Tron pulled forward of rivals in blockchain earnings final 12 months, producing $3.6 billion, a determine that highlights how stablecoin exercise can outweigh sheer market worth in terms of community earnings. Based on Token Terminal, that tally locations Tron nicely above bigger rivals on pure income phrases.

Tron Tops Income Charts

Tron’s lead stems largely from stablecoin settlements, with experiences exhibiting about 51% of circulating Tether USDT has been issued on the Tron community.

Ethereum, by comparability, recorded roughly $1 billion in income over the identical interval, at the same time as ETH’s market cap was round $540 billion — greater than 16x the TRX market cap, which sits simply north of $32 billion. The hole between market worth and on-chain income is stark.

Revenues Down In September: VanEck

Community revenues throughout blockchains fell 16% month-over-month in September, based on a VanEck report. Merchants had fewer causes to pay for precedence processing as a result of markets calmed, and that drop in exercise hit charge earnings.

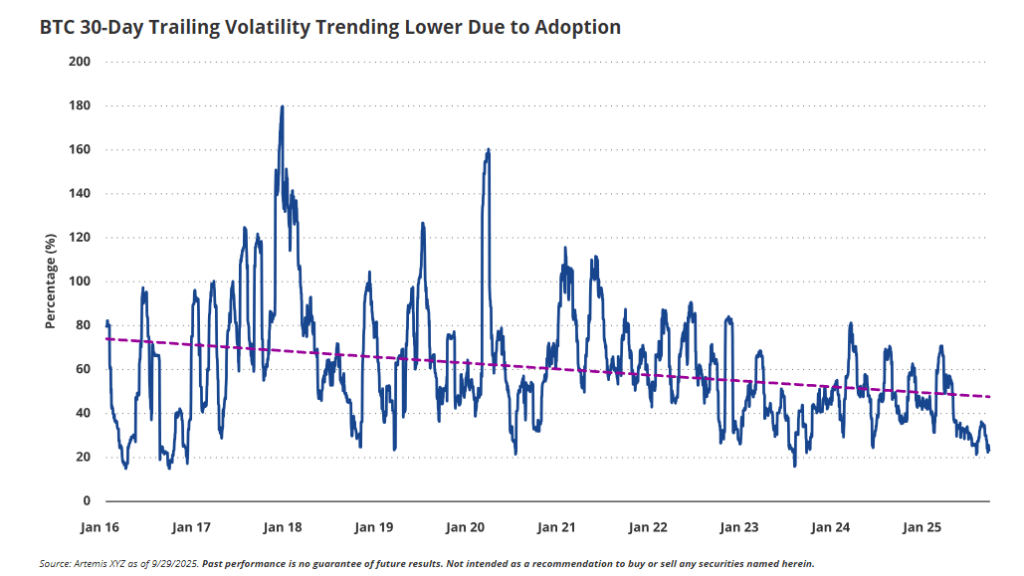

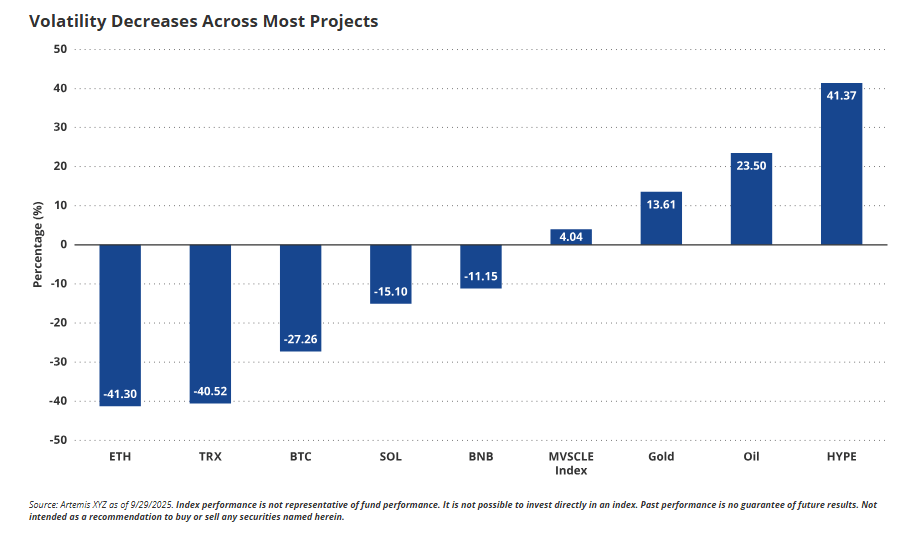

Volatility measures fell sharply: Ether volatility dropped 40%, SOL slid 16%, and Bitcoin volatility fell 26% in that month. Lower cost swings imply fewer fast trades and fewer high-fee transactions.

Charges Fell As Volatility Cooled

Ethereum community income declined by 6% in September. Solana’s receipts slipped by 11%. Tron’s charges plunged 37%, however that determine was pushed partly by a governance change: a proposal decreased gasoline costs by over 50% in August, and people decrease prices confirmed up in September’s numbers. Briefly, each market quiet and coverage strikes mixed to trim what customers paid to maneuver belongings on chain.

Stablecoins And Settlement Exercise Mattered Extra Than Hype

The stablecoin market additionally continued to develop, with information from RWA.XYZ exhibiting the whole stablecoin market cap crossed $290 billion in October 2025.

That increasing pool of tokenized greenback balances tends to favor blockchains with low cost, quick transfers. For Tron, heavy stablecoin issuance has translated into regular transaction volumes and a distinct form of financial engine than networks that rely extra on DeFi or speculative buying and selling.

Stablecoins Drive Transaction Flows

Stablecoins let worth transfer throughout borders with near-instant settlement and low charges. They commerce around the clock and don’t require a checking account, which helps clarify why on-chain volumes can diverge from pure token market caps.

Stories have disclosed that this utility-based demand is a serious cause Tron outpaced others in income, even when its native token stays far smaller by market worth.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.