Be part of Our Telegram channel to remain updated on breaking information protection

JPMorgan analysts say their year-end goal for Bitcoin is $165K whereas Citi expects the crypto to achieve $133K as BTC nears its all-time excessive (ATH).

Up to now 24 hours, the most important crypto by market cap was capable of attain a each day excessive of $121,138.74. It has since retraced to commerce at $120,151.56 as of 1:01 a.m., in response to knowledge from CoinMarketCap.

BTC value (Supply: CoinMarketCap)

Even with the pullback, BTC’s value continues to be up over 1% on the 24-hour time-frame. It’s additionally up greater than 9% on the weekly time-frame, and has flipped its month-to-month efficiency into the inexperienced as effectively. What’s extra, the crypto king is now round 3% away from its ATH of $124,457.12 that it set on Aug. 14.

JPMorgan Says Bitcoin May Hit $165K If “Debasement Commerce” Continues

In keeping with JPMorgan, BTC may climb to as excessive as $165K on a volatility-adjusted foundation relative to gold by the top of 12 months. The financial institution’s bullish prediction depends on whether or not the “debasement commerce” continues to realize momentum.

The debasement commerce is when buyers purchase exhausting belongings comparable to gold and Bitcoin to hedge in opposition to the devaluation of fiat currencies.

JPMorgan’s mannequin means that BTC would wish to rise one other 40% from its present ranges with a view to match the size of personal gold holdings as soon as threat has been accounted for.

The financial institution’s projection comes as retail buyers accelerated their embrace of the debasement commerce lately and poured capital into each gold and Bitcoin ETFs (exchange-traded funds) previously quarter.

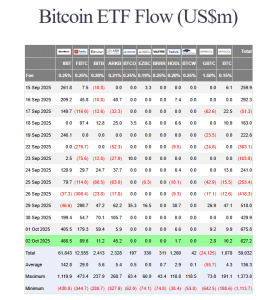

simply the flows into the Bitcoin merchandise previously quarter, Bloomberg ETF analyst Eric Balchunas famous on X that the BTC merchandise took in $7.8 billion within the third quarter.

The spot bitcoin ETFs took in $7.8b in Q3, now $21.5b YTD and $57b since inception. Strong climb up. But some on listed here are depressing bc they dwell in infantile fantasy that expects $1T of inflows daily. However actual development in actuality is 2 steps fwd, one step again. by way of @JSeyff pic.twitter.com/dAEJJTOYWW

— Eric Balchunas (@EricBalchunas) September 30, 2025

Yr-to-date (YTD), the spot Bitcoin ETFs have pulled in $21.5 billion. Buyers have additionally poured $57 billion into the funds since their inception initially of 2024.

Citi Predicts BTC Could Hit $133K By Yr-Finish, $181K In 2026

Citi additionally stays bullish on the Bitcoin value. In a current report, the financial institution projected modest however significant momentum for the broader crypto market heading into the brand new 12 months.

Analysts at Citi have now predicted that Bitcoin will attain $133K by the top of the 12 months. It is a slight lower from the financial institution’s earlier year-end goal of $135K.

The financial institution additionally gave its bullish and bearish circumstances for the main crypto. If fairness markets proceed to rally and flows decide up, the analysts mentioned BTC may soar to as excessive as $156K by year-end. Conversely, Bitcoin may additionally fall to as little as $83K below recessionary situations, the financial institution warned.

Citi went on to say that Bitcoin is best positioned than Ethereum (ETH) to seize new inflows as a result of its scale and the “digital gold” narrative surrounding BTC.

On a longer-term funding horizon, Citi predicted that Bitcoin’s value may surge to $181K within the subsequent twelve months. Nevertheless, the financial institution mentioned that this value goal will rely closely on whether or not there are sustained inflows for BTC.

Spot Bitcoin ETFs Prolong Inflows Streak

Amid the bullish forecasts from JPMorgan and Citi, spot Bitcoin ETFs discover themselves on a multi-day web inflows streak. Within the newest buying and selling session, buyers pumped one other $627.2 million into the merchandise, extending the streak to 4 days, in response to knowledge from Farside Buyers.

That was the second-consecutive day that the web each day inflows for the funding merchandise topped $600 million.

BlackRock’s IBIT performed a significant half within the substantial inflows seen within the newest buying and selling session, with the fund recording $466.5 million inflows. IBIT now additionally holds 3.8% of all of the Bitcoin, in response to Balchunas.

IBIT proudly owning 3.8% of all of the bitcoin is bonkers if you concentrate on it. An fairness ETF would wish to have $2.2 trillion in belongings to have as a lot possession of its underlying asset class. eg $SPY owns 1.1% of most shares and it is 32yrs outdated, IBIT continues to be a toddler. https://t.co/tgQ6bZxyWB

— Eric Balchunas (@EricBalchunas) September 30, 2025

Constancy’s FBTC posted the second-highest inflows of the day with $89.6 million coming into its reserves.

Bitwise’s BITB, ARK Make investments’s ARKB, VanEck’s HODL and each of Grayscale’s spot Bitcoin ETFs additionally registered web each day inflows yesterday. The remaining funds, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR, and WisdomTree’s BTCW, recorded no new funds on the day.

Associated Articles

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection