Be part of Our Telegram channel to remain updated on breaking information protection

Greater than 30 crypto ETF purposes had been filed with the Securities and Change Fee (SEC) on Friday, a tsunami NovaDiusWealth president Nate Geraci referred to as ‘’just the start.’’

The push follows the regulator’s September 17 approval of generic itemizing requirements for the New York Inventory Change, Nasdaq, and Cboe, which created a sooner path than the outdated 19b-4 course of.

Whereas the US authorities shutdown has stalled near-term opinions by the SEC, analysts say that’s solely a brief bump within the street earlier than crypto ETF approvals ramp up.

“Any crypto ETF you may presumably think about will likely be filed w/ the SEC over subsequent a number of months,” mentioned Nate Geraci, president of ETF Retailer and NovaDiusWealth. “You all don’t know what’s coming.”

30+ crypto-related ETFs filed w/ SEC this afternoon…

Just the start.

Any crypto ETF you may presumably think about will likely be filed w/ SEC over subsequent a number of months.

You all don’t know what’s coming.

h/t @JSeyff pic.twitter.com/6U2ucNbf45

— Nate Geraci (@NateGeraci) October 4, 2025

New Crypto ETF Functions Come Amid A number of October Deadlines

The brand new filings come throughout a month that was anticipated to be a pivotal one for the crypto ETF panorama, with 16 choice deadlines for these funds in October. These funds monitor quite a lot of cryptos resembling Solana (SOL), XRP, Litecoin (LTC), and others.

However the US authorities shutdown as a consequence of Congress’s failure to achieve a deal on funding has delayed the method because the SEC now operates with decreased workers.

Earlier this week, the SEC despatched out an Operations Plan saying that it is going to be unable to evaluation or approve sure filings together with new registration statements, new monetary product filings, and comparable regulatory actions in the course of the shutdown.

Seems like a chronic authorities shutdown would positively impression the launch of recent spot crypto ETFs…

ETF Cryptober is likely to be on maintain for a bit.

From SEC’s “Operations Plan Beneath a Lapse in Appropriations & Authorities Shutdown”… pic.twitter.com/Z6gY1bJbUt

— Nate Geraci (@NateGeraci) October 1, 2025

Many analysts noticed that notification as a sign that the SEC is not going to ship a choice on pending crypto ETF purposes by way of the 19b-4 course of till the shutdown ends. This seems to be the case, because the company stayed silent on the proposed Canary Litecoin ETF when the deadline for the choice got here and went earlier this week.

The shutdown can final per week or longer. In a single occasion in 2018, the federal government shut down for so long as 34 days.

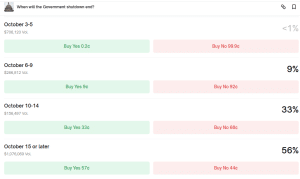

Contract asking how lengthy the US shutdown will final (Supply: Polymarket)

Merchants on the decentralized betting platform Polymarket have positioned the most important odds of 56% that the shutdown will final till Oct. 15 and presumably even later. Others see a 33% likelihood that it’ll proceed up till between Oct. 10 and Oct. 14.

Spot Bitcoin ETF Inflows Prime $900 Million

The excessive quantity of crypto ETF filings additionally occurred the identical day that over $900 million flowed into Bitcoin funds.

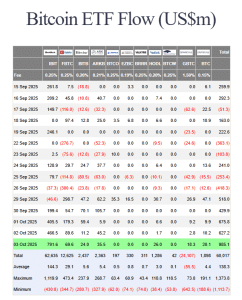

In keeping with knowledge from Farside Buyers, traders poured $985.1 million into spot Bitcoin ETFs within the newest buying and selling session.

US spot BTC ETFs flows (Supply: Farside Buyers)

BlackRock’s IBIT, which not too long ago entered the highest 20 checklist of the most important funds globally and now holds over 3% of BTC’s provide, led the cost yesterday with $791.6 million inflows. IBIT’s inflows had been over 10X the quantity recorded by the next-biggest inflows for the day, posted by Constancy’s FBTC after traders pumped $69.6 million into the ETF.

Following the most recent web day by day inflows, the US spot Bitcoin ETFs have prolonged their optimistic stream streak to 5 days. They’ve additionally pulled in over $3 billion throughout this era.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection