China’s crypto ban has been in place since 2021, however that hasn’t stopped firms from chasing what they imagine are methods to reenter.

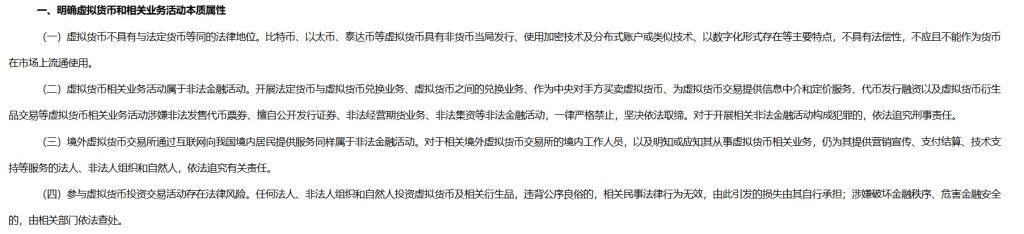

Hyped-up stablecoin bulletins in Hong Kong and abroad listings that trace at digital property are simply among the methods firms are testing boundaries. Every time, Beijing responds with recent warnings — a stark reminder that China’s crypto U-turn isn’t across the nook.

The newest warning reportedly got here from the China Securities Regulatory Fee, which suggested firms to pause real-world asset ventures in Hong Kong. It adopted a state-owned firm scrubbing bulletins about tokenizing bonds and different enterprises revealing RWA tasks, piling on latest warnings in opposition to stablecoins after Hong Kong launched its licensing framework.

To grasp why these illusions of loopholes maintain showing — and why they collapse — Journal spoke with Joshua Chu, co-chair of the Hong Kong Web3 affiliation.

This dialog has been edited for readability and size.

Journal: Crypto has been banned for years in China, so why do regulators maintain issuing recent warnings?

Chu: The problem is that many new attorneys in Hong Kong transferring into Web3 don’t have a lot expertise with cross-border points. That’s created fragmentation and lots of confusion. Some journalists and attorneys even claimed there was a 180-degree reversal on crypto coverage. China doesn’t do 180-degree turns in coverage. The one U-turn in latest reminiscence was the rollback of COVID-19 mandates.

The crypto ban from 2021 is an efficient instance: Speculative property are usually not meant for the retail sector. The Individuals’s Republic of China continues to be a communist nation, and if an unsophisticated investor loses cash playing on crypto, within the authorities’s view, that’s dropping cash for the state. That’s why the one entities we’ve seen dealing with crypto property are the federal government or state-owned enterprises.

Journal: How do you clarify this cycle the place Chinese language companies repeatedly try to enter a stylish crypto enterprise via Hong Kong, just for mainland regulators to push again?

Chu: The problem is how they’re doing it. Even massive firms with cash can act in a less-than-sophisticated manner. There’s a distinction between state-owned enterprises and personal establishments. The federal government is snug with blockchain infrastructure and overseas direct funding. What it gained’t tolerate is theory as a result of hypothesis equals bubbles.

That’s why regulators crack down on tasks designed to hype markets or pull worth from retail traders. It’s the identical logic behind China’s actual property coverage: Shopping for to stay in is ok, however hypothesis isn’t. You may consider it as a parental model of governance: Simply as mother and father wouldn’t let youngsters gamble with household financial savings, the state gained’t let retail traders gamble away wealth in crypto.

Learn additionally

Options

NFT collapse and monster egos characteristic in new Murakami exhibition

Options

The ethics of hiring low-cost Filipino workers: Crypto within the Philippines Half 2

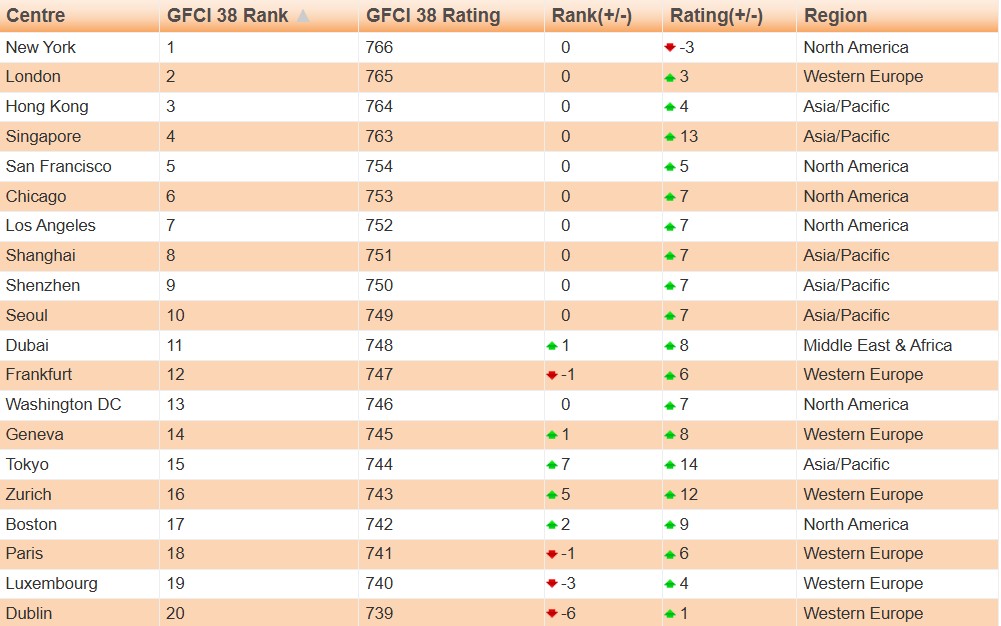

On the finish of the day, firms see revenue potential, which is why they need in. However regulators will solely help ventures which might be subtle, compliant and accountable. That’s additionally why Hong Kong can maintain itself out as one of many world’s high three monetary hubs — its repute relies on preserving the system clear, and the identical precept applies to digital property.

Journal: Isn’t the true drawback that Chinese language companies are looking for loopholes and Hong Kong attorneys aren’t outfitted to cease them?

Chu: Sadly, that occurs rather a lot. In case your complete enterprise is based on loopholes, you’re already on shaky floor. Regulators don’t create loopholes so that you can exploit; they anticipate you to construct one thing sustainable and compliant.

However due to the 2021 crypto ban, you’ve got a whole market that’s been shut out. Human psychology kicks in, and other people suppose: “Perhaps that is my manner again in.” That’s why you see firms making loud bulletins earlier than they’ve even filed an utility. Take the stablecoin regime: Some companies had been hyping plans to use for licenses simply to pump their inventory value. Naturally, regulators step in.

We’ve seen this sample earlier than. When preliminary coin choices had been being bought as a less expensive different to preliminary public choices, firms stated you didn’t want a prospectus or compliance. However there’s a cause these safeguards exist: to guard traders. So, when gamers begin chopping corners and shouting about it, it attracts scrutiny. And that’s when clampdowns occur.

Learn additionally

Options

Bots, airdrops push Ronin to No.2 blockchain for day by day customers — Not Pixels followers

Options

Crypto within the Philippines: Necessity is the mom of adoption

Journal: When Chinese language companies listed in Hong Kong or the US acquire crypto publicity, is that this regulatory arbitrage?

Chu: When a Chinese language firm lists on Nasdaq, it’s absorbing overseas funding, which triggers a special response than if it had been elevating funds domestically. The actual query is how they construction these RWA or tokenization tasks.

In the event that they’re placing Chinese language company knowledge on a public blockchain, that creates cross-border knowledge switch points. Keep in mind, even listed firms have run into issues with US auditors due to China’s strict guidelines on what data can go away the nation. Blockchain raises these considerations over again.

There’s additionally the monetary aspect. Many of those treasury methods look dangerous, particularly when pushed by institutional FOMO on the peak of a bull cycle. With out robust inside threat controls, volatility can overwhelm the market cap of those companies. That’s precisely the type of contagion threat regulators need to keep away from.

If that occurs, the scrutiny gained’t simply come from Beijing; it should come from the SEC as properly.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.