embrace tokenization as a result of its present monetary infrastructure already capabilities successfully, he mentioned. Due to that, the price to extend the present system’s effectivity incrementally won’t be price it proper now.

“So the incremental effort to maneuver to completely tokenized will simply take longer,” he mentioned.

Whereas Tenev predicts that it’ll take longer for the US to go totally on-chain, massive American banks have already began exploring blockchain know-how and tokenization.

A kind of banks is Wall Road large JPMorgan Chase, which has launched its personal permissioned USD deposit token referred to as JPMD on the Ethereum layer-2 Base community for institutional shoppers.

The financial institution has additionally accomplished its first tokenized US Treasury commerce on a public blockchain by way of a collaboration with Chainlink and Ondo Finance.

Goldman Sachs has additionally partnered with BNY Mellon to convey tokenized cash market fund devices to their shoppers.

In the meantime, Citigroup is reportedly exploring issuing its personal stablecoin and increasing into tokenized deposits in addition to digital asset custody providers. Financial institution of America has additionally expressed curiosity in tokenizing real-world property.

Tokenization Will Be To Shares What Stablecoins Have Been To The Greenback

Tenev went on to focus on how USD-pegged stablecoins have made it straightforward for offshore buyers to achieve publicity to the buck, and subsequently predicted that tokenized shares will allow offshore buyers to purchase into US equities.

He added that tokenized shares might be “the way forward for how world buyers will maintain US property.”

Robinhood has already launched a tokenized inventory providing in Europe, which supplies European buyers the power to put money into widespread US firms equivalent to SpaceX and OpenAI.

Shortly after the providing was launched, OpenAI referred to as the transfer to tokenize its personal shares “unauthorized” and legal professionals mentioned that the transfer walked a authorized tightrope.

These “OpenAI tokens” should not OpenAI fairness. We didn’t accomplice with Robinhood, weren’t concerned on this, and don’t endorse it. Any switch of OpenAI fairness requires our approval—we didn’t approve any switch.

Please watch out.

— OpenAI Newsroom (@OpenAINewsroom) July 2, 2025

Nevertheless, Tenev dismissed the controversy as a part of a regulatory lag, and mentioned that the principle hurdles to tokenized shares aren’t technical however authorized.

USDC Issuer Expands Its Tokenized Treasury Fund To Solana As RWA Market Soars

USD Coin (USDC) issuer Circle is attempting to place itself early because the tokenization market begins to swell.

JUST IN: USYC is stay on Solana 🪙

USYC brings shares of a US authorities cash market fund that accrues yield by way of worth per share and redeems to/from USDC in actual time pic.twitter.com/qAijGO6AdL

— Solana (@solana) October 1, 2025

The agency lately introduced that it has expanded its US Treasury fund providing to the lightning-fast layer-1 blockchain Solana. This expands the USYC token’s attain past Ethereum, Close to, Base, Canton, and the deliberate addition of the BNB Chain.

USYC is a tokenized model of a short-duration US authorities cash market fund, and is redeemable in actual time for Circle’s USDC stablecoin. The providing is simply accessible to non-US buyers who move know-your-customer (KYC) checks.

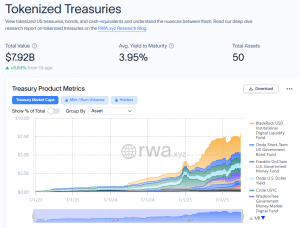

The announcement that USYC has been expanded to the Solana community comes after the broader tokenized treasury market has seen sturdy progress lately. In accordance with knowledge from RWA.xyz, the market has soared from $2.4 billion a yr in the past to just about $8 billion now.

That’s after the market grew by greater than 9% over simply the previous week.

Tokenized treasury market overview (Supply: RWA.xyz)

Of that just about $8 billion market cap, Circle’s USYC is the fifth-largest tokenized treasury fund out there.

Tokenized real-world asset cash have additionally seen their market cap rise by greater than 5% prior to now 24 hours, in keeping with knowledge from CoinGecko.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection