In keeping with the most recent on-chain knowledge, Bitcoin has been witnessing an attention-grabbing change in its holder conduct, additional intensifying the bullish hypothesis out there.

Bitcoin UTXO Depend Declines As Worth Surges

In a Quicktake put up on CryptoQuant, market analyst CryptoOnchain revealed that long-term Bitcoin buyers appear to be altering their funding technique by more and more holding on to their cash. This on-chain commentary is predicated on the Bitcoin UTXO Depend metric, which tracks the overall variety of particular person unspent transaction outputs on the blockchain.

Associated Studying

For context, an unspent transaction output is an quantity of a cryptocurrency (on this case, Bitcoin) that has been acquired by an deal with, however has not but been used as enter for a brand new transaction.

CryptoOnchain shared that this on-chain metric has been on a gentle decline since January 2025. Within the put up, the crypto analyst identified that the UTXO rely just lately reached about 166.6 million, the bottom level seen since April 2024.

For the reason that Bitcoin UTXO reached a peak of roughly 187.5 million in January, it has witnessed a contraction of as much as 11% — an occasion which CryptoOnchain interprets as a transparent signal of community consolidation.

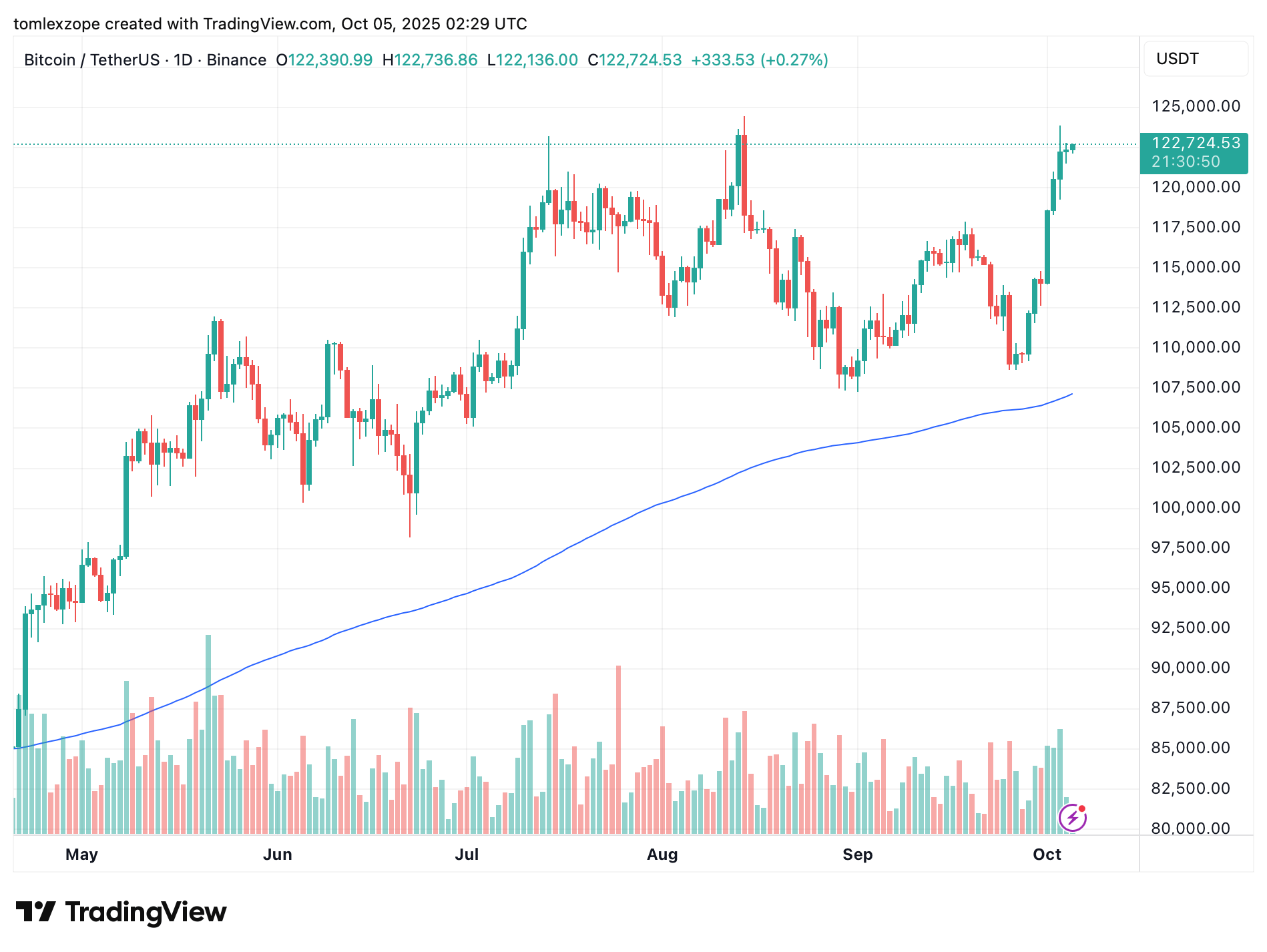

Apparently, this decline seen with unspent transaction output contrasts with Bitcoin’s worth motion. Whereas the UTXO has maintained a gentle bearish construction, Bitcoin’s worth has continued to ascend. The flagship cryptocurrency noticed a worth progress from about $99,000 to its present market worth of round $122,000.

This “inverse relationship” is one which the web pundit defined to be a “basic hallmark of a maturing market.”

Why The Decline And What To Count on

A decreased UTXO rely might be a results of a number of underlying components, together with that long-term holders are selecting to carry their cash somewhat than promoting for revenue. Owing to this “hodling” conduct, it may be stated that the market is beginning to achieve maturity.

Additionally, CryptoOnchain defined that low UTXOs might point out diminished transactions throughout the Blockchain. By extension, this might imply that fewer gross sales are occurring, which interprets to diminished promoting strain on worth.

Additionally, a decrease UTXO rely factors to rising community effectivity. As customers mixture smaller UTXOs into bigger ones, they optimize the blockchain house, main probably to a much less congested community.

Finally, the simultaneous decline in Bitcoin’s UTXO and its worth improve paints an thrilling image for the cryptocurrency’s future. This mix alerts that the premier cryptocurrency is at a reaccumulation section, that means that buyers are strategically positioning themselves in expectation of the subsequent vital upward transfer.

As of this writing, the value of BTC stands at about $122,720, displaying an over 1% progress prior to now day.

Associated Studying

Featured picture from iStock, chart from TradingView