Prime Tales of The Week

Wall Avenue’s subsequent crypto play could also be IPO-ready crypto companies, not altcoins

Wall Avenue’s rising curiosity in late-stage cryptocurrency companies may disrupt the normal boom-and-bust cycle of digital property, in line with new analysis.

Crypto monetary companies agency Matrixport mentioned Friday that greater than $200 billion price of crypto firms are getting ready preliminary public choices (IPOs), which can increase between $30 billion and $45 billion in new capital.

Matrixport mentioned investor focus is rotating away from early-stage bets towards scalable, IPO-ready firms positioned for public markets.

Continued promoting by Bitcoin miners and early adopters has “practically neutralized ETF and treasury inflows, decreasing volatility and dampening Bitcoin’s attraction to risk-seeking traders,” Matrixport mentioned in a Friday X put up. “Wall Avenue, nonetheless, has each incentive to increase the bull market, with as much as $226 billion in crypto IPOs ready within the pipeline that would increase $30 – $45 billion in new capital.”

Choose tosses lawsuit towards Yuga Labs over failure to fulfill Howey take a look at

A US choose has dismissed an investor lawsuit towards Web3 firm Yuga Labs, ruling that the case failed to indicate non-fungible tokens (NFTs) meet the authorized definition of securities.

Choose Fernando M. Olguin dominated the plaintiffs didn’t reveal how Bored Ape Yacht Membership, ApeCoin or different NFTs bought by Yuga happy the three circumstances of the Howey take a look at, a regular utilized by the US Securities and Alternate Fee to find out whether or not a transaction qualifies as an funding contract. The lawsuit was initially filed in 2022.

Yuba Labs marketed its NFTs as digital collectibles with membership perks to an unique membership, making them consumables reasonably than funding contracts, Olguin mentioned.

CleanSpark sells $48.7M in Bitcoin, treasury tops 13K BTC in September

Bitcoin miner CleanSpark ended September with 13,011 BTC in its treasury after reporting year-over-year beneficial properties in effectivity and output.

The corporate mentioned month-to-month manufacturing rose 27% from September 2024, with 629 Bitcoin mined, and bought 445 BTC for roughly $48.7 million at a median worth of $109,568. In its Friday replace, CleanSpark mentioned that fleet effectivity improved 26% 12 months over 12 months, whereas its common working hashrate for the month was 45.6 EH/s.

CleanSpark has been promoting a part of its month-to-month Bitcoin manufacturing since April as a part of a push to develop into financially self-sufficient. It additionally opened an institutional Bitcoin buying and selling desk to facilitate gross sales. In August, the corporate generated $60.7 million from the sale of 533.5 BTC.

CleanSpark’s shares on Nasdaq rose 5.28% following the report, gaining greater than 23% over the week, in line with Yahoo Finance.

Crypto treasury ‘bubble’ fears overblown: TON Technique CEO

Whereas a latest wave of company digital asset treasuries is beginning to present indicators of a bubble, the long-term outlook is optimistic, in line with TON Technique CEO Veronika Kapustina.

“I believe, look, clearly, it appears prefer it’s a bubble. As in, all the symptoms appear like it’s a bubble,” Kapustina advised Cointelegraph through the Token2049 convention in Singapore.

Kapustina defined that they’re completely different from different bubbles we’ve seen in crypto and TradFi “as a result of it’s a brand new phase of finance.” DATs turned “the commerce of the summer season,” and folks noticed it as “quick cash,” with lots of “quick cash entering into,” she mentioned.

Trump nominates appearing FDIC chair to formally head the company

US President Donald Trump despatched the nomination of appearing chair of the Federal Deposit Insurance coverage Company (FDIC), Travis Hill, to the Senate for consideration to imagine the federal government position for a five-year time period.

Based on congressional data, Trump’s nomination of Hill as FDIC chair was despatched to the Senate Banking Committee on Tuesday.

Earlier than assuming his position on the FDIC, Hill issued a press release that the division ought to provide further steerage on digital property and tokenization and spoke out towards allegations of US authorities debanking firms resulting from their ties to crypto. He adopted with a letter aimed toward monetary establishments in March, clarifying that banks may interact with digital property as a ”permissible exercise.”

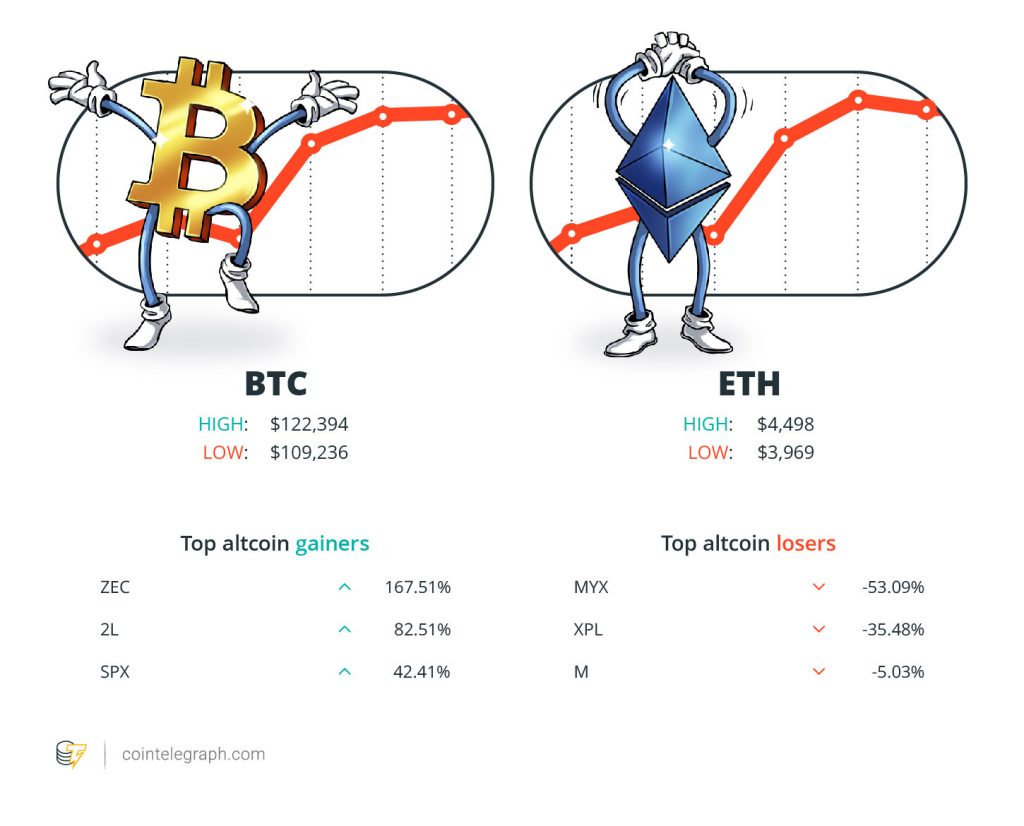

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $122,394 Ether (ETH) at $4,498 and XRP at $2.99. The entire market cap is at $4.18 trillion, in line with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are ZCash (ZEC) at 167.51%, DoubleZero (2Z) at 82.51% and SPX6900 (SPX) at 42.41%.

The highest three altcoin losers of the week are MYX Finance (MYX) at 53.09%, Plasma (XPL) at 35.48% and MemeCore (M) at 5.03%%.

For more information on crypto costs, be certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Ethereum is successfully a gateway for cash provide globally to transmit in US {dollars}.”

McAndrew Rudisill, chairman and CEO of ETHZilla

“In distinction, Bitcoin’s worth will not be pushed by the financial insurance policies of particular person states or any particular financial system, which may cut back the general correlation within the reserve.”

Dennis Dioukarev and David Perez, members of the Sweden Democrats political get together

“I wouldn’t be stunned if we went as much as $150,000 in a fairly brief time, like we’ve got to interrupt out of the $120,000 vary. However that’s most likely coming, probably within the subsequent days.”

Charles Edwards, founding father of Capriole Investments

“There’s lots of pleasure for a surge in one thing new. Then it peters out, and a little bit of consolidation, after which the true medium to long-term capital is available in.”

Veronika Kapustina, CEO of TON Technique

“The entire concept that ‘that is altseason […] and every thing will go up as a result of it’s altseason,’ we gained’t see that, and I’m very agency in that.”

Vugar Usi Zade, chief working officer at Bitget

“My thesis is principally the ECB prints now, or they print later, and in each circumstances, they lose management, as a result of in each circumstances, the individuals would reasonably both default, redenominate, do capital controls, print the cash, have their lifestyle.”

Arthur Hayes, co-founder of BitMEX

Prime Prediction of The Week

Bitcoin $120K breakout will result in ‘very fast transfer’ to $150K: Charles Edwards

Bitcoin might surge to a brand new all-time excessive of $150,000 earlier than the top of 2025 as traders pile into safe-haven property alongside gold, in line with Capriole Investments founder Charles Edwards.

Learn additionally

Options

Tim Draper’s ‘odd’ guidelines for investing in success

Options

Extinct or Extant: Can Blockchain Protect the Heritage of Endangered Populations?

Bitcoin’s restoration above the $120,000 psychological mark might result in a “very fast” breakout to a $150,000 all-time excessive, Edwards advised Cointelegraph throughout an interview at Token2049 in Singapore. “I wouldn’t be stunned if we went as much as $150,000 in a fairly brief time, like we’ve got to interrupt out of the $120,000 vary. However that’s most likely coming, probably within the subsequent days.”

Bitcoin rose over 6% prior to now week, recovering above the $118,500 mark for the primary time since Aug. 15, knowledge exhibits.

Prime FUD of The Week

Bitget exec sees ‘no logical cause’ for an altcoin season this cycle

The crypto markets are unlikely to see an altcoin season the place “every thing will go up,” as many merchants at the moment are centered on narrower developments or are simply focusing solely on Bitcoin, in line with the working chief of Bitget, one of many world’s greatest crypto exchanges.

“I don’t suppose there might be an altseason,” Vugar Usi Zade advised Cointelegraph on the Token2049 convention in Singapore on Wednesday.

“The entire concept that ‘that is altseason […] and every thing will go up as a result of it’s altseason,’ we gained’t see that, and I’m very agency in that.”

US Senate to carry listening to on crypto taxes as IRS gives reduction on company tax

The US Senate Finance Committee will maintain a listening to Wednesday on cryptocurrency taxation, a day after the Treasury Division and Inside Income Service (IRS) issued interim steerage easing company crypto tax guidelines.

The Treasury and IRS on Tuesday issued interim steerage aimed toward easing compliance underneath the Company Various Minimal Tax (CAMT), together with for firms working within the digital property sector.

Signed into legislation underneath former President Joe Biden as a part of the Inflation Discount Act of 2022, CAMT imposes a 15% minimal tax on the monetary assertion revenue of enormous firms.

Roman Storm seeks acquittal of Twister Money cash transmission cost

Roman Storm, co-founder of Twister Money, has requested a US federal choose to acquit him of his sole conviction for unlicensed cash transmission and the jury’s hung counts for cash laundering and sanctions violations, arguing prosecutors did not show he meant to assist unhealthy actors misuse the crypto mixer.

Learn additionally

Options

Blockchain detectives: Mt. Gox collapse noticed delivery of Chainalysis

Options

‘Normie degens’ go all in on sports activities fan crypto tokens for the rewards

Based on authorized paperwork filed on Sept. 30 to the US District Court docket for the Southern District of New York and reviewed by Cointelegraph, Storm’s protection argued prosecutors did not show he meant to assist unhealthy actors use Twister Money. This, in line with the protection, would nullify the grounds for his conviction based mostly on negligent inaction.

“Storm and unhealthy actors was a declare that he knew they have been utilizing Twister Money and did not take ample measures to cease them. It is a negligence principle,” the movement states.

Prime Journal Tales of The Week

Hong Kong isn’t the loophole Chinese language crypto companies suppose it’s

Chinese language firms preserve chasing what they imagine are crypto loopholes in Hong Kong and abroad markets, however regulators shut them simply as rapidly.

Japan excursions on XRP Ledger, USDC and USDT funds through Seize: Asia Specific

SBI Ripple develops XRP Ledger fee system for Japan’s tour business, OKX launches Singapore stablecoin transactions through Seize and extra.

Neglect The Terminator: SingularityNET’s Janet Adams is constructing AGI with coronary heart

SingularityNET’s Janet Adams doesn’t suppose a Terminator state of affairs is sensible, however says decentralization is important to forestall AGI’s darkish aspect.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.